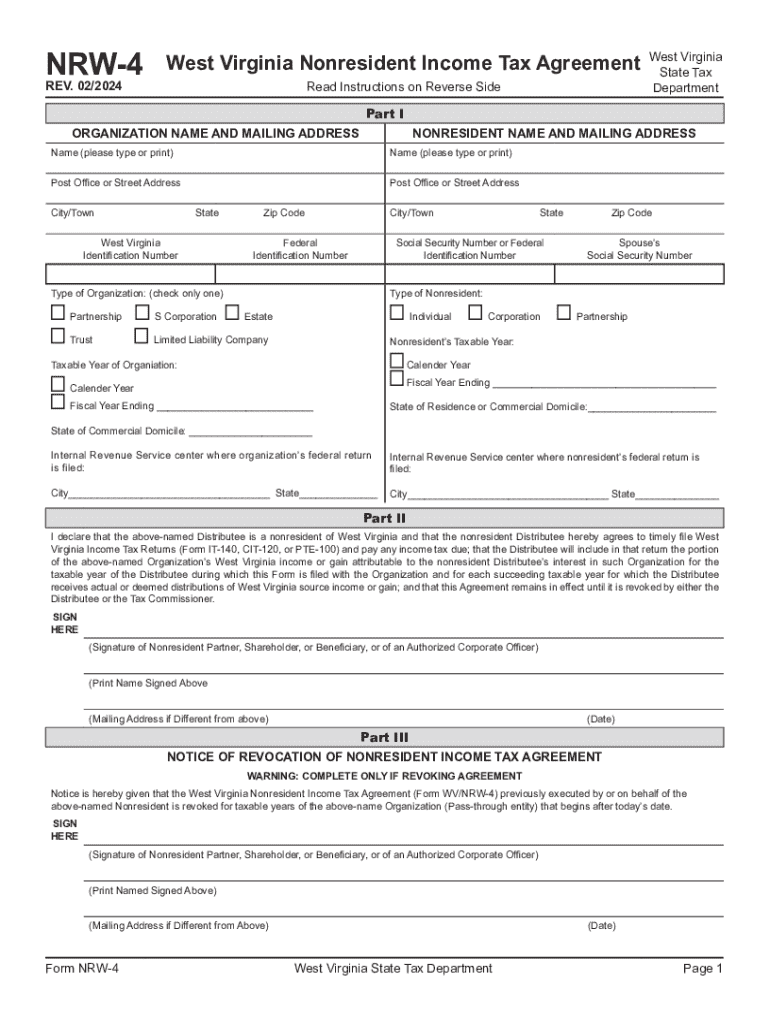

West Virginia Nonresident Income Tax Agreement Form

What is the West Virginia Nonresident Income Tax Agreement

The West Virginia Nonresident Income Tax Agreement is a crucial document for individuals who earn income in West Virginia but reside in another state. This agreement allows nonresidents to avoid double taxation on income earned within West Virginia. By filing the appropriate forms, nonresidents can ensure that they are only taxed by their home state on the income they earn in West Virginia, thereby streamlining their tax obligations.

How to use the West Virginia Nonresident Income Tax Agreement

Using the West Virginia Nonresident Income Tax Agreement involves a few key steps. First, individuals must determine their eligibility based on their residency status and the income they earn in West Virginia. Next, they should obtain the necessary forms, including the WV NRW form. After completing the form with accurate information regarding income and residency, it must be submitted to the West Virginia State Tax Department. This process helps ensure compliance with state tax laws while minimizing tax liability.

Steps to complete the West Virginia Nonresident Income Tax Agreement

Completing the West Virginia Nonresident Income Tax Agreement requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including proof of residency and income statements.

- Obtain the WV NRW form from the West Virginia State Tax Department.

- Fill out the form accurately, providing all required information.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Key elements of the West Virginia Nonresident Income Tax Agreement

Several key elements define the West Virginia Nonresident Income Tax Agreement. These include the identification of the taxpayer, the income earned in West Virginia, and the residency status of the individual. Additionally, the agreement outlines the tax rates applicable to nonresidents and provides instructions for claiming any applicable credits or deductions. Understanding these elements is essential for ensuring accurate filing and compliance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the West Virginia Nonresident Income Tax Agreement are critical for compliance. Typically, forms must be submitted by the tax return due date, which is usually April 15 for most taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to stay informed about any changes to deadlines or specific requirements that may apply in a given tax year.

Required Documents

To successfully complete the West Virginia Nonresident Income Tax Agreement, certain documents are required. These typically include:

- Proof of residency in the nonresident state.

- Income statements, such as W-2s or 1099s, detailing earnings from West Virginia sources.

- Completed WV NRW form.

Having these documents ready will facilitate a smoother filing process and help avoid delays or complications.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the west virginia nonresident income tax agreement 702776592

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wv nrw form and how can it be used?

The wv nrw form is a specific document used for various administrative purposes in West Virginia. With airSlate SignNow, you can easily create, send, and eSign the wv nrw form, streamlining your workflow and ensuring compliance with local regulations.

-

How much does it cost to use airSlate SignNow for the wv nrw form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can start with a free trial to explore features for the wv nrw form, and then choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the wv nrw form?

airSlate SignNow provides a range of features for the wv nrw form, including customizable templates, secure eSigning, and real-time tracking. These features help ensure that your documents are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for the wv nrw form?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage the wv nrw form alongside your existing tools. This integration capability enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the wv nrw form?

Using airSlate SignNow for the wv nrw form provides numerous benefits, including reduced turnaround time, enhanced security, and improved collaboration. These advantages help businesses operate more efficiently and effectively.

-

Is airSlate SignNow secure for handling the wv nrw form?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the wv nrw form. With encryption and secure access controls, you can trust that your sensitive information is safe.

-

How can I get started with the wv nrw form on airSlate SignNow?

Getting started with the wv nrw form on airSlate SignNow is easy. Simply sign up for an account, choose the wv nrw form template, and start customizing it to meet your needs. The user-friendly interface makes the process straightforward.

Get more for West Virginia Nonresident Income Tax Agreement

Find out other West Virginia Nonresident Income Tax Agreement

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document