CIT 120 Instructions West Virginia Tax Division Form

What is the CIT 120 Instructions West Virginia Tax Division

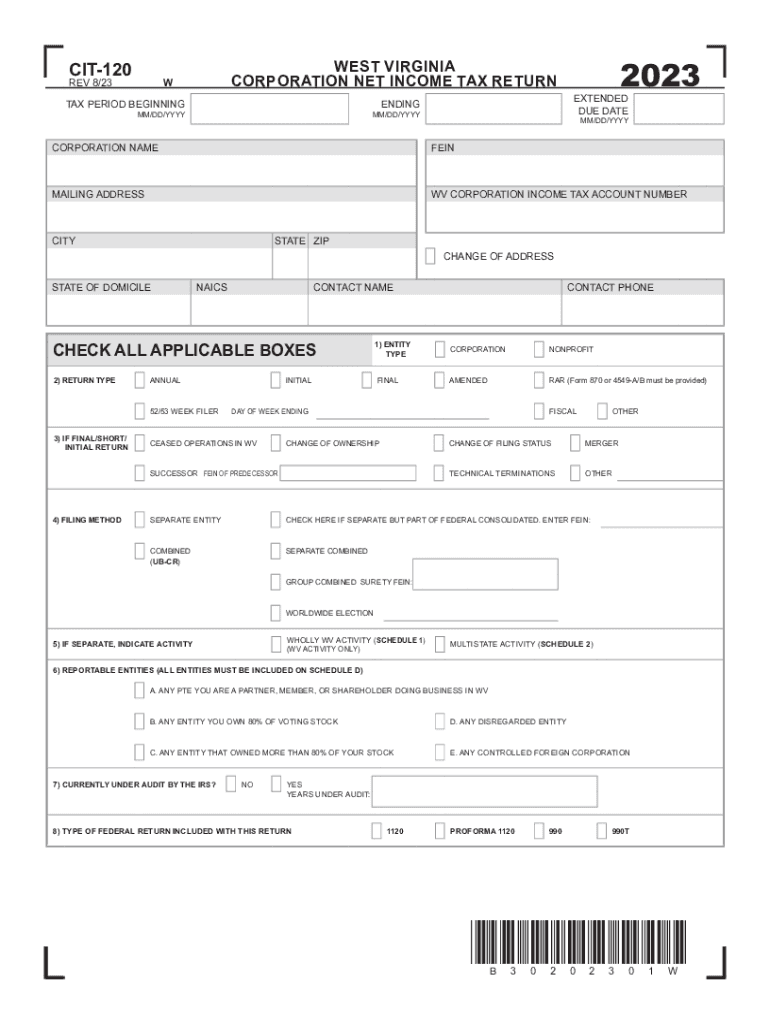

The CIT 120 Instructions provided by the West Virginia Tax Division are detailed guidelines designed to assist taxpayers in completing the Corporate Income Tax Return. This form is essential for corporations operating within West Virginia, as it outlines the necessary steps for reporting income, deductions, and tax liability. Understanding these instructions is crucial for ensuring compliance with state tax laws and for accurately calculating the amount owed to the state.

Steps to complete the CIT 120 Instructions West Virginia Tax Division

Completing the CIT 120 form involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Review the CIT 120 Instructions to understand the specific requirements for your corporation.

- Fill out the form accurately, ensuring that all figures are correct and supported by documentation.

- Double-check calculations to avoid errors that could lead to penalties.

- Submit the completed form by the specified deadline, either electronically or via mail.

Key elements of the CIT 120 Instructions West Virginia Tax Division

The CIT 120 Instructions include several key elements that taxpayers must pay attention to:

- Filing Requirements: Details on who must file the form and any exemptions.

- Income Reporting: Guidelines on how to report various types of income.

- Deductions: Information on allowable deductions that can reduce taxable income.

- Tax Rates: Current tax rates applicable to corporate income.

Filing Deadlines / Important Dates

Timely filing of the CIT 120 is crucial to avoid penalties. The standard deadline for submitting this form is the fifteenth day of the fourth month following the end of the corporation's fiscal year. Corporations should also be aware of any extensions that may apply, as well as specific dates for estimated tax payments throughout the year.

Required Documents

To complete the CIT 120, corporations must prepare and submit various documents, including:

- Financial statements, such as balance sheets and income statements.

- Records of all income earned during the tax year.

- Documentation for any deductions claimed, such as receipts and invoices.

- Prior year tax returns, if applicable, for reference.

Form Submission Methods

The CIT 120 can be submitted through multiple methods, providing flexibility for taxpayers:

- Online Submission: Corporations can file electronically through the West Virginia Tax Division's online portal.

- Mail: The completed form can be printed and sent via postal service to the designated tax office.

- In-Person: Taxpayers may choose to deliver the form directly to a local tax office.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cit 120 instructions west virginia tax division

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the CIT 120 Instructions for the West Virginia Tax Division?

The CIT 120 Instructions for the West Virginia Tax Division provide detailed guidelines on how to complete the Corporate Income Tax return. These instructions help businesses understand the necessary forms, calculations, and filing requirements to ensure compliance with state tax laws.

-

How can airSlate SignNow assist with the CIT 120 Instructions for the West Virginia Tax Division?

airSlate SignNow simplifies the process of completing and submitting the CIT 120 Instructions for the West Virginia Tax Division by allowing users to eSign documents securely. This ensures that all necessary forms are signed and submitted on time, reducing the risk of errors and penalties.

-

What features does airSlate SignNow offer for managing CIT 120 Instructions?

airSlate SignNow offers features such as document templates, customizable workflows, and secure eSigning, which are essential for managing CIT 120 Instructions for the West Virginia Tax Division. These tools streamline the document management process, making it easier for businesses to stay organized and compliant.

-

Is airSlate SignNow cost-effective for handling CIT 120 Instructions?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to manage CIT 120 Instructions for the West Virginia Tax Division. With flexible pricing plans, companies can choose a package that fits their budget while still accessing powerful document management features.

-

Can I integrate airSlate SignNow with other software for CIT 120 Instructions?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage CIT 120 Instructions for the West Virginia Tax Division alongside your existing tools. This ensures a seamless workflow and enhances productivity across your business operations.

-

What are the benefits of using airSlate SignNow for CIT 120 Instructions?

Using airSlate SignNow for CIT 120 Instructions for the West Virginia Tax Division provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can complete their tax documents faster and with greater accuracy, ensuring compliance and peace of mind.

-

How secure is airSlate SignNow when handling CIT 120 Instructions?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including CIT 120 Instructions for the West Virginia Tax Division. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for CIT 120 Instructions West Virginia Tax Division

Find out other CIT 120 Instructions West Virginia Tax Division

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy