Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R

Overview of Form 109 for California Exempt Organizations

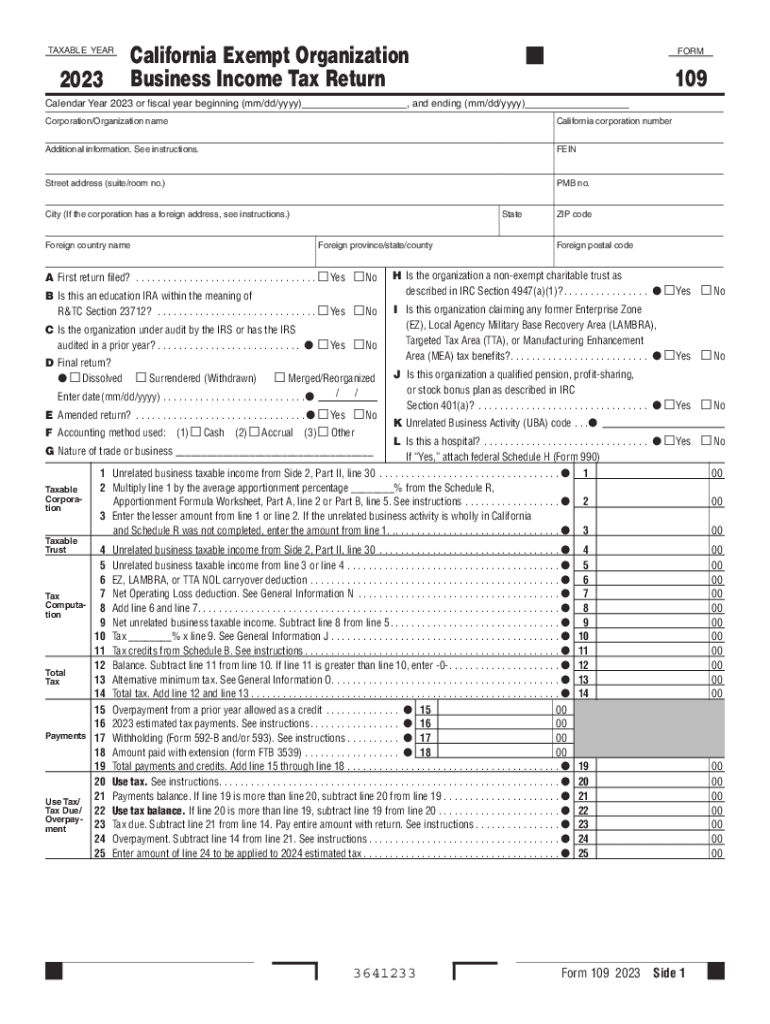

The Form 109, officially known as the California Exempt Organization Business Income Tax Return, is a crucial document for organizations exempt from federal tax under Internal Revenue Code Section 501(c). This form is specifically designed for California-based exempt organizations that generate business income. It helps ensure compliance with state tax requirements while allowing these organizations to report their income accurately.

Steps to Complete Form 109

Completing the Form 109 involves several key steps. First, gather all necessary financial records, including income statements and expense reports. Next, accurately fill out the form, detailing your organization's income, deductions, and any applicable credits. Ensure that all entries are clear and correct to avoid delays. After completing the form, review it thoroughly for any errors or omissions before submission.

Obtaining Form 109

Form 109 can be obtained through the California Franchise Tax Board’s official website. It is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, organizations can request a physical copy by contacting the Franchise Tax Board directly. It is essential to ensure that you are using the most current version of the form to comply with the latest regulations.

Key Elements of Form 109

The Form 109 includes several critical components that must be completed accurately. Key elements include the organization's name, address, and federal employer identification number (EIN). Additionally, the form requires detailed reporting of gross receipts, allowable deductions, and the calculation of taxable income. Understanding these elements is vital for ensuring compliance and avoiding potential penalties.

Filing Deadlines for Form 109

Organizations must adhere to specific filing deadlines for Form 109 to remain compliant with California tax laws. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this typically falls on May 15. It is important to mark this date on your calendar to avoid late penalties.

Legal Use of Form 109

Form 109 serves a legal purpose in the context of California tax compliance for exempt organizations. It is essential for reporting business income accurately and maintaining the organization's tax-exempt status. Failure to file this form, or filing it inaccurately, can result in penalties and jeopardize the organization's exempt status. Understanding the legal implications of this form is crucial for all exempt organizations operating in California.

Examples of Using Form 109

Various scenarios illustrate the use of Form 109. For instance, a nonprofit organization that runs a thrift store must report the income generated from sales on this form. Similarly, a charitable organization hosting fundraising events must account for any business income derived from those activities. These examples highlight the importance of accurately reporting income to ensure compliance with state tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 109 california exempt organization business income tax return form 109 california exempt organization business income tax 732573868

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 109?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The term '109' often refers to the IRS Form 109, which can be easily managed and signed using our platform, streamlining your tax documentation process.

-

How much does airSlate SignNow cost for businesses dealing with 109 forms?

Our pricing plans are designed to be cost-effective, starting at a competitive rate that suits businesses of all sizes. For those specifically handling 109 forms, we offer features that simplify the signing and management of these documents, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing 109 documents?

airSlate SignNow provides a range of features tailored for 109 document management, including customizable templates, automated workflows, and secure cloud storage. These features help ensure that your 109 forms are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other tools for handling 109 forms?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM systems and accounting software. This allows you to manage your 109 forms alongside other business processes, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for 109 eSignatures?

Using airSlate SignNow for 109 eSignatures provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security. Our platform ensures that your 109 forms are signed and stored securely, giving you peace of mind.

-

Is airSlate SignNow compliant with regulations for 109 forms?

Absolutely! airSlate SignNow is compliant with eSignature laws and regulations, ensuring that your 109 forms are legally binding. This compliance helps protect your business and ensures that your documents meet all necessary legal standards.

-

How can airSlate SignNow help with the organization of 109 documents?

airSlate SignNow helps organize your 109 documents through its intuitive dashboard and document management features. You can easily categorize, search, and retrieve your 109 forms, making it simple to stay organized and efficient.

Get more for Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R

- Minnie pearl scholarship form

- Personal data form pdf

- Employment application pdf ub orthopaedics amp sports medicine form

- Snap verification documents ky form

- Request to remove personal information from the harris county appraisal district website

- Crh employee payroll login form

- 22 pistol blueprints pdf form

- Scoreboard message memphis grizzlies form

Find out other Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors