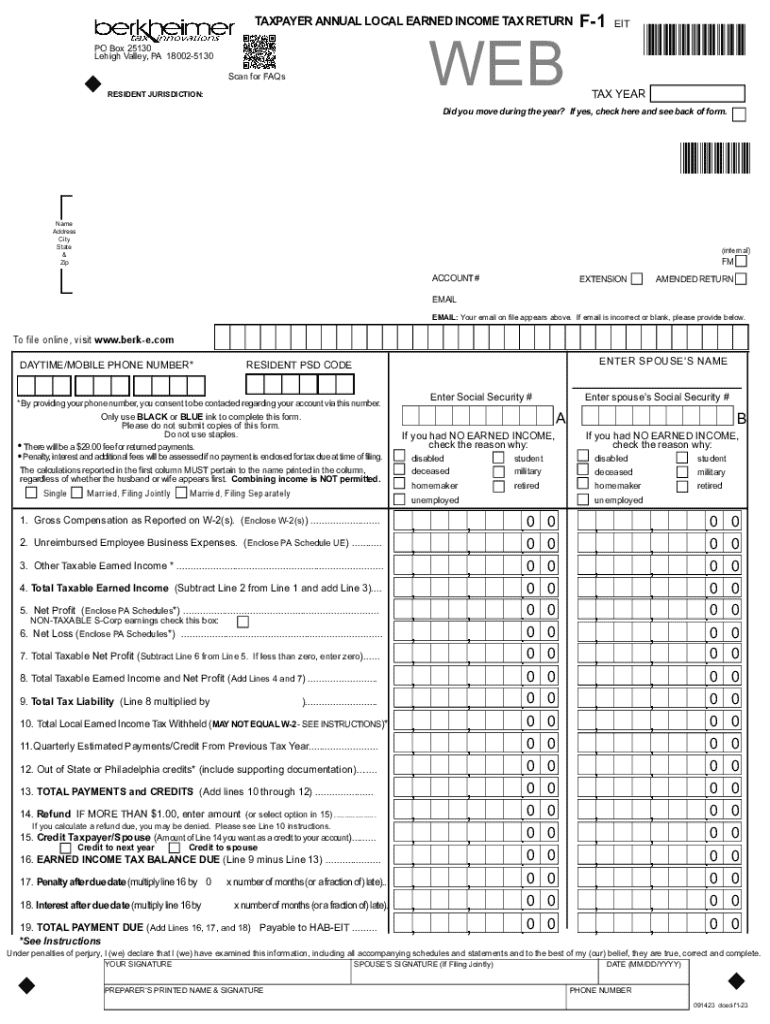

Earned Income Tax Return F 1 Form

What is the Earned Income Tax Return F-1?

The Earned Income Tax Return F-1 is a specific form used by taxpayers in the United States to report their earned income for local earned income tax purposes. This form is essential for individuals who reside in jurisdictions that impose a local earned income tax. By accurately completing the F-1, taxpayers can ensure they meet their local tax obligations and potentially qualify for any applicable credits or refunds.

How to Use the Earned Income Tax Return F-1

Using the Earned Income Tax Return F-1 involves several steps. Taxpayers must first gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, they should fill out the form with accurate details regarding their income, deductions, and any local tax credits. Once completed, the form can be submitted according to local guidelines, which may include electronic filing or mailing a paper copy to the appropriate tax authority.

Steps to Complete the Earned Income Tax Return F-1

Completing the Earned Income Tax Return F-1 requires careful attention to detail. Follow these steps for accurate completion:

- Collect all relevant income documents, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of earned income accurately.

- Include any applicable deductions or credits specific to your local area.

- Review the form for accuracy before submission.

Eligibility Criteria for the Earned Income Tax Return F-1

Eligibility to file the Earned Income Tax Return F-1 generally depends on the taxpayer's residency status and income level. Individuals who reside in a locality that imposes an earned income tax must file this form if they have earned income above a certain threshold. Additionally, specific local regulations may dictate further eligibility requirements, such as age or employment status.

Required Documents for the Earned Income Tax Return F-1

To complete the Earned Income Tax Return F-1, taxpayers must gather several key documents:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any local tax credits or deductions.

- Identification documents, such as a driver's license or Social Security card.

Filing Deadlines for the Earned Income Tax Return F-1

Filing deadlines for the Earned Income Tax Return F-1 can vary by locality. Generally, taxpayers should submit their forms by the standard federal tax deadline, which is typically April 15. However, some jurisdictions may have different deadlines or extensions, so it is crucial to check local regulations to avoid penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the earned income tax return f 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is earned berkheimer f1 and how does it relate to airSlate SignNow?

Earned berkheimer f1 refers to a specific tax credit that businesses can claim. airSlate SignNow simplifies the process of signing and managing documents related to this credit, ensuring that your business can efficiently handle the necessary paperwork.

-

How can airSlate SignNow help me manage earned berkheimer f1 documentation?

With airSlate SignNow, you can easily create, send, and eSign documents related to earned berkheimer f1. Our platform streamlines the documentation process, allowing you to focus on maximizing your tax benefits without getting bogged down in paperwork.

-

What are the pricing options for airSlate SignNow when dealing with earned berkheimer f1?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you are a small business or a large enterprise, our cost-effective solutions ensure that you can manage your earned berkheimer f1 documentation without breaking the bank.

-

What features does airSlate SignNow offer for earned berkheimer f1 management?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools make it easier to manage your earned berkheimer f1 documents efficiently and securely.

-

Can I integrate airSlate SignNow with other software for earned berkheimer f1?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for earned berkheimer f1. This allows you to connect with your existing tools and streamline your document management process.

-

What are the benefits of using airSlate SignNow for earned berkheimer f1?

Using airSlate SignNow for earned berkheimer f1 offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on your business growth.

-

Is airSlate SignNow user-friendly for managing earned berkheimer f1?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage earned berkheimer f1 documents. Our intuitive interface ensures that you can navigate the platform effortlessly, even if you're not tech-savvy.

Get more for Earned Income Tax Return F 1

- Russia medical department medical certificate of fitness form

- Fluid restriction daily worksheet form

- Behavior point sheet template form

- Case management plan template form

- 19 affirmative action plan form

- Dr 0900 form

- Annual notice of child support delinquency you owe past due form

- Attorney case access request form

Find out other Earned Income Tax Return F 1

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself