Form W 7 Rev December Application for IRS Individual Taxpayer Identification Number

What is the Form W-7?

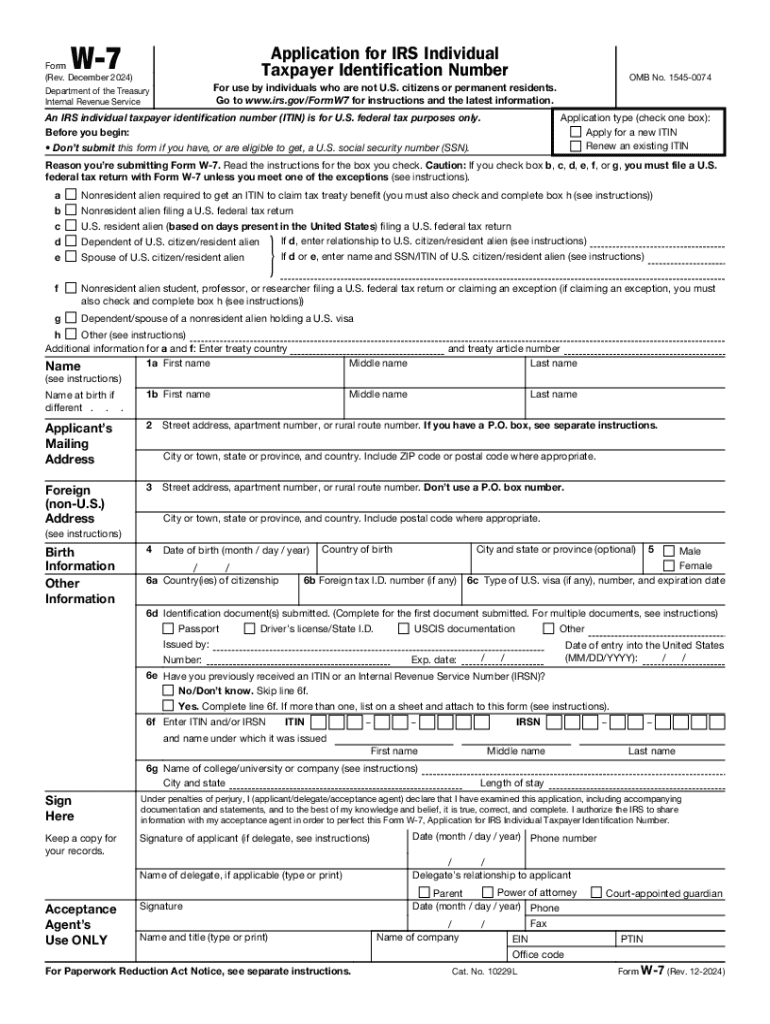

The Form W-7, officially known as the Application for IRS Individual Taxpayer Identification Number, is a crucial document for individuals who are not eligible for a Social Security Number but need to comply with U.S. tax laws. This form is primarily used by non-residents and foreign nationals who need an Individual Taxpayer Identification Number (ITIN) for tax reporting purposes. The ITIN allows these individuals to file taxes and receive tax benefits, ensuring they meet their tax obligations in the United States.

Steps to Complete the Form W-7

Completing the Form W-7 involves several key steps to ensure accurate submission. Begin by gathering the required documentation, which includes proof of identity and foreign status. Next, fill out the form with your personal information, including your name, mailing address, and the reason for needing an ITIN. It is essential to follow the instructions carefully, as errors can lead to delays in processing. Once completed, review the form for accuracy before submission.

Required Documents for Form W-7

When applying for an ITIN using the Form W-7, specific documents must be submitted to verify your identity and foreign status. Acceptable documents include a passport, national identification card, or a birth certificate. Additionally, you may need to provide documentation supporting your tax filing requirement, such as a federal tax return. Ensure that all documents are current and meet the IRS requirements to avoid complications.

Form Submission Methods

The Form W-7 can be submitted through various methods. Applicants have the option to mail the completed form along with the required documents to the IRS. Alternatively, individuals can apply in person at designated IRS Taxpayer Assistance Centers or through an IRS-authorized Acceptance Agent. Each submission method has its own processing times, so it is important to choose the one that best suits your needs.

Eligibility Criteria for Form W-7

To be eligible for an ITIN through the Form W-7, applicants must meet certain criteria. Primarily, individuals who are not eligible for a Social Security Number and need to file a federal tax return or claim tax benefits are eligible. This includes non-resident aliens, their spouses, and dependents. It is important to review the eligibility requirements carefully to ensure compliance with IRS guidelines.

IRS Guidelines for Form W-7

The IRS provides specific guidelines for completing and submitting the Form W-7. These guidelines include detailed instructions on filling out the form, acceptable documentation, and submission methods. Adhering to these guidelines is critical for a successful application, as failure to comply may result in delays or rejection of the application. Applicants should consult the IRS website or official publications for the most current information and updates.

Handy tips for filling out Form W 7 Rev December Application For IRS Individual Taxpayer Identification Number online

Quick steps to complete and e-sign Form W 7 Rev December Application For IRS Individual Taxpayer Identification Number online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to e-sign and share Form W 7 Rev December Application For IRS Individual Taxpayer Identification Number for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 7 rev december application for irs individual taxpayer identification number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W7 form and why do I need it?

The W7 form is an application used to obtain an Individual Taxpayer Identification Number (ITIN) from the IRS. You need it if you are a non-resident alien or a foreign national who needs to file a U.S. tax return. Using airSlate SignNow, you can easily eSign and send your W7 form securely.

-

How can airSlate SignNow help me with my W7 form?

airSlate SignNow simplifies the process of completing and submitting your W7 form. With our platform, you can fill out the form electronically, eSign it, and send it directly to the IRS, saving you time and ensuring accuracy in your submission.

-

Is there a cost associated with using airSlate SignNow for my W7 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow you to manage your W7 form and other documents efficiently, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing W7 forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for your W7 form. These tools enhance your workflow, making it easier to manage your tax documents and ensuring compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other applications for my W7 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when handling your W7 form. Whether you use CRM systems or cloud storage solutions, our integrations enhance your document management process.

-

What are the benefits of using airSlate SignNow for my W7 form?

Using airSlate SignNow for your W7 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive information is protected while making the eSigning process quick and easy.

-

How secure is my information when using airSlate SignNow for my W7 form?

Security is a top priority at airSlate SignNow. When you use our platform for your W7 form, your data is encrypted and stored securely, ensuring that your personal and financial information remains confidential and protected from unauthorized access.

Get more for Form W 7 Rev December Application For IRS Individual Taxpayer Identification Number

- Halal questionnaire form

- Addenbrookes cognitive examination version b pdf form

- Humana continuity of care form

- Hot sheets form

- Bveterans education benefitsb office rights and responsibilities pdf pcc form

- Application for rental california equal housing opportunity tell us about yourself use additional sheets if necessary please form

- Nevada 4 h horse levels program unce unr form

- Employee safety manual form

Find out other Form W 7 Rev December Application For IRS Individual Taxpayer Identification Number

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast