PA Schedule F Farm Income and Expenses Form and Instructions PA 40 F

What is the PA Schedule F Farm Income and Expenses Form and Instructions PA 40 F

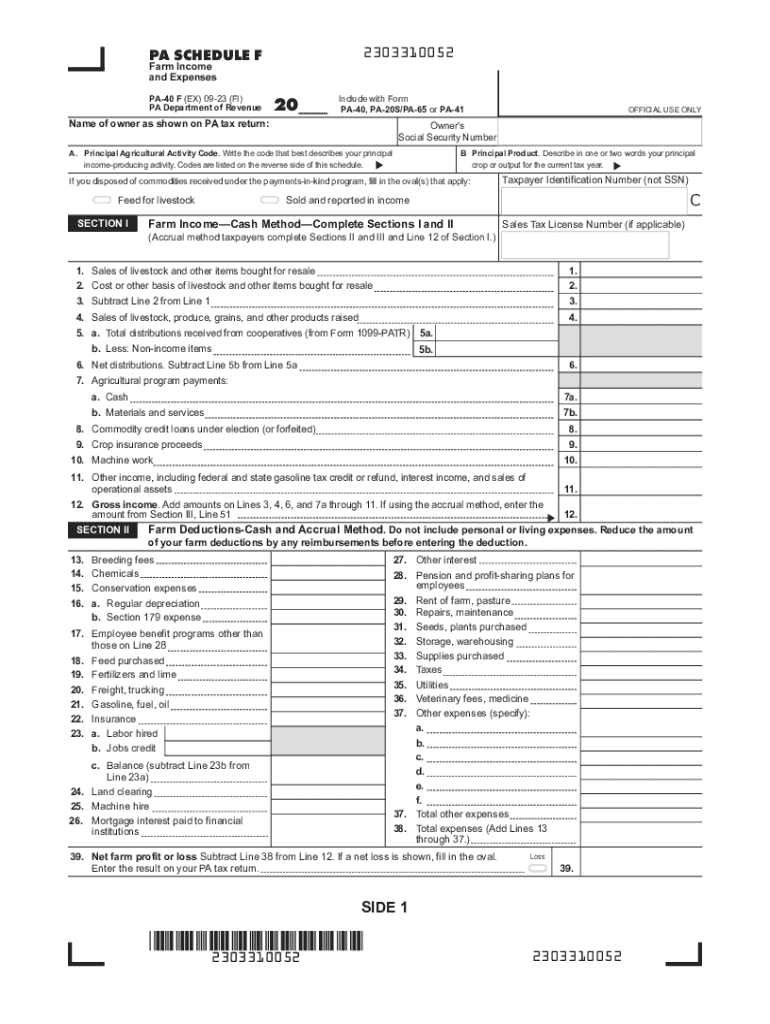

The PA Schedule F is a specific form used by farmers in Pennsylvania to report their farm income and expenses. This form is essential for individuals who earn income from farming activities and need to accurately document their financial performance for tax purposes. The PA Schedule F is filed alongside the PA-40, which is the Pennsylvania personal income tax return. It helps taxpayers calculate their net income from farming, which is crucial for determining their overall tax liability.

How to use the PA Schedule F Farm Income and Expenses Form and Instructions PA 40 F

Using the PA Schedule F involves several steps to ensure accurate reporting. First, gather all necessary financial documents related to your farming operations, including income records, receipts for expenses, and any relevant tax documents. Next, complete the form by entering your total farm income and detailing your expenses, which may include costs for supplies, labor, and equipment. It is important to follow the instructions carefully to ensure compliance with Pennsylvania tax laws. After filling out the form, it should be submitted with your PA-40 tax return.

Steps to complete the PA Schedule F Farm Income and Expenses Form and Instructions PA 40 F

Completing the PA Schedule F requires a systematic approach:

- Begin by downloading the form from the Pennsylvania Department of Revenue website or obtaining a physical copy.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Report your total farm income in the designated section, ensuring all sources of income are included.

- List all allowable expenses related to your farming operations, categorizing them appropriately.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy and completeness before submission.

Key elements of the PA Schedule F Farm Income and Expenses Form and Instructions PA 40 F

Several key elements are crucial when filling out the PA Schedule F:

- Income Reporting: Accurate reporting of all income sources, including sales of crops and livestock, is essential.

- Expense Documentation: Detailed records of all farming-related expenses must be maintained to support the figures reported on the form.

- Net Income Calculation: Understanding how to calculate net income is vital, as it directly impacts tax liability.

- Compliance: Adhering to state-specific tax laws and regulations is necessary to avoid penalties.

Legal use of the PA Schedule F Farm Income and Expenses Form and Instructions PA 40 F

The PA Schedule F is legally required for Pennsylvania residents who earn income from farming activities. It ensures compliance with state tax laws and provides a framework for accurately reporting income and expenses. Failure to file this form when required can result in penalties and interest on unpaid taxes. It is important for farmers to understand their legal obligations regarding this form and to seek assistance if needed to ensure compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa schedule f farm income and expenses form and instructions pa 40 f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F?

The PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F is a tax form used by farmers in Pennsylvania to report their income and expenses related to farming activities. This form helps ensure that all agricultural income is accurately reported to the state, allowing for proper tax calculations.

-

How can airSlate SignNow assist with the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F?

airSlate SignNow provides an efficient platform for electronically signing and sending the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F. With our user-friendly interface, you can easily manage your documents and ensure they are securely signed and submitted on time.

-

What are the pricing options for using airSlate SignNow for the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. You can choose a plan that best fits your requirements for managing the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F, ensuring you get the best value for your investment.

-

Are there any features specifically designed for handling the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F?

Yes, airSlate SignNow includes features such as customizable templates, document tracking, and automated reminders that streamline the process of completing the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F. These tools help you stay organized and ensure that all necessary steps are completed efficiently.

-

Can I integrate airSlate SignNow with other software for managing the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F alongside your other financial documents. This integration helps streamline your workflow and reduces the risk of errors.

-

What benefits does airSlate SignNow provide for completing the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F?

Using airSlate SignNow for the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are signed quickly and securely, allowing you to focus on your farming business.

-

Is it easy to use airSlate SignNow for the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate and use for the PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F. Whether you are tech-savvy or not, our intuitive interface will guide you through the process effortlessly.

Get more for PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F

- Kenya coast national polytechnic application form pdf

- Cricket tournament form pdf 421768555

- Cnic form 6110 1

- Application for late registration in university form

- Etch handwriting assessment pdf form

- Eye drop schedule template form

- Canada student visa checklist pdf form

- Raymond school district school nurse summative evaluation form

Find out other PA Schedule F Farm Income And Expenses Form And Instructions PA 40 F

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now