Form 592 Resident and Nonresident Withholding Statement , Form 592, Resident and Nonresident Withholding Statement

Understanding Form 592: Resident and Nonresident Withholding Statement

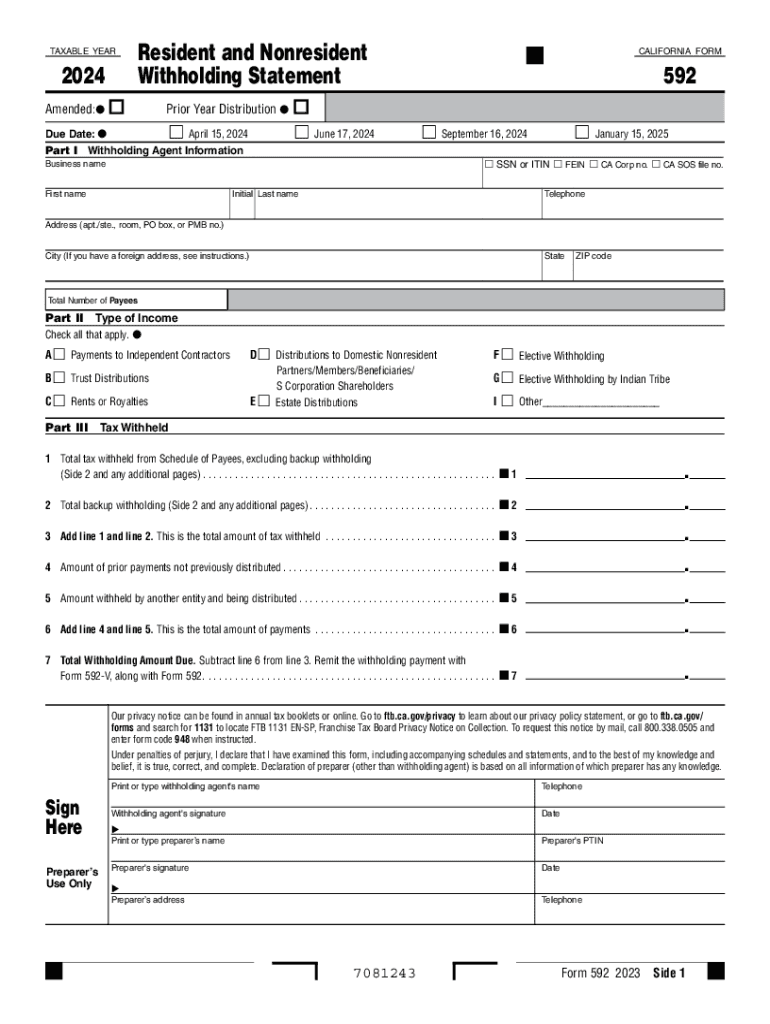

The Franchise Tax Board Form 592 serves as a Resident and Nonresident Withholding Statement, designed for use by California taxpayers. This form is essential for reporting withholding amounts for both residents and nonresidents who receive California-source income. It ensures that the correct amount of tax is withheld from payments made to nonresidents, which is crucial for compliance with California state tax laws.

Steps to Complete Form 592

Completing Form 592 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the taxpayer's identification details and the amount of income subject to withholding. Next, fill out the form by providing details such as the payee's name, address, and taxpayer identification number. Be sure to accurately report the total amount withheld and any exemptions that may apply. Finally, review the completed form for errors before submission.

How to Obtain Form 592

Form 592 can be easily obtained from the California Franchise Tax Board's official website. The form is available in both printable and fillable formats, allowing taxpayers to choose their preferred method of completion. Additionally, physical copies may be available at local tax offices or through tax professionals who assist with California state tax filings.

Filing Deadlines for Form 592

It is important to be aware of the filing deadlines associated with Form 592 to avoid penalties. Generally, Form 592 must be filed by the last day of the month following the end of the quarter in which the withholding occurred. For example, if withholding occurred in the first quarter, the form must be submitted by April 30. Taxpayers should also check for any specific deadlines related to their individual circumstances.

Key Elements of Form 592

Form 592 includes several key elements that must be accurately completed. These elements consist of the payee's information, the total amount of California-source income, the total amount withheld, and any applicable exemptions. Additionally, the form requires signatures from both the withholding agent and the payee, affirming the accuracy of the information provided. Understanding these elements is crucial for proper compliance with California tax regulations.

Legal Use of Form 592

Form 592 is legally required for reporting withholding on payments made to nonresidents. This form must be used in accordance with California tax laws to ensure that the correct amounts are withheld and reported. Failure to use Form 592 appropriately can result in penalties and interest on unpaid taxes. Taxpayers should familiarize themselves with the legal obligations surrounding this form to maintain compliance.

Examples of Using Form 592

Form 592 is commonly used in various scenarios, such as when a business makes payments to nonresident contractors or when individuals receive rental income from California properties. For instance, if a California-based company hires a nonresident consultant, they must complete Form 592 to report the withholding on payments made to that consultant. Understanding these examples can help taxpayers recognize when they need to utilize this form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 592 resident and nonresident withholding statement form 592 resident and nonresident withholding statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the franchise tax board form 592?

The franchise tax board form 592 is a tax form used in California for reporting withholding on payments made to non-residents. It is essential for businesses to ensure compliance with state tax regulations. By using airSlate SignNow, you can easily eSign and manage this form digitally.

-

How can airSlate SignNow help with the franchise tax board form 592?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the franchise tax board form 592. Our solution streamlines the process, making it easier to manage your tax documentation efficiently. This ensures that you can focus on your business while staying compliant with tax requirements.

-

Is there a cost associated with using airSlate SignNow for the franchise tax board form 592?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution allows you to manage the franchise tax board form 592 and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the franchise tax board form 592?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These features make it easy to prepare and sign the franchise tax board form 592 quickly and securely. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the franchise tax board form 592?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for the franchise tax board form 592. You can connect with tools like CRM systems, accounting software, and more to streamline your document management process. This integration helps maintain consistency and efficiency.

-

What are the benefits of using airSlate SignNow for the franchise tax board form 592?

Using airSlate SignNow for the franchise tax board form 592 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign documents from anywhere, saving you time and effort. This convenience helps you stay organized and compliant.

-

How secure is airSlate SignNow when handling the franchise tax board form 592?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When handling the franchise tax board form 592, you can trust that your information is safe and secure. Our platform adheres to industry standards to ensure your documents remain confidential.

Get more for Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

Find out other Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy