215 W 10th Street, Ste 204 Form

Understanding Pueblo County Tax

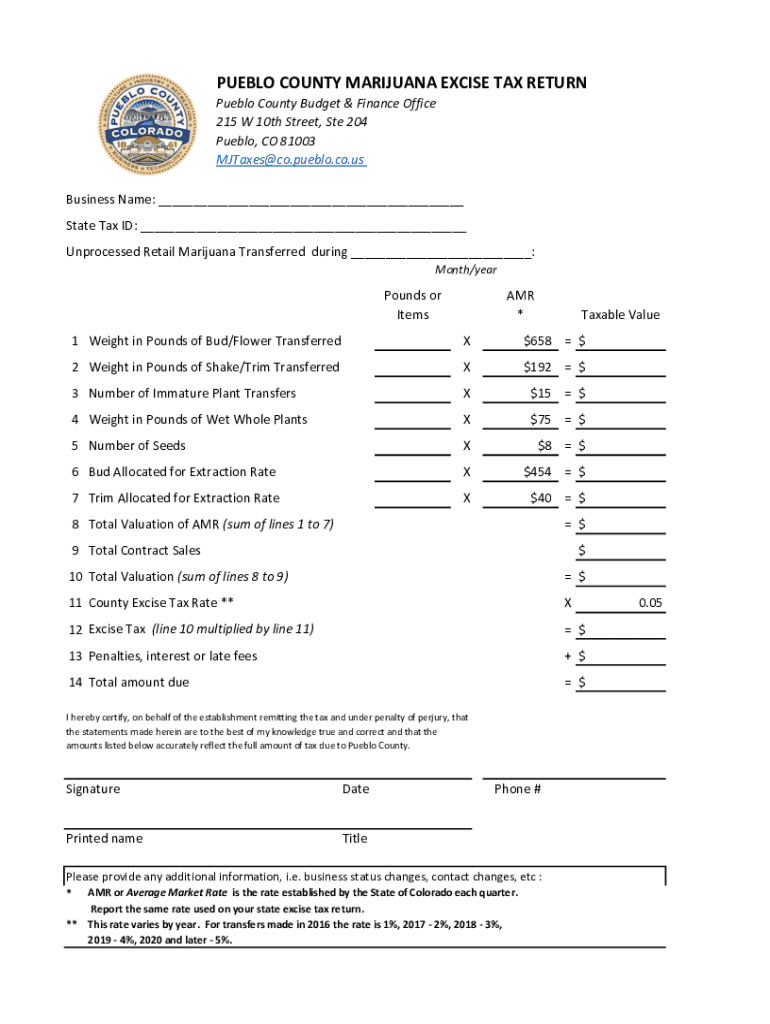

Pueblo County tax refers to the various taxes levied by the Pueblo County government in Colorado. This includes property taxes, sales taxes, and specific taxes related to marijuana sales. Understanding these taxes is essential for residents and businesses operating within the county, as they contribute to local services and infrastructure. The tax structure can vary based on property type, business activities, and specific regulations applicable to the county.

Key Elements of Pueblo County Tax

Key elements of the Pueblo County tax system include:

- Property Tax: Based on the assessed value of real estate properties, which funds local schools, roads, and public services.

- Sales Tax: A percentage added to the sale of goods and services, which supports county operations.

- Marijuana Tax: Specific excise and sales taxes applied to marijuana sales, which are used for public health and safety initiatives.

Filing Deadlines and Important Dates

Filing deadlines for Pueblo County tax forms vary based on the type of tax. Generally, property tax assessments are due by April 15 each year, while sales tax returns may have monthly or quarterly deadlines. It is crucial for taxpayers to stay informed about these dates to avoid penalties and ensure compliance with local tax regulations.

Required Documents for Filing

When filing taxes in Pueblo County, certain documents are typically required. These may include:

- Proof of income, such as W-2 forms or 1099s for self-employed individuals.

- Property tax assessment notices for real estate owners.

- Receipts for sales tax collected if operating a business.

- Documentation related to marijuana sales if applicable.

Form Submission Methods

Pueblo County tax forms can be submitted through various methods, including:

- Online: Many forms can be completed and submitted electronically through the Pueblo County tax website.

- Mail: Taxpayers can print forms, complete them, and mail them to the appropriate county office.

- In-Person: Forms can also be submitted directly at the Pueblo County tax office during business hours.

Penalties for Non-Compliance

Failure to comply with Pueblo County tax regulations can result in penalties. These may include:

- Late fees for overdue taxes.

- Interest charges on unpaid balances.

- Potential legal action for severe non-compliance cases.

Eligibility Criteria for Tax Exemptions

Certain residents and businesses in Pueblo County may qualify for tax exemptions. Eligibility criteria typically include:

- Non-profit organizations that serve the public interest.

- Senior citizens or disabled individuals may qualify for property tax relief.

- Businesses involved in specific industries, such as renewable energy, may receive tax incentives.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 215 w 10th street ste 204

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to pueblo county tax?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. For those dealing with pueblo county tax, it streamlines the process of submitting tax documents, ensuring compliance and efficiency.

-

How can airSlate SignNow help with managing pueblo county tax documents?

With airSlate SignNow, you can easily create, send, and manage your pueblo county tax documents. The platform provides templates and tools that simplify the preparation and submission of tax forms, making it easier to stay organized and compliant.

-

What are the pricing options for airSlate SignNow for pueblo county tax needs?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including those focused on pueblo county tax. You can choose from monthly or annual subscriptions, ensuring you find a plan that fits your budget while accessing essential features.

-

What features does airSlate SignNow offer for pueblo county tax management?

airSlate SignNow includes features such as document templates, automated workflows, and secure storage, all of which are beneficial for managing pueblo county tax documents. These tools help streamline the tax filing process and enhance overall productivity.

-

Is airSlate SignNow secure for handling pueblo county tax documents?

Yes, airSlate SignNow prioritizes security, utilizing encryption and compliance with industry standards to protect your pueblo county tax documents. This ensures that sensitive information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow integrate with other tools for pueblo county tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your existing tools for managing pueblo county tax. This integration capability enhances your workflow and ensures that all your tax-related tasks are streamlined.

-

What are the benefits of using airSlate SignNow for pueblo county tax?

Using airSlate SignNow for pueblo county tax offers numerous benefits, including time savings, improved accuracy, and enhanced compliance. The platform simplifies the eSigning process, making it easier to manage tax documents efficiently.

Get more for 215 W 10th Street, Ste 204

Find out other 215 W 10th Street, Ste 204

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF