Rhode Island State Taxes What Retirees Need to Know in Form

Understanding Rhode Island State Income Tax

The Rhode Island state income tax is a tax levied on the income of residents and non-residents earning income within the state. The tax rates vary based on income brackets, with rates ranging from four percent to 5.99 percent for the 2023 tax year. Understanding these rates is crucial for accurate tax planning and filing.

Residents are taxed on their total income, while non-residents are taxed only on income sourced from Rhode Island. This distinction is important for individuals who may work in Rhode Island but reside in another state.

Filing Requirements for Rhode Island State Income Tax

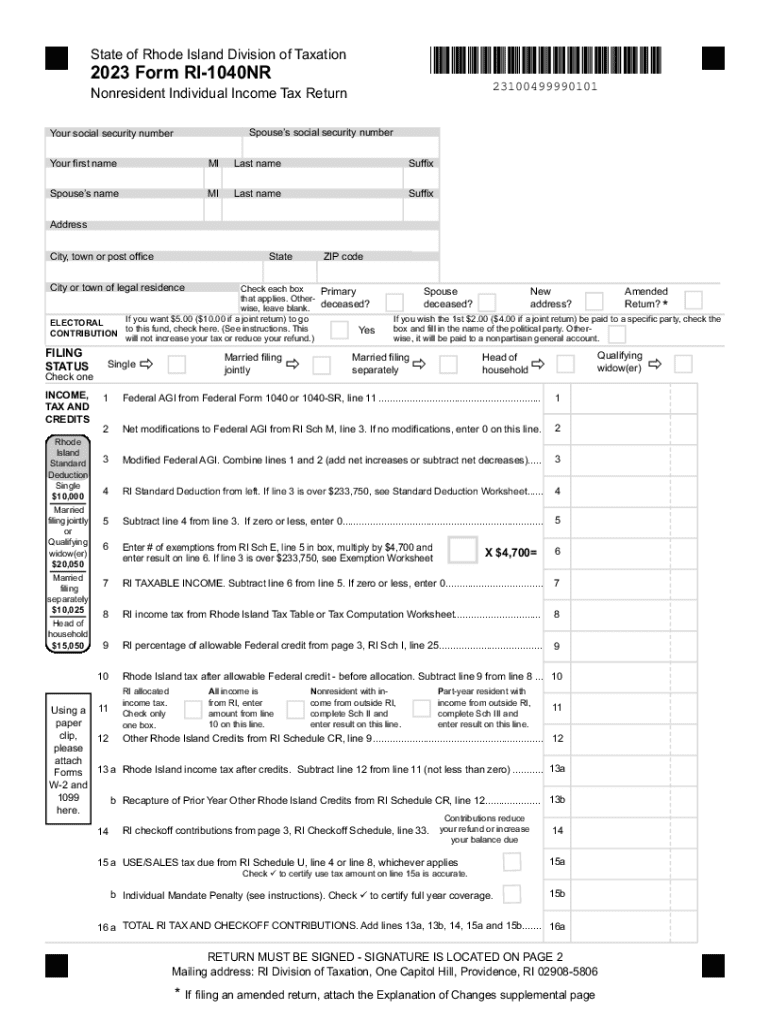

To file Rhode Island state income tax, individuals must complete the appropriate forms based on their residency status. Residents typically use the Rhode Island 1040 form, while non-residents should use the Form RI-1040NR. Each form requires specific information, including income details, deductions, and credits.

It is essential to gather all necessary documentation, such as W-2s, 1099s, and any other relevant income statements, to ensure accurate reporting. Taxpayers should also be aware of any potential deductions available, such as for retirement income or property taxes paid.

Important Deadlines for Filing

Taxpayers should be aware of the filing deadlines for Rhode Island state income tax. Typically, the deadline for filing is April 15, unless it falls on a weekend or holiday, in which case it may be extended. It is advisable to file early to avoid any last-minute complications.

If additional time is needed, taxpayers can file for an extension, which allows for an extra six months to submit their tax return. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Methods for Submitting Rhode Island State Income Tax Forms

Rhode Island offers several methods for submitting state income tax forms. Taxpayers can file online through the Rhode Island Division of Taxation's website, which provides a user-friendly interface for electronic filing. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at local tax offices.

When filing by mail, it is important to ensure that forms are sent to the correct address and postmarked by the filing deadline. For those filing electronically, confirmation of submission is typically provided, offering peace of mind that the return has been received.

Penalties for Non-Compliance with Rhode Island Tax Laws

Failure to comply with Rhode Island state income tax laws can result in various penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for significant non-compliance. It is crucial for taxpayers to understand their obligations and file accurately and on time to avoid these consequences.

In cases where taxpayers are unable to pay their tax liabilities, it is advisable to contact the Rhode Island Division of Taxation to discuss payment options or potential relief programs.

Eligibility Criteria for Filing Rhode Island State Income Tax

Eligibility to file Rhode Island state income tax is primarily determined by residency status and income level. Residents are individuals who maintain a permanent home in Rhode Island, while non-residents are those who earn income from Rhode Island sources but reside elsewhere.

Additionally, individuals must meet specific income thresholds to determine whether they are required to file a return. Those earning below a certain amount may not need to file, but it is often beneficial to do so to claim potential refunds or credits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rhode island state taxes what retirees need to know in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the impact of RI state income tax on my business?

RI state income tax can signNowly affect your business's bottom line. Understanding how it applies to your revenue and expenses is crucial for effective financial planning. Utilizing tools like airSlate SignNow can help streamline document management related to tax filings and compliance.

-

How can airSlate SignNow help with RI state income tax documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to RI state income tax. With our eSignature solution, you can quickly send tax forms and receive signed documents, ensuring compliance and reducing delays. This efficiency can save you time and help you focus on your business.

-

What features does airSlate SignNow offer for managing RI state income tax forms?

Our platform offers features like customizable templates, secure eSigning, and document tracking, which are essential for managing RI state income tax forms. These tools help ensure that your documents are completed accurately and submitted on time. Additionally, our user-friendly interface makes it easy for anyone to navigate the process.

-

Is airSlate SignNow cost-effective for handling RI state income tax needs?

Yes, airSlate SignNow is a cost-effective solution for managing RI state income tax documentation. Our pricing plans are designed to fit various business sizes and needs, allowing you to choose the best option for your budget. By reducing paperwork and streamlining processes, you can save money in the long run.

-

Can I integrate airSlate SignNow with other tools for RI state income tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage RI state income tax efficiently. This integration allows for automatic data transfer and reduces the risk of errors, making your tax preparation process smoother.

-

What are the benefits of using airSlate SignNow for RI state income tax?

Using airSlate SignNow for RI state income tax offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season. Additionally, the ease of use allows you to focus on your business rather than administrative tasks.

-

How does airSlate SignNow ensure compliance with RI state income tax regulations?

airSlate SignNow is designed to help you stay compliant with RI state income tax regulations by providing secure and legally binding eSignatures. Our platform adheres to industry standards and regulations, ensuring that your documents meet all necessary legal requirements. This compliance helps protect your business from potential penalties.

Get more for Rhode Island State Taxes What Retirees Need To Know In

Find out other Rhode Island State Taxes What Retirees Need To Know In

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now