CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax

Understanding the California 540 Form

The California 540 form is the state income tax return used by residents of California to report their income and calculate their tax liability. It is essential for individuals who earn income in California, as it helps ensure compliance with state tax laws. The form includes various sections that guide taxpayers through reporting income, claiming deductions, and determining credits. Understanding this form is crucial for accurate tax reporting and avoiding penalties.

Steps to Complete the California 540 Form

Completing the California 540 form involves several key steps:

- Gather Required Documents: Collect your W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Include all sources of income, such as wages, self-employment income, and interest.

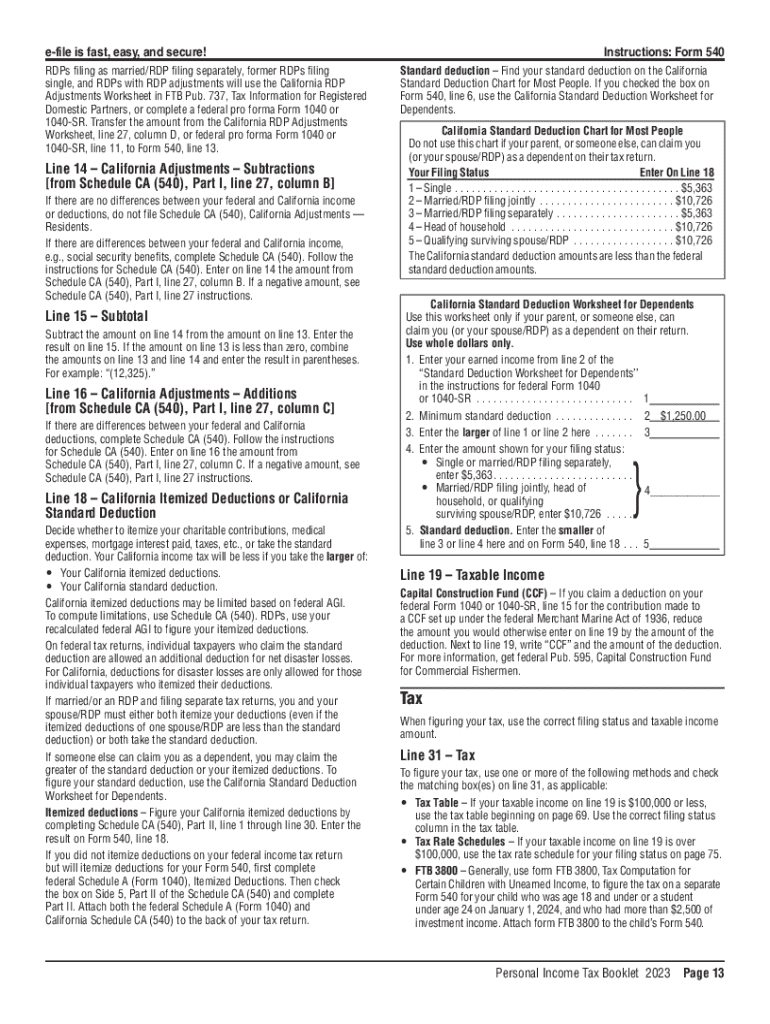

- Claim Deductions: Identify eligible deductions, such as mortgage interest and state taxes paid.

- Calculate Tax Liability: Use the tax table provided in the instructions to determine your tax owed.

- Review and Sign: Ensure all information is accurate, then sign and date the form.

Obtaining the California 540 Form

The California 540 form can be easily obtained through several methods. Taxpayers can download the form directly from the California Franchise Tax Board (FTB) website. Additionally, physical copies are available at various locations, including public libraries and post offices. It is advisable to ensure you have the latest version of the form to comply with current tax regulations.

Key Elements of the California 540 Form

The California 540 form includes several important sections that taxpayers must complete:

- Personal Information: This section requires basic details about the taxpayer and their spouse, if applicable.

- Income Reporting: Taxpayers must report all income sources, including wages and investment earnings.

- Deductions and Credits: This section allows taxpayers to claim various deductions and credits that can reduce their taxable income.

- Tax Calculation: The form provides a tax table to help determine the total tax owed based on reported income.

Filing Deadlines for the California 540 Form

It is crucial to be aware of the filing deadlines associated with the California 540 form. Typically, the deadline for filing is April 15 of each year, aligning with the federal tax deadline. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also consider any extensions they may need to file their returns, which can be requested through the FTB.

Legal Use of the California 540 Form

The California 540 form is legally mandated for residents who earn income in the state. Filing this form accurately and on time is essential to avoid penalties and interest on unpaid taxes. The information provided on the form is used by the California Franchise Tax Board to assess tax liabilities and ensure compliance with state tax laws. Understanding the legal implications of this form can help taxpayers navigate their responsibilities effectively.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california 540 forms amp instructions personal income tax booklet california 540 forms amp instructions personal income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form California 540?

The form California 540 is the state's individual income tax return form used by residents to report their income and calculate their tax liability. It is essential for ensuring compliance with California tax laws and is typically filed annually. Understanding how to fill out the form California 540 correctly can help you avoid penalties and maximize your tax refund.

-

How can airSlate SignNow help with the form California 540?

airSlate SignNow simplifies the process of completing and eSigning the form California 540 by providing an intuitive platform for document management. Users can easily upload, fill out, and send the form for signatures, ensuring a smooth and efficient filing process. This saves time and reduces the hassle of traditional paper-based methods.

-

Is there a cost associated with using airSlate SignNow for the form California 540?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals and teams. The cost is competitive and reflects the value of the features provided, such as unlimited document signing and secure storage. Investing in airSlate SignNow can streamline your tax filing process, including the form California 540.

-

What features does airSlate SignNow offer for the form California 540?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure eSigning for the form California 540. These tools enhance productivity and ensure that all parties can easily access and complete the necessary documentation. Additionally, the platform offers tracking capabilities to monitor the status of your form California 540.

-

Can I integrate airSlate SignNow with other applications for the form California 540?

Absolutely! airSlate SignNow supports integrations with various applications, including cloud storage services and CRM systems, making it easy to manage your documents related to the form California 540. This seamless integration allows for a more efficient workflow and ensures that all your important documents are in one place.

-

What are the benefits of using airSlate SignNow for tax documents like the form California 540?

Using airSlate SignNow for tax documents such as the form California 540 offers numerous benefits, including enhanced security, ease of use, and faster turnaround times. The platform ensures that your sensitive information is protected while allowing you to complete and send documents quickly. This efficiency can lead to timely tax submissions and peace of mind.

-

Is airSlate SignNow suitable for businesses that need to file multiple form California 540s?

Yes, airSlate SignNow is highly suitable for businesses that need to file multiple form California 540s. The platform allows for bulk sending and signing, making it easy to manage numerous tax returns efficiently. This feature is particularly beneficial for accounting firms and businesses with multiple employees needing to file their taxes.

Get more for CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax

Find out other CALIFORNIA 540 Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 Forms & Instructions Personal Income Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors