Form 200 Local Intangibles Tax Return Rev 11 23 Form 200 Local Intangibles Tax Return County Taxes

Understanding the Form 200 Local Intangibles Tax Return

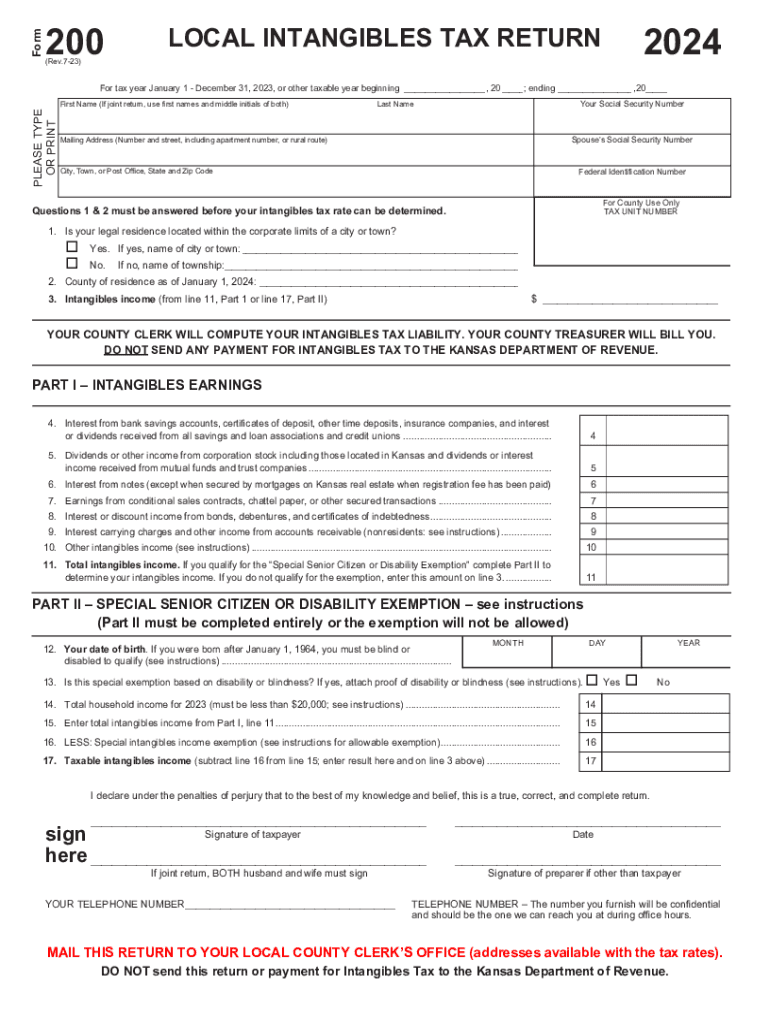

The Form 200 Local Intangibles Tax Return is a crucial document for individuals and businesses in the United States who are required to report and pay local intangibles taxes. This form is specifically designed to capture information related to intangible assets, such as stocks, bonds, and other financial instruments, that may be subject to taxation at the county level. The form ensures compliance with local tax regulations and helps maintain accurate records for tax authorities.

Steps to Complete the Form 200 Local Intangibles Tax Return

Completing the Form 200 requires careful attention to detail. Begin by gathering all necessary financial documents related to your intangible assets. This may include bank statements, investment records, and previous tax returns. Next, follow these steps:

- Enter your personal and business information in the designated sections.

- List all intangible assets and their respective values accurately.

- Calculate the total value of your intangible assets and any applicable taxes.

- Review the form for accuracy before submission.

Ensure that all fields are filled out completely to avoid delays in processing.

How to Obtain the Form 200 Local Intangibles Tax Return

The Form 200 can be obtained from your local county tax office or through their official website. Many counties provide downloadable versions of the form for convenience. If you prefer a physical copy, you can visit the tax office in person to request one. It is important to ensure that you are using the most current version of the form, as updates may occur periodically.

Legal Use of the Form 200 Local Intangibles Tax Return

The legal use of the Form 200 is essential for compliance with local tax laws. Filing this form accurately and on time helps avoid penalties and ensures that you meet your tax obligations. It is important to understand the specific regulations that apply in your county, as these can vary significantly. Consulting with a tax professional may be beneficial to navigate any complexities associated with local intangibles taxes.

Filing Deadlines and Important Dates

Timely filing of the Form 200 is crucial to avoid penalties. Each county may have different deadlines, but typically, the form must be submitted annually by a specific date, often aligned with the end of the fiscal year. It is advisable to check with your local tax authority for the exact deadlines and any potential extensions that may be available.

Required Documents for Filing the Form 200

When preparing to file the Form 200, ensure you have all required documents ready. Commonly needed documents include:

- Proof of ownership for intangible assets.

- Financial statements that detail asset values.

- Previous tax returns for reference.

Having these documents on hand will streamline the completion and submission process, helping to ensure accuracy and compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 200 local intangibles tax return rev 11 23 form 200 local intangibles tax return county taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 200 Local Intangibles Tax Return Rev 11 23?

The Form 200 Local Intangibles Tax Return Rev 11 23 is a tax document used to report local intangible taxes. This form is essential for businesses to comply with county tax regulations and ensure accurate reporting of their intangible assets.

-

How can airSlate SignNow help with the Form 200 Local Intangibles Tax Return?

airSlate SignNow provides an easy-to-use platform for businesses to complete and eSign the Form 200 Local Intangibles Tax Return Rev 11 23. Our solution streamlines the process, making it efficient and compliant with county tax requirements.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you need to manage the Form 200 Local Intangibles Tax Return Rev 11 23 or other documents, our cost-effective solutions ensure you get the best value for your investment.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the Form 200 Local Intangibles Tax Return Rev 11 23. These features help users efficiently fill out, sign, and store their tax documents securely.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage the Form 200 Local Intangibles Tax Return Rev 11 23 alongside your financial records. This integration enhances workflow efficiency and accuracy.

-

What benefits does eSigning the Form 200 Local Intangibles Tax Return offer?

eSigning the Form 200 Local Intangibles Tax Return Rev 11 23 offers numerous benefits, including faster processing times and reduced paperwork. With airSlate SignNow, you can ensure that your tax documents are signed securely and stored electronically.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax documents like the Form 200 Local Intangibles Tax Return Rev 11 23. Our platform employs advanced encryption and security protocols to protect your data.

Get more for Form 200 Local Intangibles Tax Return Rev 11 23 Form 200 Local Intangibles Tax Return County Taxes

- Pdf cvrp household summary form clean vehicle rebate project

- Policy ownership transfer affidavit form

- Form 4683 complaint

- New aid after loan discharge new aid after loan discharge form

- National homebuyers fund inc welcome to nhfs form

- Unitypoint doctors note form

- Massage client feedback form

- Government program rebate form

Find out other Form 200 Local Intangibles Tax Return Rev 11 23 Form 200 Local Intangibles Tax Return County Taxes

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile