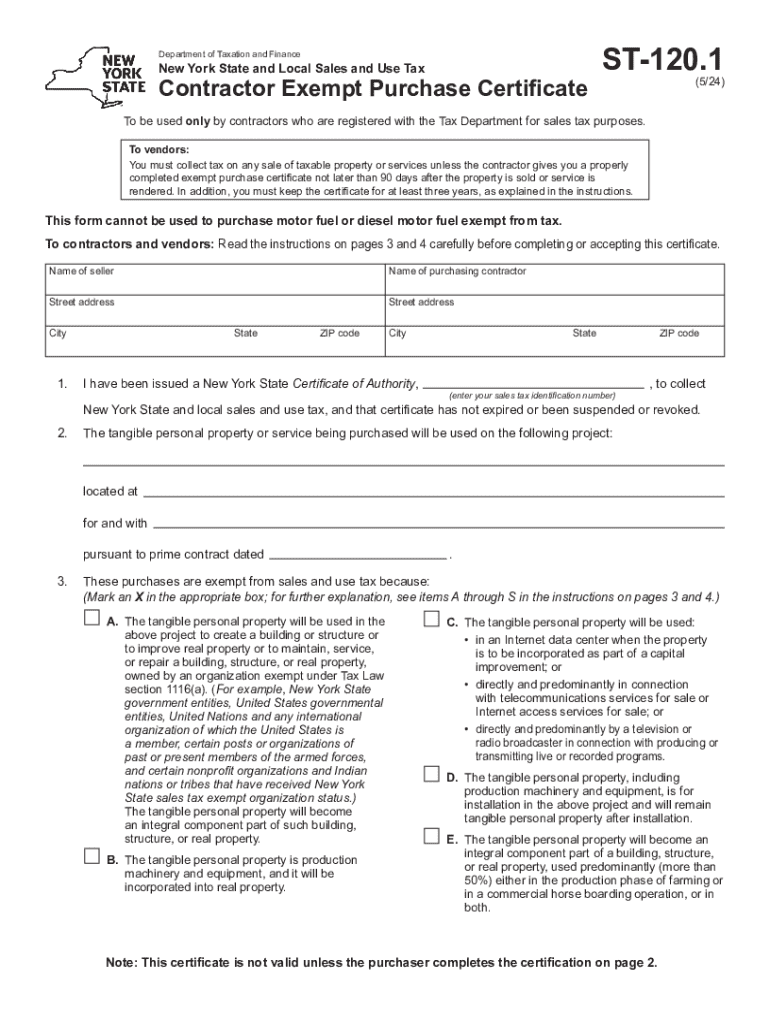

Form ST 120 1 Contractor Exempt Purchase Certificate Revised 524

Understanding the NYS Tax Exempt Form ST 120

The NYS tax exempt form ST 120 is a crucial document for businesses and organizations in New York State that wish to make tax-exempt purchases. This form allows eligible entities to buy goods and services without paying sales tax, provided they meet specific criteria. The form is primarily used by organizations that qualify as exempt under New York State tax laws, such as nonprofit organizations, government agencies, and certain educational institutions.

How to Use the NYS Tax Exempt Form ST 120

To utilize the NYS tax exempt form ST 120 effectively, eligible purchasers must complete the form accurately. When making a purchase, present the completed ST 120 form to the seller. This informs the seller that the buyer is exempt from sales tax on the transaction. It is essential to ensure that the form is filled out completely, including the purchaser's name, address, and the reason for the exemption. Sellers are required to keep a copy of the form for their records, which serves as proof of the tax-exempt status of the sale.

Steps to Complete the NYS Tax Exempt Form ST 120

Completing the NYS tax exempt form ST 120 involves several straightforward steps:

- Download the form from the New York State Department of Taxation and Finance website.

- Fill in the purchaser's name and address in the designated fields.

- Indicate the reason for the exemption, selecting the appropriate category that applies to your organization.

- Provide any additional information required, such as the seller's name and address.

- Sign and date the form to certify its accuracy.

Once completed, present the form to the seller at the time of purchase.

Legal Use of the NYS Tax Exempt Form ST 120

The legal use of the NYS tax exempt form ST 120 is governed by New York State tax regulations. Only eligible organizations may use this form to make tax-exempt purchases. Misuse of the form can lead to penalties, including fines and back taxes owed. It is important for purchasers to understand their eligibility and ensure compliance with all applicable laws to avoid legal repercussions.

Examples of Using the NYS Tax Exempt Form ST 120

There are various scenarios in which the NYS tax exempt form ST 120 can be utilized. For instance:

- A nonprofit organization purchasing office supplies for its operations can present the form to avoid sales tax.

- A government agency buying equipment for public use may use the ST 120 to make the purchase tax-exempt.

- Educational institutions acquiring materials for classroom use can benefit from the tax exemption by providing the form to their suppliers.

These examples illustrate how the form facilitates cost savings for eligible entities engaged in tax-exempt activities.

Eligibility Criteria for the NYS Tax Exempt Form ST 120

To qualify for the NYS tax exempt form ST 120, organizations must meet specific eligibility criteria established by New York State law. Generally, the following types of entities are eligible:

- Nonprofit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Government entities at the local, state, or federal level.

- Certain educational institutions, including public and private schools.

Organizations must ensure they possess the necessary documentation to support their exempt status when completing the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 120 1 contractor exempt purchase certificate revised 524

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYS tax exempt form ST 120?

The NYS tax exempt form ST 120 is a certificate that allows eligible organizations to make tax-exempt purchases in New York State. This form is essential for nonprofits, government entities, and certain other organizations to avoid paying sales tax on qualifying purchases.

-

How can airSlate SignNow help with the NYS tax exempt form ST 120?

airSlate SignNow simplifies the process of completing and submitting the NYS tax exempt form ST 120 by providing an easy-to-use platform for eSigning and document management. Users can quickly fill out the form, obtain necessary signatures, and send it securely, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the NYS tax exempt form ST 120?

airSlate SignNow offers a cost-effective solution for managing documents, including the NYS tax exempt form ST 120. Pricing plans are designed to fit various business needs, and users can choose a plan that best suits their volume of document transactions.

-

What features does airSlate SignNow offer for handling the NYS tax exempt form ST 120?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for the NYS tax exempt form ST 120. These features enhance the user experience by streamlining the document workflow and ensuring that all necessary steps are completed efficiently.

-

Can I integrate airSlate SignNow with other software for the NYS tax exempt form ST 120?

Yes, airSlate SignNow offers integrations with various software applications, allowing users to seamlessly manage the NYS tax exempt form ST 120 alongside their existing tools. This integration capability enhances productivity and ensures that all documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the NYS tax exempt form ST 120?

Using airSlate SignNow for the NYS tax exempt form ST 120 provides numerous benefits, including reduced processing time, enhanced security, and improved compliance. The platform's user-friendly interface makes it easy for organizations to manage their tax-exempt documentation efficiently.

-

How secure is airSlate SignNow when handling the NYS tax exempt form ST 120?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive information related to the NYS tax exempt form ST 120. Users can trust that their documents are safe and secure throughout the signing process.

Get more for Form ST 120 1 Contractor Exempt Purchase Certificate Revised 524

Find out other Form ST 120 1 Contractor Exempt Purchase Certificate Revised 524

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free