Tax Credit Recap Schedule West Virginia Tax Division Form

What is the Tax Credit Recap Schedule for West Virginia?

The Tax Credit Recap Schedule is an essential document used by taxpayers in West Virginia to summarize and claim various tax credits available under state law. This schedule helps individuals and businesses ensure they receive all eligible credits, which can significantly reduce their overall tax liability. It is particularly important for those who have participated in programs that offer tax incentives, such as investment credits or job creation credits.

Steps to Complete the Tax Credit Recap Schedule

Completing the Tax Credit Recap Schedule involves several key steps:

- Gather all necessary documentation, including prior tax returns, proof of eligibility for credits, and any supporting materials related to the credits being claimed.

- Fill out the form by entering personal information, including your name, address, and Social Security number, as required.

- List each tax credit you are claiming, providing details such as the amount and the specific program associated with each credit.

- Review the completed schedule for accuracy, ensuring all information is correct and all required attachments are included.

- Submit the schedule along with your tax return by the designated filing deadline.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Tax Credit Recap Schedule. Typically, the deadline aligns with the state income tax return due date, which is usually April 15 for most taxpayers. However, if the date falls on a weekend or holiday, the deadline may be adjusted. It is crucial to stay informed about any changes to deadlines that may occur in a given tax year.

Required Documents for the Tax Credit Recap Schedule

To accurately complete the Tax Credit Recap Schedule, taxpayers must have several documents ready:

- Previous year’s tax return to reference past credits claimed.

- Documentation supporting eligibility for each credit, such as receipts or certificates from qualifying programs.

- Any correspondence from the West Virginia Tax Division regarding credits or tax issues.

- Identification documents, including Social Security numbers or Employer Identification Numbers (EIN) for businesses.

Eligibility Criteria for Tax Credits

Eligibility for tax credits in West Virginia can vary based on the specific program. Generally, taxpayers must meet certain criteria, which may include:

- Residency status in West Virginia.

- Participation in qualifying programs or activities that promote economic development.

- Compliance with state tax laws and regulations.

- Timely filing of tax returns and payment of any owed taxes.

Who Issues the Tax Credit Recap Schedule?

The Tax Credit Recap Schedule is issued by the West Virginia State Tax Division. This division is responsible for administering state tax laws, including the management of tax credits and incentives. Taxpayers can contact the division for assistance or clarification regarding the schedule and the credits available.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax credit recap schedule west virginia tax division

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

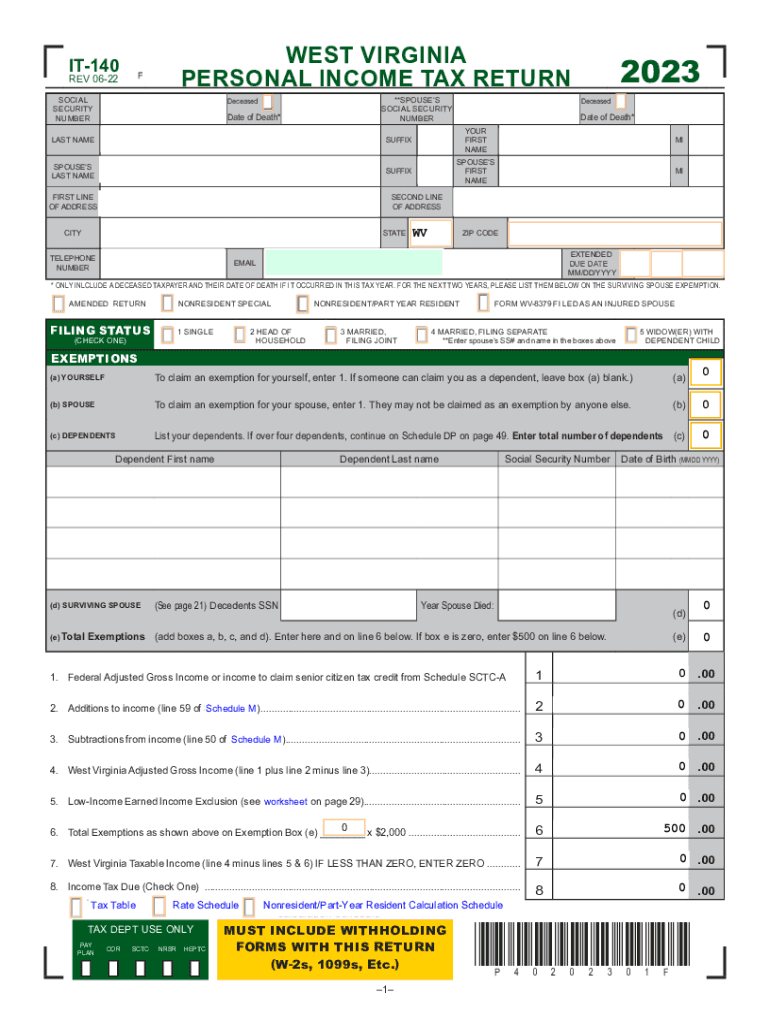

What is the wv tax form it 140?

The wv tax form it 140 is a tax return form used by West Virginia residents to report their income and calculate their state tax liability. It is essential for individuals to accurately complete this form to ensure compliance with state tax laws and to avoid penalties.

-

How can airSlate SignNow help with the wv tax form it 140?

airSlate SignNow simplifies the process of completing and submitting the wv tax form it 140 by allowing users to eSign documents securely and efficiently. With our platform, you can easily fill out the form, sign it electronically, and send it directly to the appropriate tax authorities.

-

Is there a cost associated with using airSlate SignNow for the wv tax form it 140?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage your documents, including the wv tax form it 140, without breaking the bank while enjoying all the necessary features.

-

What features does airSlate SignNow offer for the wv tax form it 140?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing the wv tax form it 140. These features streamline the process, making it easier for users to complete their tax forms accurately and on time.

-

Can I integrate airSlate SignNow with other software for the wv tax form it 140?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your documents related to the wv tax form it 140. This ensures that you can work within your preferred tools while benefiting from our eSigning capabilities.

-

What are the benefits of using airSlate SignNow for tax forms like the wv tax form it 140?

Using airSlate SignNow for the wv tax form it 140 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign your tax forms quickly, ensuring you meet deadlines without hassle.

-

Is airSlate SignNow secure for handling the wv tax form it 140?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the wv tax form it 140. We utilize advanced encryption and security protocols to protect your information throughout the signing process.

Get more for Tax Credit Recap Schedule West Virginia Tax Division

- Louisiana marriage license application form

- Caregiver job application form pdf

- Lego dimensions checklist pdf form

- Pa application form pdf

- Herbalife declaration form

- American national make a payment form

- Motor vehicle dealer board dealerwholesale colorado gov colorado form

- 05 idaho marriage first sex pub health and welfare healthandwelfare idaho form

Find out other Tax Credit Recap Schedule West Virginia Tax Division

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement