Book 21 Colorado Severance Tax Booklet If You Are Using a Screen Reader or Other Assistive Technology, Please Note that Colorado Form

Key elements of the Colorado severance tax forms

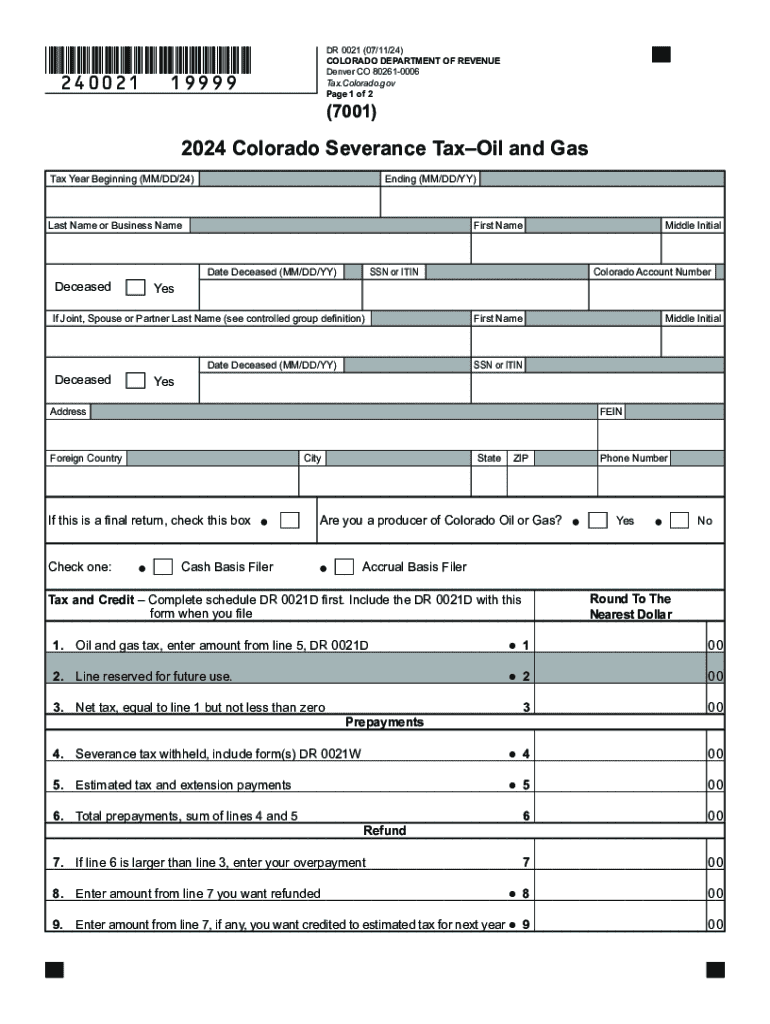

The Colorado severance tax forms are essential for businesses involved in the extraction of natural resources, such as oil and gas. These forms help ensure compliance with state tax regulations. The primary form used is the Colorado DR 0021, which is specifically designed for reporting severance tax liabilities. This form requires detailed information about the quantity of resources extracted and the corresponding tax calculations. Additionally, the forms include sections for reporting any applicable deductions or credits, which can significantly impact the overall tax liability.

Steps to complete the Colorado severance tax forms

Completing the Colorado severance tax forms involves several steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to the resources extracted, including production reports. Next, fill out the Colorado DR 0021 form, ensuring that all sections are completed accurately. Pay particular attention to the calculations for severance tax owed, as errors can lead to penalties. After completing the form, review it thoroughly for any mistakes before submitting it to the Colorado Department of Revenue. Finally, keep a copy of the submitted form and any supporting documents for your records.

Filing deadlines and important dates

Filing deadlines for Colorado severance tax forms are crucial for compliance. Typically, the severance tax return is due on the last day of the month following the end of each quarter. For example, the first quarter return is due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. It is important to stay informed about any changes to these deadlines, as the Colorado Department of Revenue may adjust them based on legislative changes or other factors.

Required documents for Colorado severance tax filing

When filing Colorado severance tax forms, certain documents are necessary to support the information provided on the forms. These typically include production reports that detail the volume of resources extracted, sales records, and any relevant contracts or agreements. Additionally, businesses may need to provide documentation of any deductions or credits claimed on the severance tax return. Having these documents organized and readily available can streamline the filing process and help avoid potential issues with the Colorado Department of Revenue.

Form submission methods for Colorado severance tax

Businesses can submit Colorado severance tax forms through various methods. The Colorado Department of Revenue allows for electronic filing via their online portal, which is often the quickest and most efficient method. Alternatively, forms can be submitted by mail. When choosing to file by mail, it is essential to send the forms to the correct address and allow sufficient time for delivery to meet filing deadlines. In-person submissions are also possible at designated Department of Revenue offices, but it is advisable to check for any specific requirements or hours of operation before visiting.

Penalties for non-compliance with Colorado severance tax regulations

Failure to comply with Colorado severance tax regulations can result in significant penalties. Late filings may incur a penalty based on the amount of tax owed, and interest may accrue on any unpaid taxes. In cases of willful neglect or fraudulent reporting, the penalties can be much more severe, including potential criminal charges. It is essential for businesses to understand these risks and ensure timely and accurate submissions of their severance tax forms to avoid complications with the Colorado Department of Revenue.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the book 21 colorado severance tax booklet if you are using a screen reader or other assistive technology please note that colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Colorado severance tax forms?

Colorado severance tax forms are documents required by the state of Colorado for companies that extract natural resources. These forms help ensure compliance with state tax regulations and facilitate the accurate reporting of severance taxes owed. Understanding these forms is crucial for businesses operating in the resource extraction sector.

-

How can airSlate SignNow help with Colorado severance tax forms?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign Colorado severance tax forms. Our user-friendly interface simplifies the process, ensuring that all necessary documents are completed accurately and submitted on time. This helps businesses stay compliant and avoid potential penalties.

-

Are there any costs associated with using airSlate SignNow for Colorado severance tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions ensure that you can manage your Colorado severance tax forms without breaking the bank. You can choose a plan that fits your budget while still accessing all essential features.

-

What features does airSlate SignNow offer for managing Colorado severance tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for Colorado severance tax forms. These tools streamline the process, making it easier to manage multiple forms and ensure that all signatures are collected efficiently. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other software for Colorado severance tax forms?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing Colorado severance tax forms. Whether you use accounting software or project management tools, our platform can seamlessly connect to help you maintain efficiency and organization.

-

What are the benefits of using airSlate SignNow for Colorado severance tax forms?

Using airSlate SignNow for Colorado severance tax forms provides numerous benefits, including time savings, improved accuracy, and enhanced compliance. Our platform reduces the risk of errors and ensures that all forms are completed and submitted correctly. This allows businesses to focus on their core operations while we handle the paperwork.

-

Is airSlate SignNow secure for handling Colorado severance tax forms?

Yes, airSlate SignNow prioritizes security and compliance when handling Colorado severance tax forms. Our platform employs advanced encryption and security protocols to protect sensitive information. You can trust that your documents are safe and secure throughout the entire signing process.

Get more for Book 21 Colorado Severance Tax Booklet If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado

- Markhams account application online form

- How to write an affidavit for self employment form

- How to fill form 6 sample 42392053

- Pmmvy form 1 a in gujarati pdf

- Indemnity form for school trip

- Aviz de refuz la plata bcr form

- Patient advocate forms

- Ohio cdl pre trip inspection evaluation score sheet form

Find out other Book 21 Colorado Severance Tax Booklet If You Are Using A Screen Reader Or Other Assistive Technology, Please Note That Colorado

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking