Form CT 19IT Title 19 Status Release

What is the Form CT 19IT Title 19 Status Release

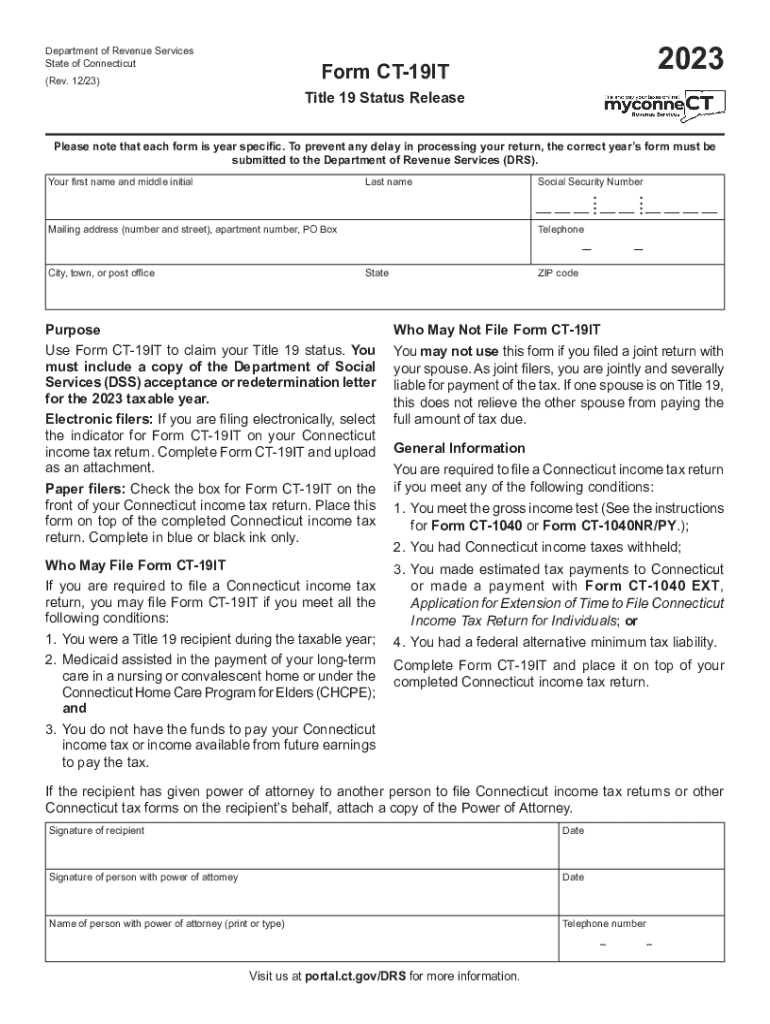

The Form CT 19IT Title 19 Status Release is a document used in Connecticut to request the release of information related to an individual's Title 19 status. This form is essential for individuals seeking to confirm their eligibility for Medicaid benefits under Title 19, which provides health coverage for low-income individuals and families. By completing this form, applicants can ensure that their Title 19 status is accurately documented and accessible to relevant parties, such as healthcare providers and financial institutions.

How to use the Form CT 19IT Title 19 Status Release

Using the Form CT 19IT Title 19 Status Release involves several key steps. First, individuals must accurately fill out the required personal information, including their name, address, and Social Security number. Next, the form must be signed and dated to validate the request. Once completed, the form can be submitted to the appropriate state agency or healthcare provider that requires verification of Title 19 status. It is important to keep a copy of the submitted form for personal records.

Steps to complete the Form CT 19IT Title 19 Status Release

Completing the Form CT 19IT Title 19 Status Release requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary personal information, including your full name, address, and Social Security number.

- Fill in the form clearly, ensuring all sections are completed.

- Sign and date the form to authenticate the request.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the designated agency or healthcare provider.

Required Documents

When submitting the Form CT 19IT Title 19 Status Release, certain documents may be required to support your request. Commonly required documents include:

- Proof of identity, such as a driver's license or state-issued ID.

- Documentation of income, which may include pay stubs or tax returns.

- Any previous correspondence related to Title 19 status.

Having these documents ready will facilitate a smoother application process.

Eligibility Criteria

To be eligible for Title 19 benefits in Connecticut, individuals must meet specific criteria. These criteria typically include:

- Residency in Connecticut.

- Meeting income limits set by the state.

- Being aged, blind, or disabled, or having dependent children.

Understanding these eligibility requirements is crucial for individuals seeking to utilize the Form CT 19IT Title 19 Status Release effectively.

Form Submission Methods

The Form CT 19IT Title 19 Status Release can be submitted through various methods, depending on the requirements of the receiving agency. Common submission methods include:

- Online submission through the state’s official website, if available.

- Mailing the completed form to the appropriate agency address.

- In-person submission at designated state offices or healthcare providers.

Choosing the right submission method can help ensure timely processing of your request.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 19it title 19 status release

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form CT 19IT Title 19 Status Release?

The Form CT 19IT Title 19 Status Release is a document used to verify an individual's eligibility for Title 19 benefits in Connecticut. This form is essential for ensuring that applicants receive the necessary support and services under the Title 19 program.

-

How can airSlate SignNow help with the Form CT 19IT Title 19 Status Release?

airSlate SignNow streamlines the process of completing and submitting the Form CT 19IT Title 19 Status Release. Our platform allows users to easily fill out, sign, and send the form electronically, ensuring a faster and more efficient submission process.

-

Is there a cost associated with using airSlate SignNow for the Form CT 19IT Title 19 Status Release?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage the Form CT 19IT Title 19 Status Release without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the Form CT 19IT Title 19 Status Release?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Form CT 19IT Title 19 Status Release. These tools enhance the user experience and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the Form CT 19IT Title 19 Status Release?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Form CT 19IT Title 19 Status Release alongside your existing tools. This flexibility helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the Form CT 19IT Title 19 Status Release?

Using airSlate SignNow for the Form CT 19IT Title 19 Status Release provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, making it easier for users to complete their forms quickly and accurately.

-

Is airSlate SignNow secure for handling the Form CT 19IT Title 19 Status Release?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form CT 19IT Title 19 Status Release is protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for Form CT 19IT Title 19 Status Release

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497430469 form

- Wi corporation 497430470 form

- Wisconsin pre incorporation agreement shareholders agreement and confidentiality agreement wisconsin form

- Wi bylaws corporation form

- Corporate records maintenance package for existing corporations wisconsin form

- Wi articles form

- Wi formation 497430475

- Wi company form

Find out other Form CT 19IT Title 19 Status Release

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online

- Sign Colorado Affidavit of Service Secure

- Sign Connecticut Affidavit of Service Free

- Sign Michigan Affidavit of Service Online

- How To Sign New Hampshire Affidavit of Service

- How Can I Sign Wyoming Affidavit of Service