Form 3805V Net Operating Loss NOL Computation and NOL and Disaster Loss Limitations Individuals, Estates, and Trusts Form 3805V

Understanding Form 3805V: Net Operating Loss Computation

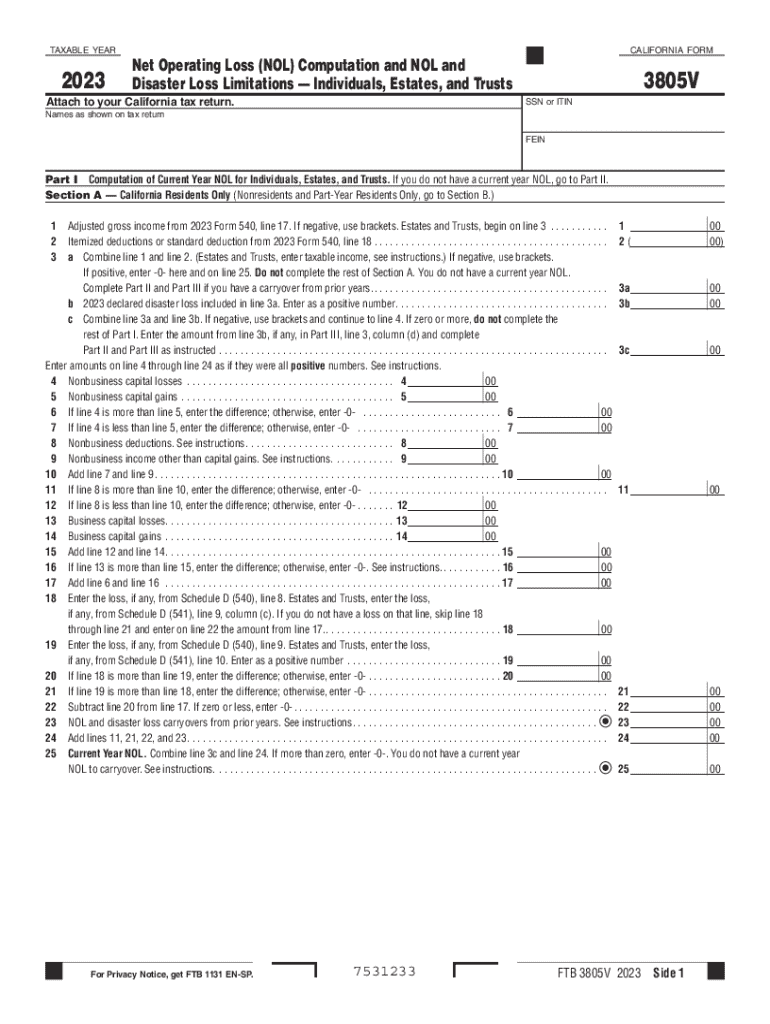

The Form 3805V is essential for individuals, estates, and trusts in California to compute and report net operating losses (NOL) and disaster loss limitations. This form allows taxpayers to determine the amount of NOL they can carry forward to offset future taxable income, which can significantly reduce tax liability. Understanding the nuances of this form is crucial for effective tax planning and compliance.

Steps to Complete Form 3805V

Completing Form 3805V involves several key steps:

- Gather all necessary financial documents, including income statements and prior tax returns.

- Calculate your net operating loss for the current year, ensuring to account for any applicable deductions.

- Fill out the form by entering the calculated NOL and any adjustments based on disaster losses.

- Review the completed form for accuracy before submission.

- Submit the form along with your California tax return to ensure proper processing.

Key Elements of Form 3805V

Form 3805V consists of several critical components:

- Taxpayer Information: Basic details such as name, address, and Social Security number.

- NOL Calculation: A section dedicated to detailing the computation of your net operating loss.

- Disaster Loss Limitations: Information on any losses incurred due to federally declared disasters.

- Carryforward Information: Details on how much of the NOL can be carried forward to future tax years.

Legal Use of Form 3805V

Form 3805V is legally required for California taxpayers who wish to claim a net operating loss or disaster loss. Proper use of this form ensures compliance with state tax laws and helps avoid penalties. Taxpayers should be aware of the specific guidelines provided by the California Franchise Tax Board regarding eligibility and documentation needed for submission.

Obtaining Form 3805V

Form 3805V can be easily obtained through the California Franchise Tax Board's official website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, the form may be accessible through various tax preparation software, which can streamline the completion process.

Examples of Using Form 3805V

Consider a scenario where an individual incurred significant business losses due to a natural disaster. By accurately completing Form 3805V, they can report these losses and potentially carry them forward to offset future income, thus reducing their tax burden. Another example involves an estate that experienced losses during a fiscal year; using Form 3805V allows the estate to manage tax liabilities effectively.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3805v net operating loss nol computation and nol and disaster loss limitations individuals estates and trusts form 3805v 734945070

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3805v feature in airSlate SignNow?

The 3805v feature in airSlate SignNow allows users to streamline their document signing process. This feature enhances the user experience by providing a simple interface for sending and eSigning documents efficiently. With 3805v, businesses can reduce turnaround times and improve workflow.

-

How much does airSlate SignNow with the 3805v feature cost?

Pricing for airSlate SignNow with the 3805v feature varies based on the plan you choose. We offer flexible pricing options to accommodate businesses of all sizes. For detailed pricing information, please visit our website or contact our sales team.

-

What are the key benefits of using the 3805v feature?

The 3805v feature provides numerous benefits, including increased efficiency and reduced paperwork. By utilizing airSlate SignNow, businesses can save time and resources while ensuring secure document transactions. Additionally, the 3805v feature supports compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications using the 3805v feature?

Yes, the 3805v feature in airSlate SignNow supports integrations with various applications. This allows users to connect their existing tools and streamline their workflows. Popular integrations include CRM systems, cloud storage services, and project management tools.

-

Is the 3805v feature suitable for small businesses?

Absolutely! The 3805v feature in airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its cost-effective solution and user-friendly interface make it an ideal choice for small teams looking to enhance their document management processes.

-

How secure is the 3805v feature in airSlate SignNow?

The 3805v feature prioritizes security, ensuring that all documents are encrypted and stored safely. airSlate SignNow complies with industry standards to protect sensitive information. Users can trust that their data is secure while using the 3805v feature.

-

What types of documents can I send using the 3805v feature?

With the 3805v feature in airSlate SignNow, you can send a variety of documents, including contracts, agreements, and forms. This versatility allows businesses to handle different types of paperwork efficiently. The feature supports multiple file formats for added convenience.

Get more for Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V

Find out other Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement