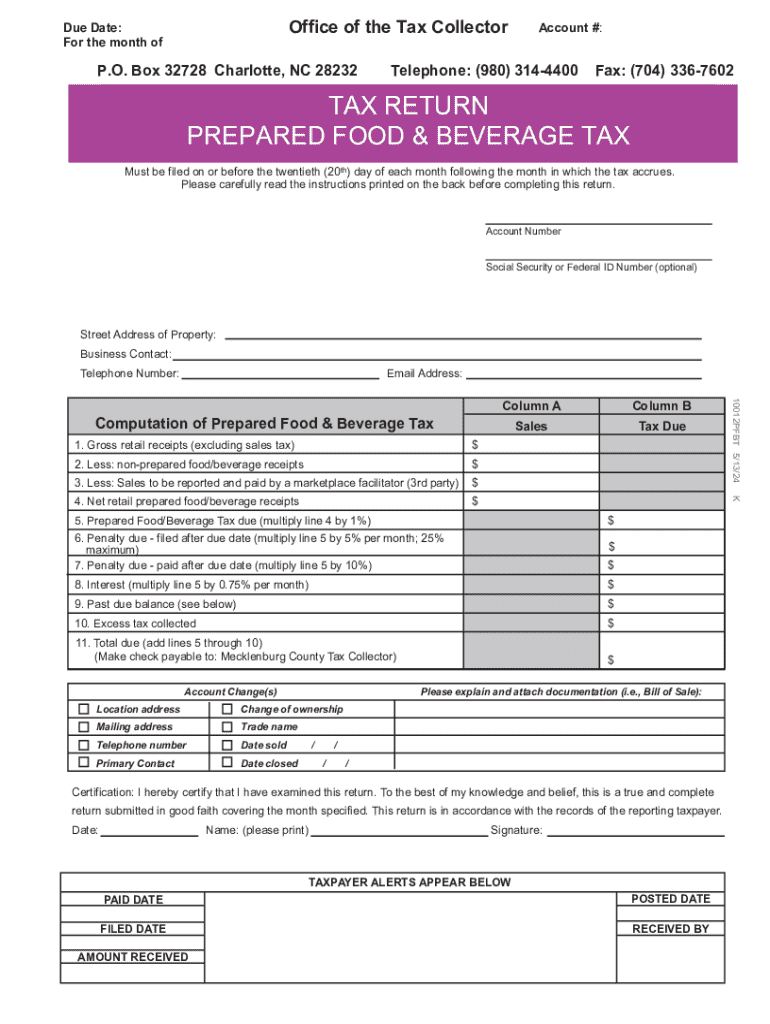

Important Tax Due DatesOffice of the Tax Collector Form

Understanding Important Tax Due Dates

The Important Tax Due Dates from the Office of the Tax Collector outline critical deadlines for tax payments and filings. These dates are essential for individuals and businesses to avoid penalties and ensure compliance with federal and state tax laws. Key due dates typically include income tax filing deadlines, estimated tax payment deadlines, and specific dates for property taxes or other local taxes. Staying informed about these dates helps taxpayers plan their finances effectively and meet their obligations on time.

How to Utilize Important Tax Due Dates

To effectively use the Important Tax Due Dates, taxpayers should first identify the relevant deadlines that apply to their specific situation. This may include personal income tax, business taxes, or property taxes. Once identified, individuals can create a calendar or reminder system to track these dates. Utilizing digital tools, such as e-signature solutions, can streamline the filing process, allowing for timely submissions and reducing the risk of errors. Keeping organized records of all tax-related documents will also facilitate compliance.

Steps to Complete Tax Filings on Due Dates

Completing tax filings by the Important Tax Due Dates involves several steps. First, gather all necessary documentation, including income statements, previous tax returns, and any relevant deductions or credits. Next, determine the appropriate forms needed for filing, such as the 1040 for individual income tax or the appropriate business forms. After filling out the forms, review them for accuracy. Finally, submit the forms either electronically or via mail, ensuring they are sent before the deadline to avoid penalties.

Penalties for Missing Tax Due Dates

Failing to meet the Important Tax Due Dates can result in various penalties, including late fees, interest on unpaid taxes, and potential legal consequences. The IRS and state tax authorities impose these penalties to encourage timely compliance. For individuals, the failure to file may result in a penalty of five percent of the unpaid tax for each month the return is late, up to 25 percent. Businesses may face additional penalties based on their entity type and the nature of their tax obligations.

State-Specific Rules for Tax Deadlines

Tax due dates can vary significantly by state, so it is crucial for taxpayers to understand the specific rules that apply in their jurisdiction. Each state may have different deadlines for income tax, sales tax, and property tax. Some states may also offer extensions or alternative filing options. Taxpayers should consult their state’s tax authority or website for the most accurate and up-to-date information regarding their tax deadlines.

Examples of Tax Scenarios and Deadlines

Different taxpayer scenarios can influence the Important Tax Due Dates. For instance, self-employed individuals may need to make estimated tax payments quarterly, while employees typically file their taxes annually. Retirees may have different considerations, such as required minimum distributions that affect their tax filings. Understanding these scenarios helps taxpayers prepare adequately for their specific deadlines and obligations.

Filing Methods for Tax Documents

Taxpayers have several options for submitting their tax documents by the Important Tax Due Dates. Common methods include online filing through the IRS website or state tax portals, mailing paper forms, or delivering them in person to local tax offices. Each method has its advantages, such as the speed of online submissions or the personal touch of in-person filings. Choosing the right method can enhance the filing experience and ensure compliance with deadlines.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the important tax due datesoffice of the tax collector

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Important Tax Due DatesOffice Of The Tax Collector for this year?

The Important Tax Due DatesOffice Of The Tax Collector vary each year, but typically include deadlines for property taxes, income taxes, and other local taxes. It's essential to stay updated on these dates to avoid penalties. You can find the specific dates on your local tax collector's website or through official announcements.

-

How can airSlate SignNow help me manage Important Tax Due DatesOffice Of The Tax Collector?

airSlate SignNow provides a streamlined solution for managing Important Tax Due DatesOffice Of The Tax Collector by allowing you to eSign and send documents quickly. This ensures that you can submit necessary forms and payments on time. Additionally, you can set reminders for upcoming due dates to stay organized.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Important Tax Due DatesOffice Of The Tax Collector. These features help you ensure that all necessary documents are completed and submitted on time. The platform is designed to simplify the tax document process.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax documents?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing Important Tax Due DatesOffice Of The Tax Collector. With flexible pricing plans, you can choose a package that fits your budget while still accessing essential features. This affordability makes it easier for small businesses to stay compliant with tax regulations.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage Important Tax Due DatesOffice Of The Tax Collector. This allows you to streamline your workflow and ensure that all your tax-related documents are in one place. Check our integrations page for a list of compatible software.

-

What benefits does eSigning provide for tax documents?

eSigning through airSlate SignNow offers numerous benefits for tax documents, especially regarding Important Tax Due DatesOffice Of The Tax Collector. It speeds up the signing process, reduces paper usage, and enhances security. Additionally, eSigned documents are legally binding, ensuring compliance with tax regulations.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by employing advanced encryption and secure storage solutions. This is crucial when dealing with Important Tax Due DatesOffice Of The Tax Collector, as sensitive information is often involved. You can trust that your documents are protected throughout the signing process.

Get more for Important Tax Due DatesOffice Of The Tax Collector

Find out other Important Tax Due DatesOffice Of The Tax Collector

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free