Cambios Y Nuevos Formularios De Retencin De Salarios Y

What is the Cambios Y Nuevos Formularios De Retencin De Salarios Y

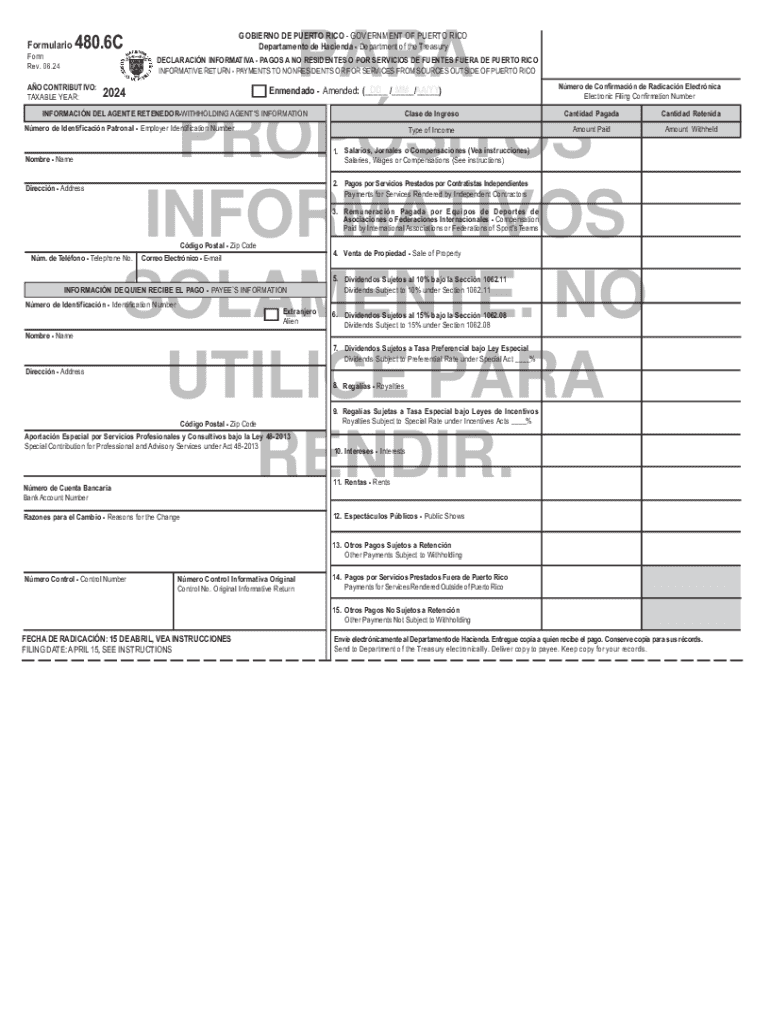

The Cambios Y Nuevos Formularios De Retencin De Salarios Y refers to updated forms used for withholding income tax from employee wages in the United States. These forms are essential for employers to accurately calculate the amount of federal income tax to withhold from their employees' paychecks. The changes often reflect adjustments in tax laws, exemptions, and deductions, ensuring compliance with the latest IRS regulations. Understanding these forms is crucial for both employers and employees to maintain proper tax withholding practices.

How to use the Cambios Y Nuevos Formularios De Retencin De Salarios Y

Using the Cambios Y Nuevos Formularios De Retencin De Salarios Y involves several key steps. First, employers must obtain the latest version of the form, which can typically be found on the IRS website or through payroll service providers. Next, employers should fill out the form with accurate employee information, including Social Security numbers and withholding allowances. After completing the form, it should be provided to employees for their review and signature, ensuring they understand their withholding preferences. Finally, employers must retain copies of the completed forms for their records and submit any necessary information to the IRS as required.

Steps to complete the Cambios Y Nuevos Formularios De Retencin De Salarios Y

Completing the Cambios Y Nuevos Formularios De Retencin De Salarios Y involves a systematic approach:

- Gather necessary employee information, including full name, address, and Social Security number.

- Determine the correct withholding allowances based on the employee's tax situation.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the completed form with the employee to confirm accuracy and understanding.

- Obtain the employee's signature and date on the form.

- File the form with the employer's payroll records and ensure compliance with IRS submission guidelines.

Key elements of the Cambios Y Nuevos Formularios De Retencin De Salarios Y

Key elements of the Cambios Y Nuevos Formularios De Retencin De Salarios Y include:

- Employee Information: Basic details such as name, address, and Social Security number.

- Withholding Allowances: The number of allowances claimed by the employee, affecting the amount withheld.

- Additional Withholding: Options for employees to request extra amounts to be withheld from their paychecks.

- Signature and Date: Required for validation, confirming that the employee agrees to the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the Cambios Y Nuevos Formularios De Retencin De Salarios Y, emphasizing the importance of accuracy in completing the forms. Employers must ensure that they are using the most current version of the form and are aware of any changes in tax laws that may affect withholding amounts. The IRS also outlines the responsibilities of employers in retaining completed forms and submitting necessary information to the agency. Regular updates and revisions to the forms are made available by the IRS to reflect changes in tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Cambios Y Nuevos Formularios De Retencin De Salarios Y are critical for compliance. Employers must ensure that completed forms are provided to employees by the first payroll period of the year. Additionally, any changes in withholding allowances should be submitted promptly to avoid discrepancies in tax withholding throughout the year. Employers should also be aware of any deadlines set by the IRS for submitting annual tax filings that may include information from these forms.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cambios y nuevos formularios de retencin de salarios y

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Cambios Y Nuevos Formularios De Retencin De Salarios Y?

The Cambios Y Nuevos Formularios De Retencin De Salarios Y refer to the updated forms required for salary retention compliance. These changes ensure that businesses adhere to the latest regulations and avoid penalties. Understanding these forms is crucial for accurate payroll processing.

-

How can airSlate SignNow help with Cambios Y Nuevos Formularios De Retencin De Salarios Y?

airSlate SignNow simplifies the process of managing Cambios Y Nuevos Formularios De Retencin De Salarios Y by providing an intuitive platform for document creation and eSigning. Our solution allows you to easily customize and send these forms for signatures, ensuring compliance and efficiency. This streamlines your payroll operations signNowly.

-

What features does airSlate SignNow offer for managing salary retention forms?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning for managing Cambios Y Nuevos Formularios De Retencin De Salarios Y. These tools help you create, send, and track documents effortlessly. Additionally, our platform ensures that all forms are compliant with the latest regulations.

-

Is airSlate SignNow cost-effective for small businesses dealing with salary retention?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing Cambios Y Nuevos Formularios De Retencin De Salarios Y. Our pricing plans are flexible and cater to various needs, ensuring that you get the best value for your investment. This affordability allows small businesses to maintain compliance without breaking the bank.

-

Can airSlate SignNow integrate with other payroll systems?

Absolutely! airSlate SignNow offers seamless integrations with various payroll systems, making it easier to manage Cambios Y Nuevos Formularios De Retencin De Salarios Y. This integration ensures that your payroll data is synchronized and up-to-date, enhancing overall efficiency. You can connect with popular platforms to streamline your processes.

-

What are the benefits of using airSlate SignNow for salary retention forms?

Using airSlate SignNow for Cambios Y Nuevos Formularios De Retencin De Salarios Y provides numerous benefits, including improved compliance, faster processing times, and enhanced security. Our platform allows you to track document status in real-time, reducing delays and ensuring timely submissions. This leads to a more efficient payroll process overall.

-

How secure is airSlate SignNow for handling sensitive payroll documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your Cambios Y Nuevos Formularios De Retencin De Salarios Y and other sensitive documents. Our platform is compliant with industry standards, ensuring that your data remains safe and confidential.

Get more for Cambios Y Nuevos Formularios De Retencin De Salarios Y

Find out other Cambios Y Nuevos Formularios De Retencin De Salarios Y

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast