City of Philadelphia BUSINESS INCOME & RECEIPTS TAX Form

Understanding the City Of Philadelphia Business Income & Receipts Tax

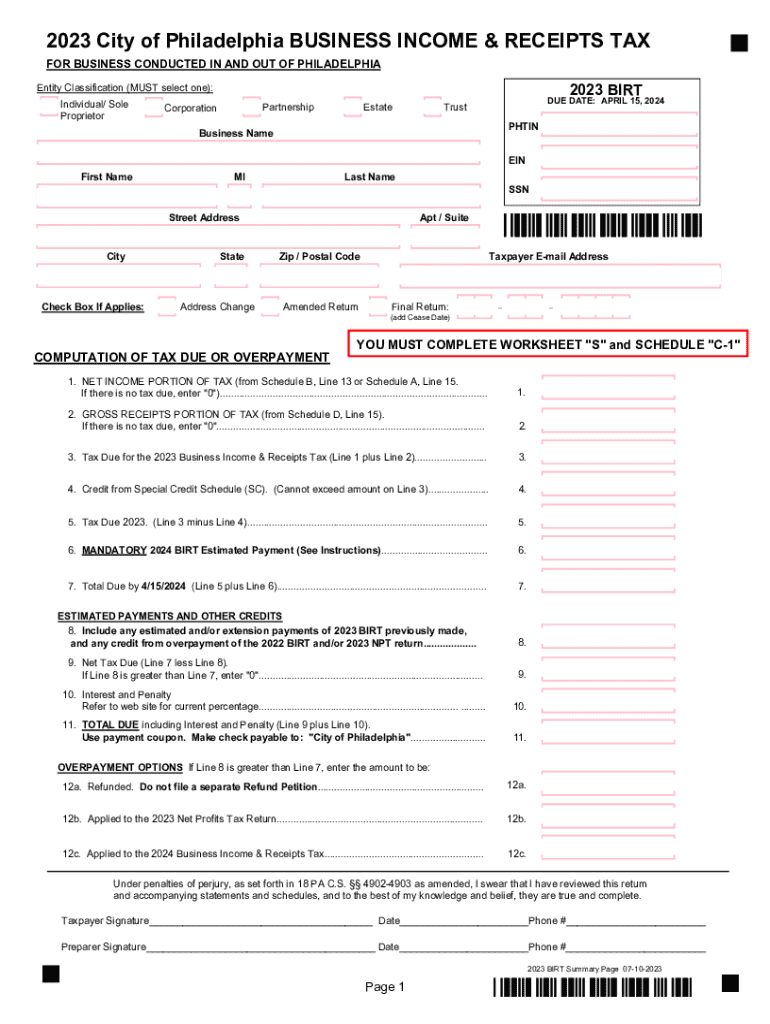

The City Of Philadelphia Business Income & Receipts Tax (BIRT) is a tax imposed on businesses operating within the city. It applies to various business entities, including corporations, partnerships, and sole proprietorships. The tax is calculated based on the gross receipts and net income of the business. Understanding this tax is essential for compliance and effective financial planning.

Steps to Complete the City Of Philadelphia Business Income & Receipts Tax

Completing the City Of Philadelphia Business Income & Receipts Tax involves several key steps:

- Determine your business type and the applicable tax rates.

- Calculate your gross receipts and net income accurately.

- Gather all necessary documentation, including financial statements and receipts.

- Fill out the required forms accurately, ensuring all information is complete.

- Submit the forms by the designated deadline to avoid penalties.

Required Documents for the City Of Philadelphia Business Income & Receipts Tax

To successfully file the City Of Philadelphia Business Income & Receipts Tax, businesses must prepare specific documents, including:

- Financial statements detailing income and expenses.

- Proof of gross receipts, such as sales records and invoices.

- Prior year tax returns, if applicable.

- Any additional documentation that supports your income and deductions.

Filing Deadlines for the City Of Philadelphia Business Income & Receipts Tax

Filing deadlines for the City Of Philadelphia Business Income & Receipts Tax vary based on the business's fiscal year. Typically, businesses must file their tax returns annually. It is crucial to be aware of these dates to ensure timely submission and avoid late fees:

- Annual returns are generally due on the 15th day of the fourth month following the end of the fiscal year.

- Extensions may be available, but they must be requested before the original deadline.

Penalties for Non-Compliance with the City Of Philadelphia Business Income & Receipts Tax

Failure to comply with the City Of Philadelphia Business Income & Receipts Tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can increase the longer the return remains unfiled.

- Interest on unpaid taxes, accruing from the due date until the payment is made.

- Potential legal action for continued non-compliance, which could affect business operations.

Who Issues the City Of Philadelphia Business Income & Receipts Tax

The City Of Philadelphia Department of Revenue is responsible for issuing the Business Income & Receipts Tax. This department oversees the administration, collection, and enforcement of the tax, providing resources and guidance to help businesses understand their obligations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of philadelphia business income receipts tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX?

The City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX is a tax imposed on businesses operating within the city. It is calculated based on the gross receipts and net income of the business. Understanding this tax is crucial for compliance and financial planning.

-

How can airSlate SignNow help with City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX documentation?

airSlate SignNow streamlines the process of preparing and signing documents related to the City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX. Our platform allows you to easily create, send, and eSign necessary tax forms, ensuring you meet all deadlines efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to provide cost-effective solutions for managing documents related to the City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features are particularly beneficial for managing the City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX documents, making the process more efficient and organized.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions. This integration is essential for businesses dealing with the City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX, as it allows for easy data transfer and accurate record-keeping.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation offers numerous benefits, including time savings, enhanced security, and improved accuracy. For businesses managing the City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX, these advantages can lead to better compliance and reduced stress during tax season.

-

Is airSlate SignNow suitable for small businesses handling City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Our platform provides an affordable and user-friendly solution for managing the City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX documentation effectively.

Get more for City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX

Find out other City Of Philadelphia BUSINESS INCOME & RECEIPTS TAX

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage