KW 3 Annual Withholding Tax Return and Instructions Rev 6 19 Form

Understanding the KW-3 Annual Withholding Tax Return

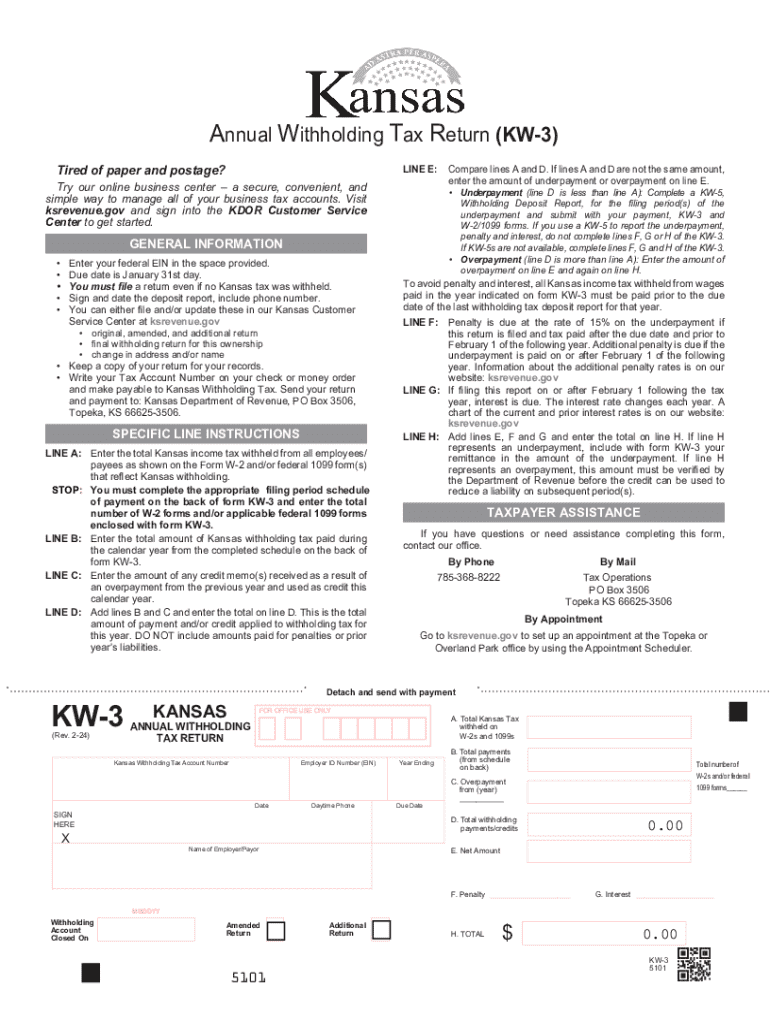

The KW-3 Annual Withholding Tax Return is a crucial document for employers in Kansas. It summarizes the total amount of state income tax withheld from employees' wages throughout the year. This form is essential for reporting to the Kansas Department of Revenue and ensuring compliance with state tax laws.

Employers must accurately complete the KW-3 to reflect the total withholding amounts reported on individual employee W-2 forms. This ensures that the state has a comprehensive overview of tax collections from various employers, facilitating proper allocation of state funds.

Steps to Complete the KW-3 Annual Withholding Tax Return

Completing the KW-3 involves several key steps:

- Gather all W-2 forms issued to employees for the tax year.

- Calculate the total Kansas withholding tax withheld from all employees.

- Fill out the KW-3 form with the total amounts, including any adjustments.

- Review the completed form for accuracy to avoid penalties.

- Submit the form to the Kansas Department of Revenue by the designated deadline.

Following these steps ensures that employers fulfill their tax obligations accurately and on time.

Filing Deadlines for the KW-3 Form

Employers must be aware of the important deadlines associated with the KW-3 Annual Withholding Tax Return. The form is typically due by January thirty-first of the year following the tax year being reported. This deadline coincides with the due date for W-2 forms, ensuring that all withholding information is submitted simultaneously.

Failure to meet this deadline may result in penalties, so it is advisable for employers to mark their calendars and prepare the necessary documentation in advance.

Obtaining the KW-3 Annual Withholding Tax Return

The KW-3 form can be easily obtained from the Kansas Department of Revenue's website. Employers can download a printable version of the form, which is available in PDF format. Additionally, many tax preparation software programs include the KW-3, allowing for electronic completion and submission.

It is important to ensure that the most current version of the form is used, as outdated forms may not be accepted by the state.

Key Elements of the KW-3 Annual Withholding Tax Return

The KW-3 form includes several key elements that must be accurately filled out:

- Employer Information: Name, address, and identification number.

- Total Kansas Withholding: The total amount withheld from all employees.

- Adjustments: Any necessary corrections or adjustments to previous filings.

- Signature: The form must be signed by an authorized representative of the business.

Each of these elements is critical for ensuring that the form is processed correctly and that the employer remains compliant with Kansas tax regulations.

Penalties for Non-Compliance with the KW-3 Filing

Employers who fail to file the KW-3 form on time or submit inaccurate information may face penalties from the Kansas Department of Revenue. These penalties can include fines and interest on any unpaid taxes. In some cases, repeated non-compliance may lead to further legal consequences.

To avoid penalties, employers should ensure timely and accurate completion of the KW-3, as well as maintain thorough records of all employee withholdings throughout the year.

Handy tips for filling out KW 3 Annual Withholding Tax Return And Instructions Rev 6 19 online

Quick steps to complete and e-sign KW 3 Annual Withholding Tax Return And Instructions Rev 6 19 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant platform for maximum simplicity. Use signNow to e-sign and share KW 3 Annual Withholding Tax Return And Instructions Rev 6 19 for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kw 3 annual withholding tax return and instructions rev 6 19

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Kansas withholding tax and how does it affect my business?

Kansas withholding tax is a tax that employers in Kansas are required to withhold from their employees' wages. This tax is essential for ensuring that employees meet their state tax obligations. Understanding Kansas withholding tax is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with managing Kansas withholding tax documents?

airSlate SignNow provides an efficient platform for sending and eSigning documents related to Kansas withholding tax. With our easy-to-use interface, businesses can streamline the process of collecting necessary signatures and maintaining compliance. This saves time and reduces the risk of errors in tax documentation.

-

What features does airSlate SignNow offer for Kansas withholding tax management?

Our platform includes features such as customizable templates, automated reminders, and secure storage for Kansas withholding tax documents. These tools help businesses manage their tax-related paperwork efficiently. Additionally, our integration capabilities allow for seamless data transfer to accounting software.

-

Is airSlate SignNow cost-effective for small businesses dealing with Kansas withholding tax?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing Kansas withholding tax. Our pricing plans are flexible and cater to various needs, ensuring that you only pay for what you use. This affordability helps small businesses stay compliant without breaking the bank.

-

Can I integrate airSlate SignNow with my existing payroll system for Kansas withholding tax?

Absolutely! airSlate SignNow offers integrations with various payroll systems, making it easy to manage Kansas withholding tax alongside your payroll processes. This integration ensures that all tax documents are accurately handled and stored, reducing the risk of discrepancies and enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for Kansas withholding tax compliance?

Using airSlate SignNow for Kansas withholding tax compliance offers numerous benefits, including improved accuracy, faster processing times, and enhanced security for sensitive documents. Our platform helps businesses maintain compliance with state regulations while simplifying the document management process. This ultimately leads to better resource allocation and peace of mind.

-

How does airSlate SignNow ensure the security of Kansas withholding tax documents?

airSlate SignNow prioritizes the security of your Kansas withholding tax documents by employing advanced encryption and secure cloud storage. Our platform complies with industry standards to protect sensitive information from unauthorized access. This commitment to security helps businesses confidently manage their tax-related documents.

Get more for KW 3 Annual Withholding Tax Return And Instructions Rev 6 19

- Sy015 form

- Behavior based safety observation checklist xls form

- Raf 1 form

- Equity bank kenya funds transfer form

- Non creamy layer certificate pdf form

- Lost and found form pdf 20345427

- Public partnerships form

- Application to licence a vehicle or transfer a vehicle licence motor vehicle dealers form vl12

Find out other KW 3 Annual Withholding Tax Return And Instructions Rev 6 19

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy