FTB Publication 1067 Guidelines for Filing a Group Form 540NR FTB Publication 1067 Guidelines for Filing a Group Form 540NR 2023-2026

Understanding the FTB Publication 1067 Guidelines for Filing a Group Form 540NR

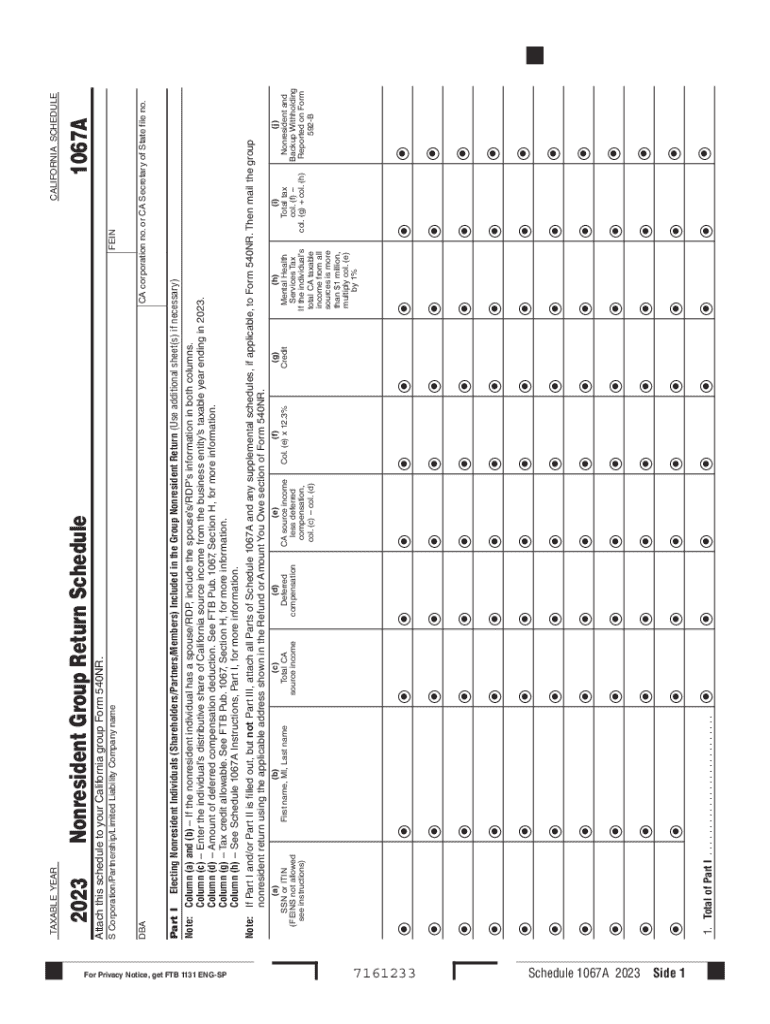

The FTB Publication 1067 provides essential guidelines for individuals and entities filing a Group Form 540NR in California. This publication outlines the procedures and requirements necessary for accurate filing, ensuring compliance with state tax laws. It is particularly relevant for those who are part of a group of nonresidents who need to report income earned in California. Familiarizing yourself with these guidelines can help streamline the filing process and reduce the risk of errors.

Steps to Complete the FTB Publication 1067 Guidelines for Filing a Group Form 540NR

Completing the Group Form 540NR involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements and deductions applicable to each member of the group.

- Determine eligibility: Ensure that all group members meet the criteria for filing as a group, which typically includes sharing certain types of income and deductions.

- Complete the form: Fill out the Group Form 540NR accurately, ensuring that all sections are completed and that the information is consistent across all members.

- Review and verify: Double-check all entries for accuracy, as mistakes can lead to penalties or delays in processing.

- Submit the form: File the completed Group Form 540NR by the specified deadline, using the appropriate submission method.

Key Elements of the FTB Publication 1067 Guidelines for Filing a Group Form 540NR

Several important elements must be considered when filing a Group Form 540NR:

- Group composition: Understand who qualifies as a member of the group and the implications of their income sources.

- Income allocation: Accurately allocate income and deductions among group members based on their respective contributions and earnings.

- Filing requirements: Adhere to specific filing requirements, including deadlines and necessary documentation.

- Compliance with state laws: Ensure that all filings comply with California tax laws to avoid penalties.

Legal Use of the FTB Publication 1067 Guidelines for Filing a Group Form 540NR

The FTB Publication 1067 serves as an authoritative resource for legal compliance when filing a Group Form 540NR. By following these guidelines, taxpayers can ensure they are meeting their legal obligations under California law. This publication is particularly useful for tax professionals and individuals who need clarity on the legal ramifications of their filings. Adhering to these guidelines helps mitigate risks associated with non-compliance, such as audits or penalties.

Required Documents for Filing the Group Form 540NR

When preparing to file a Group Form 540NR, it is essential to gather the following documents:

- Income statements for each group member, including W-2s and 1099s.

- Documentation of any deductions or credits claimed by group members.

- Identification numbers for all group members, such as Social Security numbers or ITINs.

- Any prior year tax returns that may be relevant for comparison or accuracy.

Filing Deadlines and Important Dates for Group Form 540NR

Awareness of filing deadlines is crucial for compliance. The Group Form 540NR typically has specific deadlines that must be met to avoid penalties. These deadlines may vary based on the type of income reported and the fiscal year of the group. It is advisable to check the California Franchise Tax Board's official calendar for the most current deadlines to ensure timely submission.

Create this form in 5 minutes or less

Find and fill out the correct ftb publication 1067 guidelines for filing a group form 540nr ftb publication 1067 guidelines for filing a group form 540nr

Create this form in 5 minutes!

How to create an eSignature for the ftb publication 1067 guidelines for filing a group form 540nr ftb publication 1067 guidelines for filing a group form 540nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the California guidelines for electronic signatures?

The California guidelines for electronic signatures are established under the Uniform Electronic Transactions Act (UETA) and the California Electronic Signatures Act. These laws ensure that electronic signatures hold the same legal weight as traditional handwritten signatures, provided they meet certain criteria. airSlate SignNow complies with these California guidelines, making it a reliable choice for businesses operating in the state.

-

How does airSlate SignNow ensure compliance with California guidelines?

airSlate SignNow ensures compliance with California guidelines by implementing robust security measures and maintaining a clear audit trail for all signed documents. Our platform adheres to the legal requirements set forth by California law, ensuring that your electronic signatures are valid and enforceable. This commitment to compliance helps businesses operate confidently within California's legal framework.

-

What features does airSlate SignNow offer to meet California guidelines?

airSlate SignNow offers a range of features designed to meet California guidelines, including secure document storage, customizable templates, and multi-factor authentication. These features not only enhance security but also streamline the signing process, making it easier for businesses to comply with state regulations. By using airSlate SignNow, you can ensure that your document management aligns with California's legal standards.

-

Is airSlate SignNow cost-effective for businesses in California?

Yes, airSlate SignNow is a cost-effective solution for businesses in California looking to streamline their document signing processes. Our pricing plans are designed to accommodate various business sizes and needs, ensuring that you get the best value for your investment. By utilizing airSlate SignNow, you can save time and resources while adhering to California guidelines.

-

Can airSlate SignNow integrate with other tools while following California guidelines?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms, allowing businesses to maintain compliance with California guidelines while enhancing their workflow. Whether you use CRM systems, project management tools, or cloud storage services, our integrations ensure that your document signing process remains efficient and compliant with state regulations.

-

What benefits does airSlate SignNow provide for California businesses?

airSlate SignNow provides numerous benefits for California businesses, including increased efficiency, reduced paper usage, and enhanced security. By adopting our eSignature solution, you can streamline your document workflows while ensuring compliance with California guidelines. This not only saves time but also contributes to a more sustainable business model.

-

How can I get started with airSlate SignNow under California guidelines?

Getting started with airSlate SignNow under California guidelines is simple. You can sign up for a free trial on our website, where you can explore our features and see how they align with California's legal requirements. Our user-friendly interface makes it easy to create, send, and manage documents while ensuring compliance with state regulations.

Get more for FTB Publication 1067 Guidelines For Filing A Group Form 540NR FTB Publication 1067 Guidelines For Filing A Group Form 540NR

- Fabrication bill format in word

- Environment of care rounds template form

- Vex engineering notebook rubric form

- Risk assessment template for craft stall form

- Sumatin account form

- Welcome to chile affidavit form

- Good health certificate for pli pdf form

- 5 2 docx pdsa worksheet the plan do study act pdsa form

Find out other FTB Publication 1067 Guidelines For Filing A Group Form 540NR FTB Publication 1067 Guidelines For Filing A Group Form 540NR

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney