Oregon Form 40 Resident Individual Income Tax Return

What is the Oregon Form 40 Resident Individual Income Tax Return

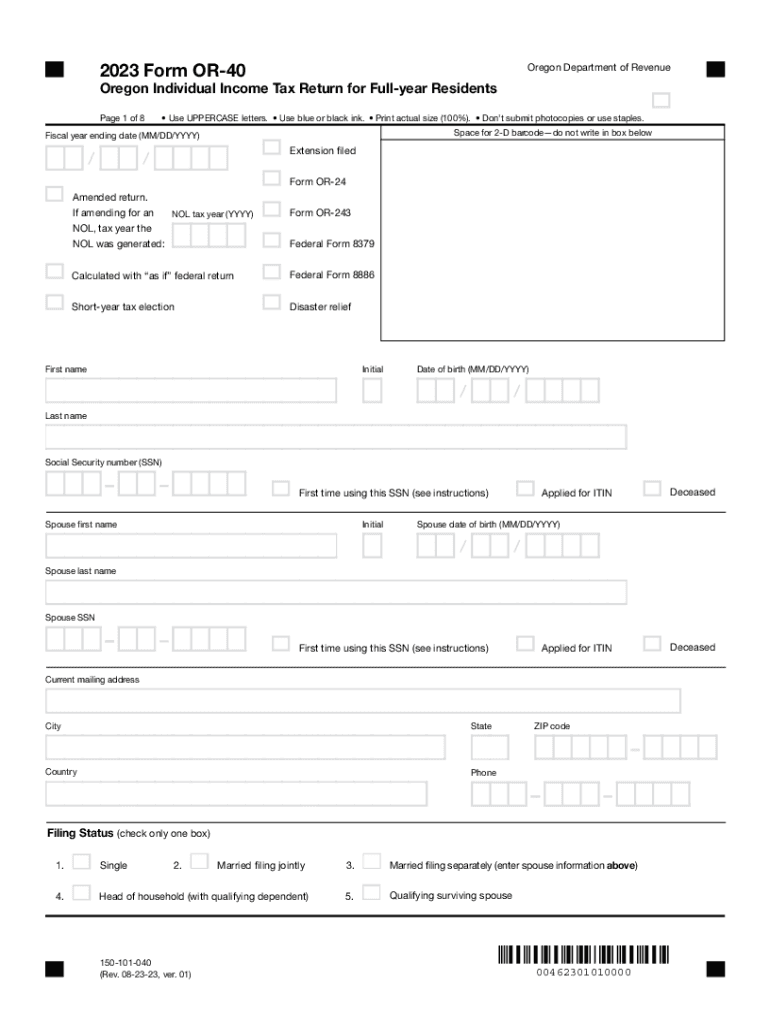

The Oregon Form 40 is the official document used by residents of Oregon to report their individual income tax. This form is essential for calculating the state tax owed based on income earned during the tax year. It is specifically designed for residents, meaning individuals who have established their permanent home in Oregon for the entire year. The form includes sections for reporting various types of income, deductions, and credits that may apply to the taxpayer's situation.

How to use the Oregon Form 40 Resident Individual Income Tax Return

Using the Oregon Form 40 involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. Be sure to follow the instructions provided for each section to ensure accuracy. After completing the form, review it for any errors before submitting it to the Oregon Department of Revenue.

Steps to complete the Oregon Form 40 Resident Individual Income Tax Return

Completing the Oregon Form 40 requires careful attention to detail. Here are the steps to follow:

- Gather all income documentation, such as W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and any other sources.

- Claim any deductions or credits you qualify for, such as those for education or medical expenses.

- Calculate your total tax owed or refund due based on the provided tax tables.

- Sign and date the form before submitting it.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Oregon Form 40. Typically, the deadline for submitting your tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you need more time, you can file for an extension, which typically grants you an additional six months to submit your return, although any taxes owed must still be paid by the original deadline.

Required Documents

To accurately complete the Oregon Form 40, you will need several documents, including:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Documentation for any deductions, such as receipts for medical expenses or education costs.

- Last year's tax return for reference.

Form Submission Methods

The Oregon Form 40 can be submitted in several ways. Taxpayers have the option to file electronically using approved tax software, which often simplifies the process and increases accuracy. Alternatively, you can print the completed form and mail it to the Oregon Department of Revenue. In-person submissions are also accepted at designated locations, though this method may require an appointment. Ensure that you choose the method that best suits your needs and allows for timely submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon form 40 resident individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Oregon tax information?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. For those dealing with Oregon tax information, it simplifies the process of signing tax forms and documents, ensuring compliance and accuracy.

-

How can airSlate SignNow help me manage my Oregon tax information?

With airSlate SignNow, you can easily create, send, and sign documents related to your Oregon tax information. The platform streamlines the workflow, making it easier to manage deadlines and ensure that all necessary forms are completed and submitted on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that can help you manage your Oregon tax information efficiently, ensuring you get the best value for your investment.

-

Does airSlate SignNow integrate with other software for managing Oregon tax information?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage Oregon tax information. This integration allows for a more streamlined process, connecting your eSigning needs with accounting and tax software.

-

What features does airSlate SignNow offer for handling Oregon tax information?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing Oregon tax information. These features ensure that your documents are handled securely and efficiently.

-

Is airSlate SignNow secure for handling sensitive Oregon tax information?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive Oregon tax information. The platform uses advanced encryption and security protocols to protect your data throughout the signing process.

-

Can I access airSlate SignNow on mobile devices for Oregon tax information?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your Oregon tax information on the go. This flexibility ensures that you can sign and send documents anytime, anywhere, without being tied to a desktop.

Get more for Oregon Form 40 Resident Individual Income Tax Return

Find out other Oregon Form 40 Resident Individual Income Tax Return

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe