CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc

Understanding the 2023 California 540 2EZ Tax Form

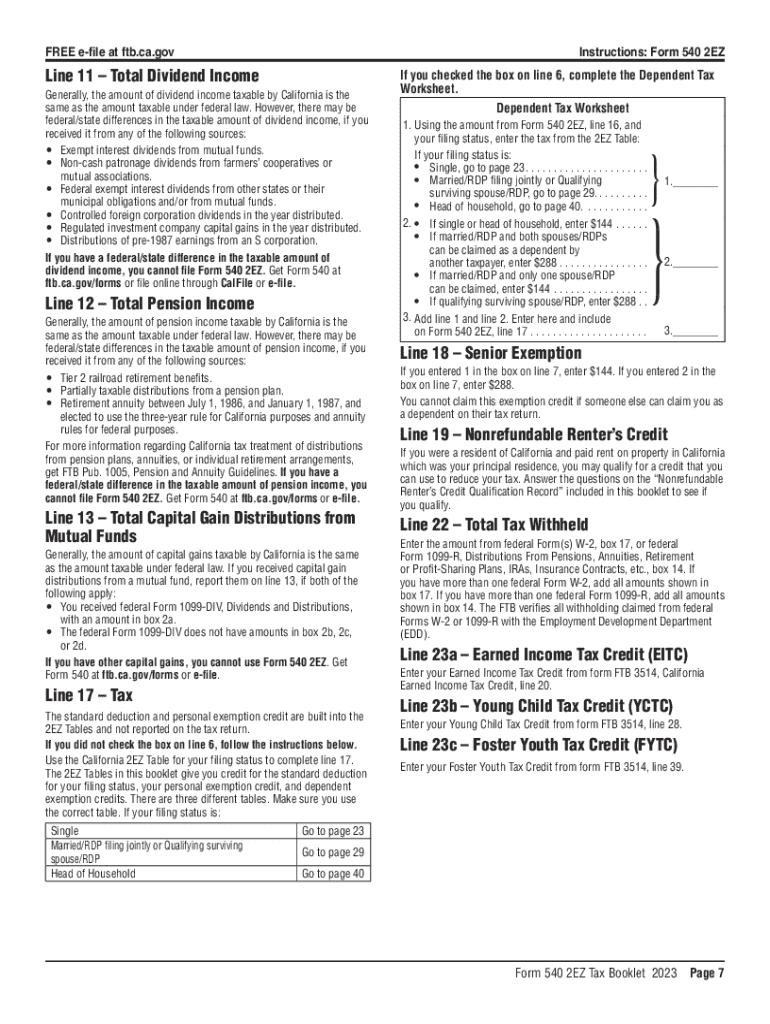

The 2023 California 540 2EZ tax form is a simplified version of the California personal income tax return. It is designed for taxpayers who meet specific criteria, making it easier to file taxes. This form is typically used by individuals with straightforward tax situations, such as those who do not itemize deductions and have a taxable income below a certain threshold. The 540 2EZ form allows for a more streamlined filing process, reducing the complexity often associated with tax preparation.

Steps to Complete the 2023 California 540 2EZ Tax Form

Completing the 2023 California 540 2EZ tax form involves several key steps:

- Gather your documents: Collect all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report your income: Include all sources of income, ensuring accuracy in your reporting.

- Claim deductions: Use the standard deduction available for the 2023 tax year, as itemizing is not an option on this form.

- Calculate your tax: Follow the instructions to determine your tax liability based on your taxable income.

- Sign and date the form: Ensure that you sign and date your return before submission.

Obtaining the 2023 California 540 2EZ Tax Form

Taxpayers can obtain the 2023 California 540 2EZ tax form through various channels. The form is available online at the California Franchise Tax Board (FTB) website, where users can download and print it. Additionally, physical copies can be requested from local FTB offices or ordered by phone. Many tax preparation services also provide access to this form as part of their services.

Filing Deadlines for the 2023 California 540 2EZ Tax Form

The filing deadline for the 2023 California 540 2EZ tax form aligns with the federal tax deadline, typically falling on April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be mindful of this deadline to avoid penalties and interest for late filing.

Eligibility Criteria for the 2023 California 540 2EZ Tax Form

To qualify for the 2023 California 540 2EZ tax form, taxpayers must meet specific eligibility criteria:

- Filing status must be single, married filing jointly, or head of household.

- Taxable income must be below a specified limit, which is adjusted annually.

- Taxpayers cannot claim dependents.

- Only certain types of income are allowed, such as wages, salaries, and interest.

Key Elements of the 2023 California 540 2EZ Tax Form

The 2023 California 540 2EZ tax form includes several key elements that are essential for accurate filing:

- Personal Information: Basic details such as name, address, and Social Security number.

- Income Reporting: Sections for reporting various types of income.

- Deductions: A standard deduction amount that simplifies the process.

- Tax Calculation: A straightforward method for calculating tax owed based on income.

Form Submission Methods for the 2023 California 540 2EZ Tax Form

Taxpayers have multiple options for submitting the 2023 California 540 2EZ tax form. The form can be filed electronically using tax preparation software, which often streamlines the process and reduces errors. Alternatively, taxpayers can print the completed form and submit it by mail to the appropriate FTB address. In-person filing is also available at designated FTB offices, providing assistance for those who need help with their tax returns.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california 540 2ez forms amp instructions personal income tax booklet california 540 2ez forms amp instructions personal income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 540 tax form?

The 2023 540 tax form is a California state income tax return used by residents to report their income and calculate their tax liability. It is essential for individuals who need to file their taxes in California for the year 2023. Understanding this form is crucial for ensuring compliance with state tax laws.

-

How can airSlate SignNow help with the 2023 540 tax form?

airSlate SignNow provides a seamless way to send and eSign the 2023 540 tax form, making the filing process more efficient. With our platform, users can easily upload, sign, and share their tax documents securely. This helps streamline the tax preparation process and ensures that all necessary signatures are obtained.

-

Is airSlate SignNow cost-effective for managing the 2023 540 tax form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 2023 540 tax form and other documents. Our pricing plans are designed to fit various budgets, making it accessible for individuals and businesses alike. By using our service, you can save time and reduce costs associated with traditional document handling.

-

What features does airSlate SignNow offer for the 2023 540 tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the 2023 540 tax form. These features enhance the user experience by simplifying the signing process and ensuring that all documents are completed accurately. Additionally, users can access their documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other software for the 2023 540 tax form?

Absolutely! airSlate SignNow offers integrations with various software applications that can assist in managing the 2023 540 tax form. This includes accounting software and document management systems, allowing for a more streamlined workflow. Integrating these tools can enhance productivity and ensure that all tax-related documents are organized.

-

What are the benefits of using airSlate SignNow for the 2023 540 tax form?

Using airSlate SignNow for the 2023 540 tax form provides numerous benefits, including increased efficiency, enhanced security, and ease of use. Our platform allows users to complete and sign documents quickly, reducing the time spent on tax preparation. Additionally, the secure environment ensures that sensitive information is protected.

-

Is it easy to use airSlate SignNow for the 2023 540 tax form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to manage the 2023 540 tax form. The intuitive interface guides users through the process of uploading, signing, and sending documents. Even those with minimal technical skills can navigate the platform with ease.

Get more for CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc

Find out other CALIFORNIA 540 2EZ Forms & Instructions Personal Income Tax Booklet CALIFORNIA 540 2EZ Forms & Instructions Personal Inc

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF