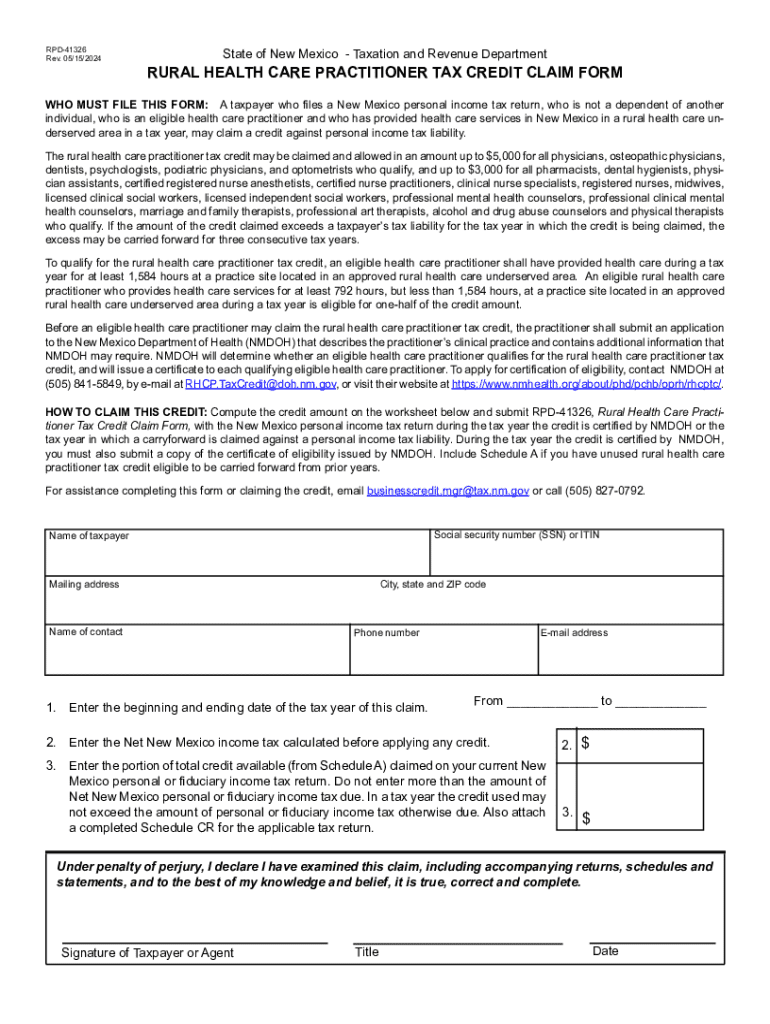

RURAL HEALTH CARE PRACTITIONER TAX CREDIT Form

Understanding the New Mexico Rural Health Care Practitioner Tax Credit

The New Mexico Rural Health Care Practitioner Tax Credit is designed to incentivize healthcare professionals to practice in rural areas of New Mexico. This credit aims to address the shortage of healthcare providers in these regions, enhancing access to essential medical services. Eligible practitioners include physicians, nurse practitioners, and physician assistants who meet specific criteria outlined by the state.

Eligibility Criteria for the Tax Credit

To qualify for the New Mexico Rural Health Care Practitioner Tax Credit, applicants must meet several requirements:

- Be a licensed healthcare practitioner in New Mexico.

- Provide services in a designated rural area as defined by the state.

- Have a valid New Mexico medical or health-related license.

- Meet the minimum service hours required in the rural community.

Steps to Complete the RPD 41326 Form

Filling out the RPD 41326 form is essential for claiming the New Mexico Rural Health Care Practitioner Tax Credit. Follow these steps to ensure accurate completion:

- Gather necessary documents, including proof of service in a rural area and your professional license.

- Download the RPD 41326 form from the New Mexico Taxation and Revenue Department website.

- Fill out the form, providing all required information, including your contact details and service history.

- Review the form for accuracy before submission.

- Submit the completed form via mail or online, as per the guidelines provided.

Required Documents for Application

When applying for the New Mexico Rural Health Care Practitioner Tax Credit, you will need to submit several documents to support your application:

- A copy of your New Mexico healthcare license.

- Documentation proving your practice location in a rural area.

- Records of your service hours in the rural community.

- Any additional forms as specified in the RPD 41326 instructions.

Form Submission Methods

There are several methods available for submitting the RPD 41326 form:

- Online Submission: Use the New Mexico Taxation and Revenue Department's online portal to submit your form electronically.

- Mail: Send the completed form and required documents to the address specified in the instructions.

- In-Person: Visit your local Taxation and Revenue office to submit the form directly.

Key Elements of the Tax Credit

The New Mexico Rural Health Care Practitioner Tax Credit includes several key elements that practitioners should be aware of:

- The credit amount is determined based on the number of years of service in a rural area.

- Practitioners can claim the credit on their state income tax return.

- There are specific deadlines for submitting the RPD 41326 form to ensure eligibility for the tax year.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rural health care practitioner tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nm rural tax credit?

The nm rural tax credit is a financial incentive provided by the state of New Mexico to encourage investment in rural areas. This credit can signNowly reduce your tax liability, making it an attractive option for businesses looking to expand in rural communities.

-

How can airSlate SignNow help with the nm rural tax credit application process?

airSlate SignNow streamlines the document signing process, making it easier to manage the paperwork required for the nm rural tax credit application. With our eSignature solution, you can quickly send, sign, and store documents securely, ensuring a smooth application experience.

-

What are the benefits of using airSlate SignNow for nm rural tax credit documentation?

Using airSlate SignNow for nm rural tax credit documentation offers several benefits, including enhanced efficiency and reduced turnaround times. Our platform allows you to track document status in real-time, ensuring that you never miss a deadline related to your tax credit application.

-

Is airSlate SignNow cost-effective for businesses applying for the nm rural tax credit?

Yes, airSlate SignNow is a cost-effective solution for businesses applying for the nm rural tax credit. Our pricing plans are designed to fit various budgets, allowing you to manage your documentation needs without overspending while maximizing your potential tax credits.

-

What features does airSlate SignNow offer for managing nm rural tax credit documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage, all of which are essential for managing nm rural tax credit documents. These tools help you streamline the process and ensure compliance with state requirements.

-

Can airSlate SignNow integrate with other software for nm rural tax credit management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your nm rural tax credit management. Whether you use accounting software or project management tools, our integrations help you maintain a cohesive workflow.

-

How secure is airSlate SignNow when handling nm rural tax credit documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure access protocols to protect your nm rural tax credit documents, ensuring that sensitive information remains confidential and secure throughout the signing process.

Get more for RURAL HEALTH CARE PRACTITIONER TAX CREDIT

- 48725 form

- Degrees of reading power sample test form

- Consent to treat form

- Line clearance template form

- Gc form 106 2 c subpoena duces tecum greene county

- Parsippany certificate of occupancy form

- Application for inspection docx form

- Billing and coding outpatient physical and occupational therapy services form

Find out other RURAL HEALTH CARE PRACTITIONER TAX CREDIT

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement