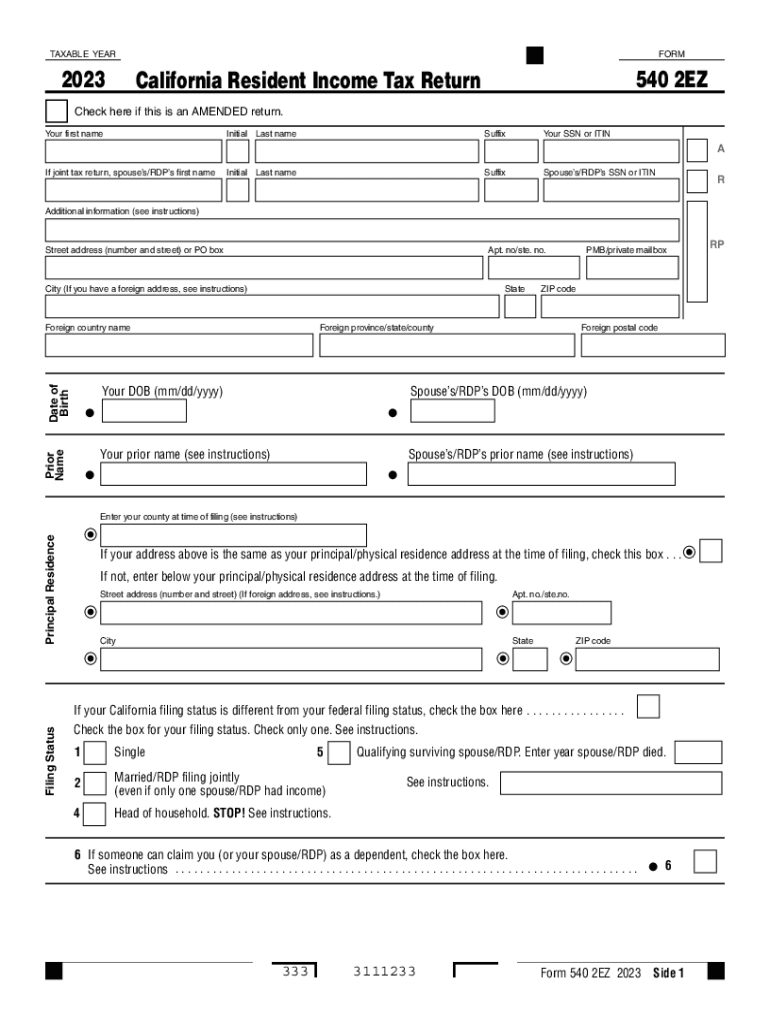

Form 540 2EZ California Resident Income Tax Return , Form 540 2EZ, California Resident Income Tax Return

What is the California tax form 540EZ?

The California tax form 540EZ is a simplified version of the California Resident Income Tax Return, designed for individuals with straightforward tax situations. This form is specifically for residents of California who meet certain eligibility criteria, such as having a taxable income below a specified threshold and not claiming certain deductions or credits. The 540EZ form allows taxpayers to report their income, calculate their tax liability, and determine their refund or amount owed in a streamlined manner.

How to obtain the California tax form 540EZ

To obtain the California tax form 540EZ, individuals can visit the California Franchise Tax Board (FTB) website, where the form is available for download in PDF format. Additionally, taxpayers can request a printed version of the form by contacting the FTB directly. Many local libraries and post offices also provide copies of the form for public use. It is important to ensure that you are using the correct version for the applicable tax year, such as the 2023 California tax form 540EZ.

Steps to complete the California tax form 540EZ

Completing the California tax form 540EZ involves several straightforward steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your income, including wages, interest, and any other taxable income.

- Calculate your tax liability using the provided tax tables or formulas.

- Determine any credits or payments, including withholding and estimated tax payments.

- Sign and date the form before submitting it to the FTB.

Key elements of the California tax form 540EZ

The California tax form 540EZ includes several key elements that taxpayers must be aware of:

- Filing Status: Taxpayers must indicate their filing status, such as single or married filing jointly.

- Income Reporting: The form requires detailed reporting of various income sources, including wages and interest.

- Tax Calculation: The form provides a simplified method for calculating tax owed based on income brackets.

- Refund or Amount Owed: Taxpayers can determine if they are due a refund or if they owe additional taxes.

Eligibility criteria for the California tax form 540EZ

To qualify for using the California tax form 540EZ, taxpayers must meet specific eligibility criteria:

- Be a resident of California for the entire tax year.

- Have a taxable income below the maximum limit set for the tax year.

- Not claim any dependents.

- Not have income from self-employment or rental properties.

- Not claim certain deductions, such as itemized deductions or credits that require additional forms.

Filing deadlines for the California tax form 540EZ

The filing deadline for the California tax form 540EZ typically aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should ensure that their forms are postmarked or submitted electronically by the deadline to avoid penalties and interest on any taxes owed.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 2ez california resident income tax return form 540 2ez california resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California tax form 540EZ?

The California tax form 540EZ is a simplified tax return form for residents of California with straightforward tax situations. It is designed for individuals who meet specific criteria, making it easier to file taxes. Using airSlate SignNow, you can quickly eSign and submit your California tax form 540EZ online.

-

Who is eligible to use the California tax form 540EZ?

Eligibility for the California tax form 540EZ includes single or married filing jointly taxpayers with a taxable income below a certain threshold. Additionally, you must not claim any dependents or have complex tax situations. airSlate SignNow can help you determine your eligibility and streamline the eSigning process.

-

How can airSlate SignNow help with filing the California tax form 540EZ?

airSlate SignNow simplifies the process of filing the California tax form 540EZ by allowing you to eSign documents securely and efficiently. Our platform ensures that your forms are completed accurately and submitted on time. With our user-friendly interface, you can manage your tax documents with ease.

-

What are the costs associated with using airSlate SignNow for the California tax form 540EZ?

airSlate SignNow offers a cost-effective solution for eSigning documents, including the California tax form 540EZ. Pricing plans vary based on features and usage, but we provide affordable options for individuals and businesses alike. You can choose a plan that best fits your needs without breaking the bank.

-

Can I integrate airSlate SignNow with other tax software for the California tax form 540EZ?

Yes, airSlate SignNow can integrate with various tax software solutions, making it easier to manage your California tax form 540EZ. This integration allows for seamless data transfer and document management. You can enhance your workflow by combining our eSigning capabilities with your preferred tax software.

-

What features does airSlate SignNow offer for managing the California tax form 540EZ?

airSlate SignNow provides features such as secure eSigning, document templates, and real-time tracking for the California tax form 540EZ. These tools help you streamline the filing process and ensure that your documents are handled efficiently. Our platform is designed to enhance your productivity and simplify tax management.

-

Is airSlate SignNow secure for submitting the California tax form 540EZ?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your California tax form 540EZ is submitted safely. We use advanced encryption and security protocols to protect your sensitive information. You can trust our platform for secure eSigning and document management.

Get more for Form 540 2EZ California Resident Income Tax Return , Form 540 2EZ, California Resident Income Tax Return

Find out other Form 540 2EZ California Resident Income Tax Return , Form 540 2EZ, California Resident Income Tax Return

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document