Springfield Individual Return 21 Form

What is the Springfield Individual Return 21

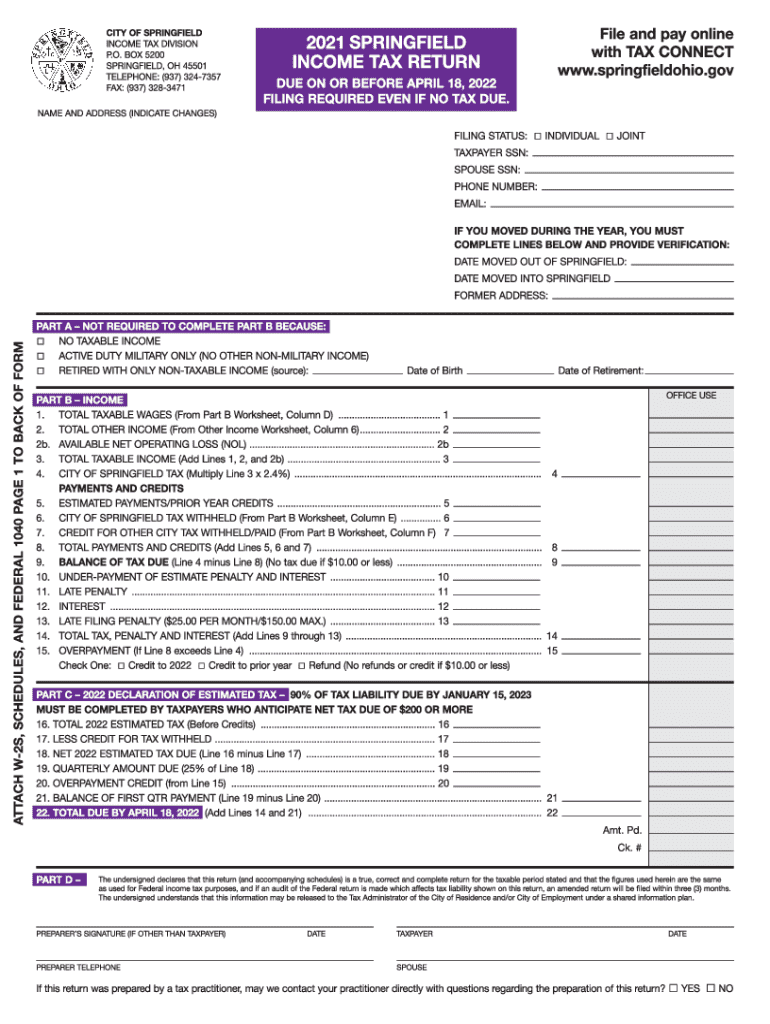

The Springfield Individual Return 21 is a specific tax form used by residents of Springfield, Ohio, to report their individual income for tax purposes. This form is essential for calculating the local income tax owed to the city. It captures various income sources, deductions, and credits applicable to the taxpayer, ensuring compliance with local tax regulations.

Steps to complete the Springfield Individual Return 21

Completing the Springfield Individual Return 21 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Ensure you have your Social Security number and any relevant identification numbers.

- Fill out the form accurately, entering your income, deductions, and credits as applicable.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Submit the form by the designated deadline to ensure timely processing.

Required Documents

To successfully file the Springfield Individual Return 21, you will need several documents:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Records of any additional income, such as rental income or dividends.

- Documentation for deductions, including receipts for expenses related to work or education.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Springfield Individual Return 21 to avoid late fees. Typically, the deadline aligns with the federal tax filing date, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check for any specific local announcements regarding deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Springfield Individual Return 21 can be submitted through various methods:

- Online: Many taxpayers prefer to file electronically using approved software, which can streamline the process.

- Mail: Completed forms can be mailed to the city tax department. Ensure that you send it well before the deadline to allow for processing time.

- In-Person: Taxpayers may also choose to deliver their forms directly to the local tax office during business hours.

Penalties for Non-Compliance

Failing to file the Springfield Individual Return 21 on time can result in penalties. These may include fines based on the amount of tax owed, interest on unpaid taxes, and potential legal action for continued non-compliance. It is advisable to file even if you cannot pay the full amount owed to minimize penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the springfield individual return 21

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is income tax return filing?

Income tax return filing is the process of submitting your tax return to the government, detailing your income, expenses, and other relevant financial information. It is essential for determining your tax liability and ensuring compliance with tax laws. Using airSlate SignNow, you can easily manage and eSign your tax documents, streamlining the income tax return filing process.

-

How can airSlate SignNow help with income tax return filing?

airSlate SignNow simplifies income tax return filing by allowing you to send, sign, and manage your tax documents electronically. Our platform ensures that your documents are securely stored and easily accessible, making it easier to gather the necessary information for your tax return. With our user-friendly interface, you can complete your income tax return filing efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, making it a cost-effective solution for income tax return filing. Our plans include features tailored for individuals and businesses, ensuring you only pay for what you need. Visit our pricing page to find the best option for your income tax return filing requirements.

-

Is airSlate SignNow secure for income tax return filing?

Yes, airSlate SignNow prioritizes security, ensuring that your documents are protected during the income tax return filing process. We use advanced encryption and secure cloud storage to safeguard your sensitive information. You can trust airSlate SignNow to keep your income tax return filing data safe and confidential.

-

Can I integrate airSlate SignNow with other software for income tax return filing?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, enhancing your income tax return filing experience. By connecting our platform with your existing tools, you can streamline your workflow and ensure that all your financial data is synchronized for accurate tax reporting.

-

What features does airSlate SignNow offer for income tax return filing?

airSlate SignNow provides a range of features designed to facilitate income tax return filing, including document templates, eSignature capabilities, and automated workflows. These tools help you manage your tax documents efficiently, reducing the time and effort required for filing. Our platform is designed to make income tax return filing as straightforward as possible.

-

How does airSlate SignNow improve the efficiency of income tax return filing?

By using airSlate SignNow, you can signNowly improve the efficiency of your income tax return filing. Our platform allows for quick document preparation, electronic signatures, and easy sharing, which reduces the time spent on paperwork. This streamlined process enables you to focus on other important aspects of your business while ensuring timely income tax return filing.

Get more for Springfield Individual Return 21

Find out other Springfield Individual Return 21

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement