INFORMATIVE RETURN PASS through ENTITY

What is the INFORMATIVE RETURN PASS THROUGH ENTITY

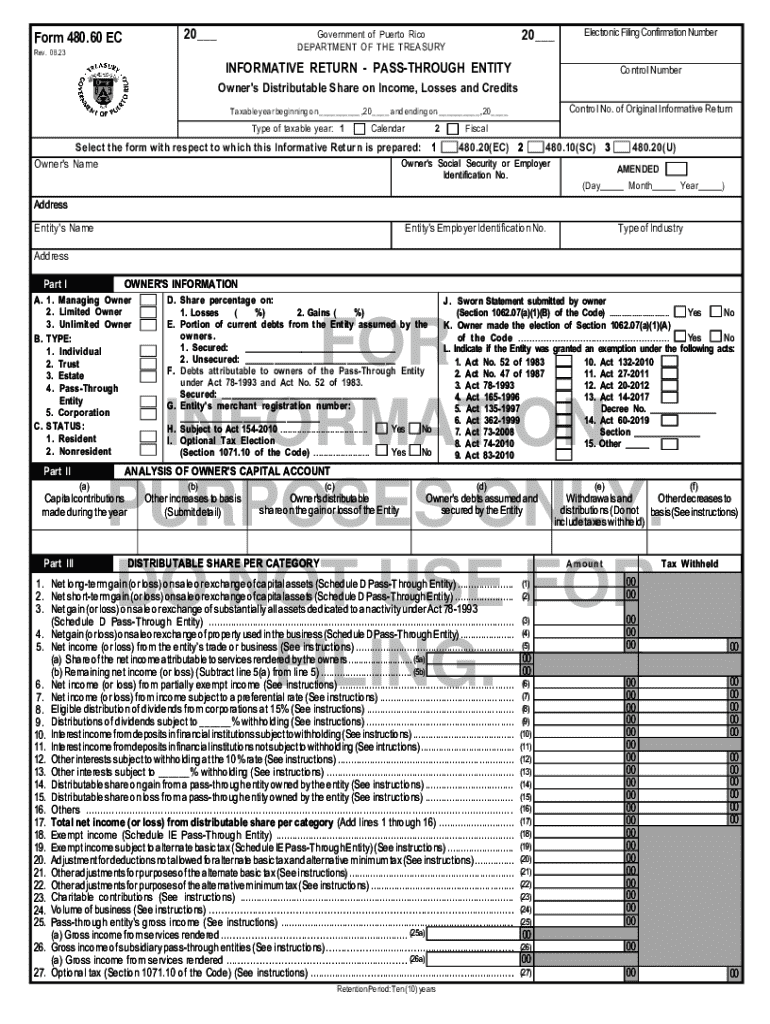

The INFORMATIVE RETURN PASS THROUGH ENTITY is a tax-related document used primarily by certain business entities in the United States. This form provides essential information about the income, deductions, and credits of the entity, which is typically a partnership, LLC, or S corporation. Unlike traditional tax forms, this document does not result in a tax liability for the entity itself; instead, it informs the IRS about the financial activities that pass through to the individual owners or shareholders. Understanding this form is crucial for compliance with federal tax regulations.

How to use the INFORMATIVE RETURN PASS THROUGH ENTITY

Using the INFORMATIVE RETURN PASS THROUGH ENTITY involves several steps. First, the entity must gather all relevant financial information, including income statements, expense reports, and any applicable deductions. Next, the entity completes the form accurately, ensuring that all data is correct and consistent with the financial records. Once completed, the form should be submitted to the IRS by the specified deadline. It is important for each owner or shareholder to receive a copy of the information reported, as they will need it for their personal tax filings.

Key elements of the INFORMATIVE RETURN PASS THROUGH ENTITY

The key elements of the INFORMATIVE RETURN PASS THROUGH ENTITY include the entity's name, address, and Employer Identification Number (EIN). Additionally, it requires detailed reporting of income sources, deductions, and credits allocated to each owner or shareholder. The form must also specify the type of entity and provide information on any distributions made during the tax year. Accurate reporting of these elements ensures compliance and helps prevent potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the INFORMATIVE RETURN PASS THROUGH ENTITY vary based on the entity type. Generally, partnerships and S corporations must file by March 15 of each year, while LLCs may have different deadlines depending on their classification. It is essential to be aware of these dates to avoid late filing penalties. Extensions may be available, but they must be requested before the original deadline.

Required Documents

To complete the INFORMATIVE RETURN PASS THROUGH ENTITY, several documents are typically required. These include financial statements, such as profit and loss statements, balance sheets, and any supporting documentation for deductions and credits claimed. Additionally, the entity should have records of distributions made to owners or shareholders throughout the year. Having these documents organized and readily available facilitates a smoother filing process.

Penalties for Non-Compliance

Failure to file the INFORMATIVE RETURN PASS THROUGH ENTITY by the deadline can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, inaccurate reporting may lead to further scrutiny from the IRS, potentially resulting in audits or additional penalties. It is crucial for entities to ensure timely and accurate filing to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the informative return pass through entity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an INFORMATIVE RETURN PASS THROUGH ENTITY?

An INFORMATIVE RETURN PASS THROUGH ENTITY is a tax reporting mechanism used by certain business structures, such as partnerships and S corporations, to report income, deductions, and credits to the IRS. This type of return provides essential information to the IRS while allowing the income to pass through to the owners for personal tax reporting.

-

How does airSlate SignNow support the creation of INFORMATIVE RETURN PASS THROUGH ENTITY documents?

airSlate SignNow offers a user-friendly platform that allows businesses to easily create, send, and eSign documents related to INFORMATIVE RETURN PASS THROUGH ENTITY filings. With customizable templates and a streamlined workflow, users can efficiently manage their tax documentation.

-

What are the pricing options for airSlate SignNow when dealing with INFORMATIVE RETURN PASS THROUGH ENTITY documents?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. Whether you need basic features for occasional use or advanced functionalities for frequent INFORMATIVE RETURN PASS THROUGH ENTITY documentation, there is a plan that fits your needs and budget.

-

What features does airSlate SignNow offer for managing INFORMATIVE RETURN PASS THROUGH ENTITY documents?

Key features of airSlate SignNow include document templates, real-time collaboration, and secure eSigning capabilities. These tools simplify the process of preparing and managing INFORMATIVE RETURN PASS THROUGH ENTITY documents, ensuring compliance and efficiency.

-

Can airSlate SignNow integrate with other software for INFORMATIVE RETURN PASS THROUGH ENTITY management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage INFORMATIVE RETURN PASS THROUGH ENTITY documents. This integration allows for streamlined data transfer and improved accuracy in your tax reporting.

-

What are the benefits of using airSlate SignNow for INFORMATIVE RETURN PASS THROUGH ENTITY filings?

Using airSlate SignNow for INFORMATIVE RETURN PASS THROUGH ENTITY filings offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform's intuitive design makes it easy to navigate, ensuring that you can focus on your business rather than administrative tasks.

-

Is airSlate SignNow compliant with regulations for INFORMATIVE RETURN PASS THROUGH ENTITY documentation?

Absolutely, airSlate SignNow is designed to comply with all relevant regulations for INFORMATIVE RETURN PASS THROUGH ENTITY documentation. The platform prioritizes data security and legal compliance, giving users peace of mind when managing sensitive tax information.

Get more for INFORMATIVE RETURN PASS THROUGH ENTITY

Find out other INFORMATIVE RETURN PASS THROUGH ENTITY

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document