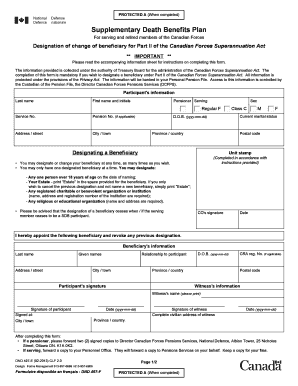

Supplementary Death Benefit Form

What is the Supplemental Death Benefit Form

The supplemental death benefit form is a document used to designate additional life insurance benefits that may be available to beneficiaries upon the policyholder's death. This form allows individuals to specify the amount of supplemental coverage they wish to add to their existing life insurance policy. It is particularly relevant for those who want to enhance their financial security for their loved ones in the event of an unexpected passing.

Steps to Complete the Supplemental Death Benefit Form

Completing the supplemental death benefit form involves several key steps:

- Gather necessary information, including personal details and policy numbers.

- Clearly indicate the amount of supplemental coverage desired.

- Provide beneficiary information, ensuring that all names and relationships are accurately listed.

- Review the form for completeness and accuracy before submission.

- Sign and date the form to validate your request.

How to Obtain the Supplemental Death Benefit Form

The supplemental death benefit form can typically be obtained through your life insurance provider. Most companies offer the form on their official website, or you may request it directly from a customer service representative. It is important to ensure you have the most current version of the form to avoid any processing delays.

Legal Use of the Supplemental Death Benefit Form

This form serves a legal purpose in ensuring that beneficiaries receive the intended financial support. It is essential to complete the form accurately, as any discrepancies may lead to complications in the claims process. Understanding the legal implications of the form can help policyholders ensure their wishes are honored.

Required Documents

When filling out the supplemental death benefit form, you may need to provide several supporting documents, including:

- A copy of the existing life insurance policy.

- Identification documents, such as a driver's license or Social Security card.

- Any previous beneficiary designations if applicable.

Form Submission Methods

The completed supplemental death benefit form can usually be submitted in several ways, depending on the insurance provider's policies:

- Online submission through the insurance company’s secure portal.

- Mailing the form to the designated address provided by the insurer.

- In-person submission at a local insurance office, if available.

Eligibility Criteria

To utilize the supplemental death benefit form, policyholders typically need to meet certain eligibility criteria. These may include being an active policyholder with a qualifying life insurance plan and being of a certain age. It is advisable to check with your insurance provider for specific requirements that apply to your situation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the supplementary death benefit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a supplemental death benefit form?

A supplemental death benefit form is a document that allows policyholders to request additional life insurance coverage beyond their standard policy. This form is essential for ensuring that beneficiaries receive adequate financial support in the event of the policyholder's passing. Completing the supplemental death benefit form is a straightforward process that can be done online.

-

How do I fill out the supplemental death benefit form?

Filling out the supplemental death benefit form is simple with airSlate SignNow. You can access the form online, where you will need to provide personal information, policy details, and any additional coverage amounts you wish to request. Once completed, you can eSign the document and submit it electronically for processing.

-

Are there any fees associated with the supplemental death benefit form?

Typically, there are no additional fees for submitting a supplemental death benefit form through airSlate SignNow. However, it is important to review your insurance policy for any potential costs related to increased coverage. Our platform offers a cost-effective solution for managing all your document needs, including this form.

-

What are the benefits of using airSlate SignNow for the supplemental death benefit form?

Using airSlate SignNow for your supplemental death benefit form offers numerous benefits, including ease of use, quick processing times, and secure electronic signatures. Our platform streamlines the entire process, allowing you to focus on what matters most while ensuring your documents are handled efficiently. Plus, you can access your forms anytime, anywhere.

-

Can I track the status of my supplemental death benefit form?

Yes, airSlate SignNow provides tracking features for your supplemental death benefit form. Once submitted, you can easily monitor the status of your form through your account dashboard. This transparency ensures you stay informed about the processing of your request.

-

Is the supplemental death benefit form secure with airSlate SignNow?

Absolutely! The supplemental death benefit form is secured with advanced encryption and compliance measures on airSlate SignNow. We prioritize the safety of your personal information and ensure that all documents are transmitted securely, giving you peace of mind throughout the process.

-

What integrations does airSlate SignNow offer for the supplemental death benefit form?

airSlate SignNow integrates seamlessly with various applications to enhance your experience with the supplemental death benefit form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management and storage. These integrations help you maintain organization and efficiency.

Get more for Supplementary Death Benefit Form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497429634 form

- Washington subordination agreement form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497429636 form

- Real estate form 497429637

- Landlord in with form

- Wa real estate form

- Tenant keep lease form

- Mortgage statutory form with representative acknowledgment washington

Find out other Supplementary Death Benefit Form

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form