Form MT 203 Distributor of Tobacco Products Tax Return Revised 824

What is the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824

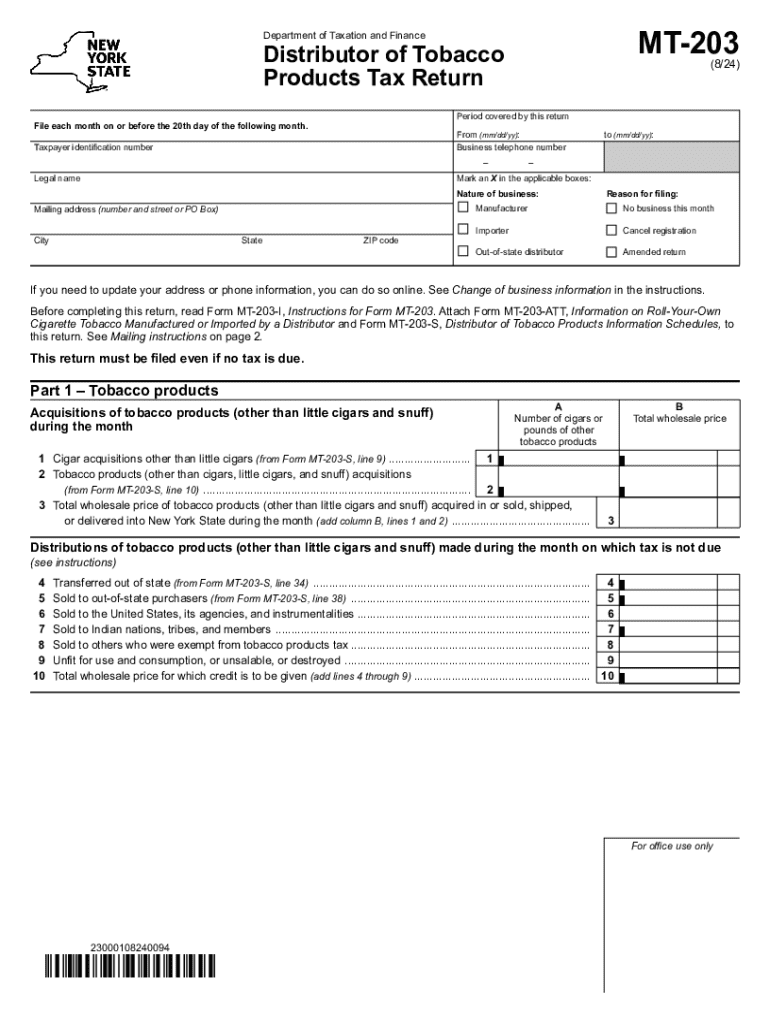

The Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824 is a tax document specifically designed for distributors of tobacco products in the United States. This form is used to report and remit taxes owed on tobacco products distributed within the state. It is essential for compliance with state regulations governing the sale and distribution of tobacco, ensuring that all applicable taxes are accurately calculated and submitted.

How to use the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824

Using the Form MT 203 involves several key steps. First, gather all necessary information regarding the tobacco products distributed, including quantities and types. Next, accurately complete the form, ensuring that all sections are filled out correctly to reflect the products sold and the corresponding taxes owed. Finally, submit the completed form to the appropriate state agency, either electronically or via mail, depending on state requirements.

Steps to complete the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824

Completing the Form MT 203 requires attention to detail. Begin by entering your business information, including your name, address, and tax identification number. Next, list the types of tobacco products distributed and their quantities. Calculate the total tax due based on the rates applicable to each product type. Review the form for accuracy before signing and dating it. Ensure that all calculations are correct to avoid potential penalties for errors.

Filing Deadlines / Important Dates

Filing deadlines for the Form MT 203 are typically set by state tax authorities. It is crucial to be aware of these dates to avoid late fees or penalties. Generally, the form must be submitted quarterly, but specific due dates may vary by state. Mark your calendar with these important dates to ensure timely filing and compliance with tax obligations.

Penalties for Non-Compliance

Failure to file the Form MT 203 on time or inaccuracies in the submitted information can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is important for distributors to understand the implications of non-compliance and to take all necessary steps to ensure accurate and timely submissions.

Legal use of the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824

The Form MT 203 is legally mandated for tobacco product distributors operating within the state. It serves as a formal declaration of the taxes owed on distributed products and is required by law to ensure compliance with state tax regulations. Proper use of this form helps maintain transparency in the tobacco distribution industry and supports state revenue collection efforts.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mt 203 distributor of tobacco products tax return revised 824

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824?

The Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824 is a tax return specifically designed for distributors of tobacco products in Montana. This form allows businesses to report their tobacco product sales and calculate the associated taxes. Understanding this form is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow help with the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824?

airSlate SignNow simplifies the process of completing and submitting the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824. With our platform, you can easily fill out the form, eSign it, and send it directly to the relevant authorities. This streamlines your tax reporting process and ensures timely submissions.

-

What are the pricing options for using airSlate SignNow for the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans include features that support the completion and submission of the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824, ensuring you get the best value for your investment. You can choose a plan that fits your budget and needs.

-

Are there any integrations available for airSlate SignNow when handling the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824. These integrations help streamline your workflow, allowing for automatic data transfer and reducing the risk of errors in your tax submissions.

-

What features does airSlate SignNow offer for managing the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824?

airSlate SignNow provides a range of features to assist with the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824, including customizable templates, eSignature capabilities, and document tracking. These features enhance your efficiency and ensure that your tax return is completed accurately and on time.

-

How secure is airSlate SignNow when handling sensitive documents like the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive documents, including the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824. You can trust that your information is safe and secure while using our platform.

-

Can I access the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824 on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage the Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824 from your smartphone or tablet. This flexibility ensures you can complete your tax return anytime, anywhere.

Get more for Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824

- Form st 810 new york state and local quarterly sales and use tax return for part quarterly monthly filers revised 1122

- Ilovepdf download form

- State income tax law changes for the third quarter of 2022 form

- 2021 form 3805q net operating loss nol computation and nol and

- New york state e file signature authorization for tax year 2022 for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

- Inst 1040 schedule j form

- New york state authorization for electronic funds withdrawal form

- Form it 370 application for automatic six month extension of

Find out other Form MT 203 Distributor Of Tobacco Products Tax Return Revised 824

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free