State Controller Malia M Cohen is Available for Interviews on Form

Understanding California Form 540 NR

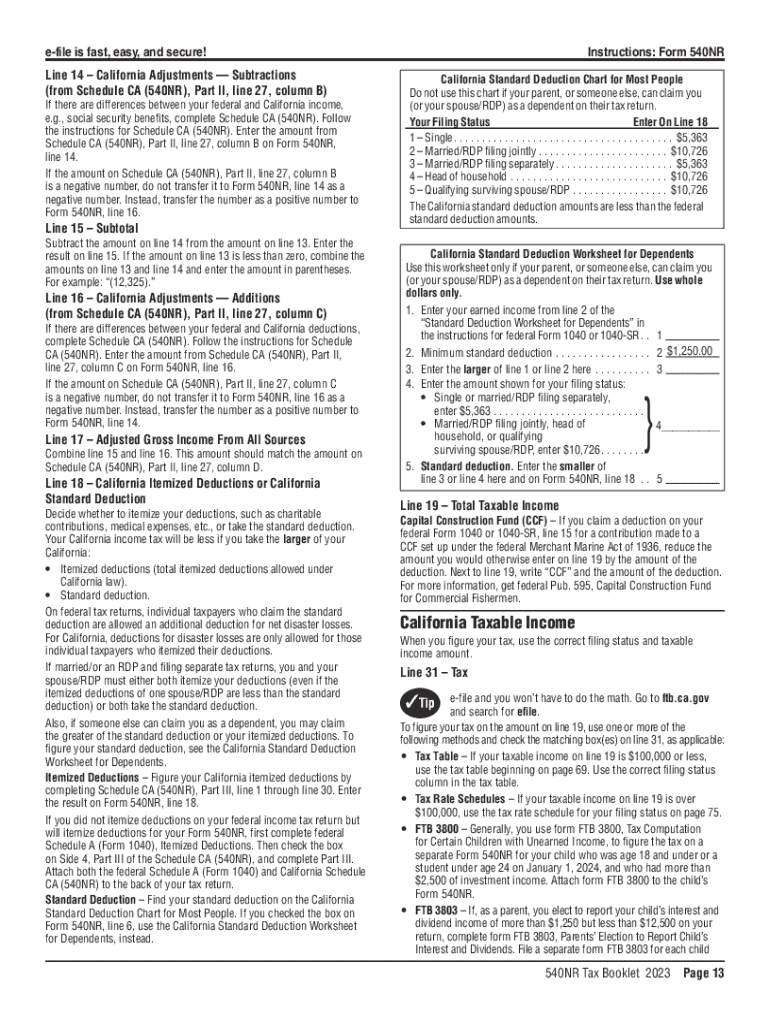

The California Form 540 NR is designed for non-residents who earn income in California. This tax form allows individuals to report their California-source income while ensuring compliance with state tax regulations. Non-residents must accurately fill out this form to determine their tax obligations in California, as it differs from the standard resident tax forms.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for California Form 540 NR. Typically, the deadline aligns with the federal tax filing date, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should verify the specific dates each year to avoid penalties.

Required Documents for Filing

To complete California Form 540 NR, taxpayers need several documents, including:

- W-2 forms from employers for California income

- 1099 forms for any additional income received

- Documentation of deductions and credits applicable to non-residents

- Previous year’s tax return for reference

Gathering these documents in advance can streamline the filing process and ensure accuracy.

Form Submission Methods

California Form 540 NR can be submitted through various methods. Taxpayers have the option to file online using the California Franchise Tax Board's e-file system, which is efficient and secure. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its advantages, and taxpayers should choose based on their preferences and circumstances.

Penalties for Non-Compliance

Failing to file California Form 540 NR or inaccurately reporting income can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal consequences. It is crucial for non-residents to ensure timely and accurate submissions to avoid these repercussions.

Eligibility Criteria for Non-Residents

To qualify for filing California Form 540 NR, individuals must meet specific eligibility criteria. Generally, this form is for those who are not residents of California but have earned income from California sources. This includes wages, rental income, or business income generated within the state. Understanding these criteria helps ensure that non-residents file the correct form and comply with tax laws.

Digital vs. Paper Version of the Form

Taxpayers can choose between a digital or paper version of California Form 540 NR. The digital version offers advantages such as faster processing times and reduced chances of errors. Conversely, some individuals may prefer the traditional paper form for various reasons, including familiarity. Regardless of the choice, ensuring that the form is filled out correctly is essential for compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state controller malia m cohen is available for interviews on

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the california form 540 nr?

The california form 540 nr is a tax form used by non-residents of California to report their income earned in the state. It is essential for ensuring compliance with California tax laws. By using this form, non-residents can accurately calculate their tax obligations.

-

How can airSlate SignNow help with the california form 540 nr?

airSlate SignNow simplifies the process of completing and eSigning the california form 540 nr. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. Additionally, you can securely send the completed form to the relevant parties.

-

Is there a cost associated with using airSlate SignNow for the california form 540 nr?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our plans are designed to be cost-effective, providing excellent value for businesses that frequently handle documents like the california form 540 nr. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the california form 540 nr?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the california form 540 nr. These features enhance the user experience by making the document management process seamless and efficient. You can also integrate with other tools to streamline your workflow.

-

Can I integrate airSlate SignNow with other software for the california form 540 nr?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage the california form 540 nr alongside your existing tools. This integration capability enhances productivity and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for the california form 540 nr?

Using airSlate SignNow for the california form 540 nr provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are handled efficiently, reducing the risk of errors. Additionally, eSigning is legally binding, making it a reliable choice for tax forms.

-

How secure is airSlate SignNow when handling the california form 540 nr?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data while handling the california form 540 nr. You can trust that your sensitive information is safe and secure throughout the entire document process.

Get more for State Controller Malia M Cohen Is Available For Interviews On

Find out other State Controller Malia M Cohen Is Available For Interviews On

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney