January S 012 ST 12 Wisconsin Sales and Use Tax Return State, County, City, and Stadium Sales and Use Tax Form

What is the Wisconsin Sales and Use Tax Return Form ST-12?

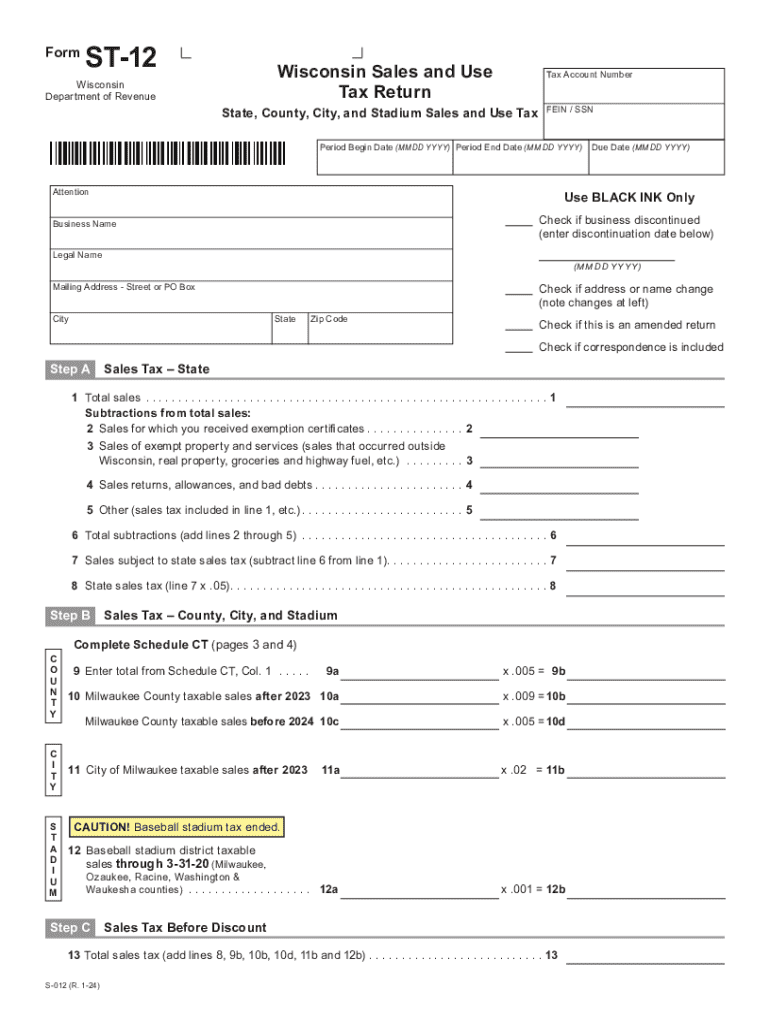

The Wisconsin Sales and Use Tax Return Form ST-12 is a crucial document used by businesses to report and remit sales and use taxes collected during a specific period. This form is essential for compliance with state tax regulations, ensuring that businesses accurately report their taxable sales, including state, county, city, and stadium sales taxes. The ST-12 form is typically required to be filed on a monthly, quarterly, or annual basis, depending on the volume of taxable sales. Understanding the purpose of this form is vital for businesses operating in Wisconsin to avoid penalties and maintain good standing with the Wisconsin Department of Revenue.

Steps to Complete the Wisconsin Sales and Use Tax Return Form ST-12

Completing the ST-12 form involves several key steps:

- Gather Required Information: Collect all necessary sales data, including total sales, exempt sales, and any sales tax collected during the reporting period.

- Fill Out the Form: Enter the collected data into the appropriate fields on the ST-12 form. Ensure accuracy to avoid discrepancies.

- Calculate Taxes Owed: Use the provided tax rates to calculate the total sales tax owed. Include state, county, city, and any applicable stadium taxes.

- Review the Form: Double-check all entries for accuracy. Errors can lead to penalties or delays in processing.

- Submit the Form: File the completed ST-12 form electronically or via mail, depending on your preference and the requirements set by the Wisconsin Department of Revenue.

How to Obtain the Wisconsin Sales and Use Tax Return Form ST-12

The ST-12 form can be easily obtained through the Wisconsin Department of Revenue's official website. It is available in both printable and fillable formats, allowing businesses to choose the method that best suits their needs. Additionally, businesses can request a physical copy of the form by contacting the Department of Revenue directly. It is important to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Filing Deadlines for the Wisconsin Sales and Use Tax Return Form ST-12

Understanding the filing deadlines for the ST-12 form is critical for maintaining compliance. Generally, the deadlines are as follows:

- Monthly Filers: Due on the 20th of the month following the reporting period.

- Quarterly Filers: Due on the 20th of the month following the end of the quarter.

- Annual Filers: Due on January 31 of the following year.

Late submissions may result in penalties, so it is advisable to mark these dates on your calendar and prepare your filing in advance.

Key Elements of the Wisconsin Sales and Use Tax Return Form ST-12

The ST-12 form comprises several key elements that businesses must complete:

- Total Sales: Report the total amount of sales made during the reporting period.

- Exempt Sales: Detail any sales that are exempt from sales tax.

- Sales Tax Collected: Indicate the total sales tax amount collected from customers.

- Tax Calculation: Provide calculations for state, county, city, and stadium sales taxes.

- Signature: The form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Legal Use of the Wisconsin Sales and Use Tax Return Form ST-12

The ST-12 form is legally mandated for businesses that engage in sales of tangible personal property or taxable services in Wisconsin. Filing this form is not only a requirement but also a means to ensure that businesses contribute to the state’s revenue system. Accurate and timely filing helps businesses avoid legal repercussions, including fines and audits by the Wisconsin Department of Revenue. Understanding the legal implications of this form is essential for all business owners operating within the state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the january s 012 st 12 wisconsin sales and use tax return state county city and stadium sales and use tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help me learn how to wi return?

airSlate SignNow is a powerful eSignature solution that simplifies the process of sending and signing documents. If you're looking to understand how to wi return, our platform provides intuitive tools that streamline document management, making it easier for you to focus on your core business activities.

-

How does airSlate SignNow's pricing structure work for those wanting to know how to wi return?

Our pricing is designed to be cost-effective, catering to businesses of all sizes. When considering how to wi return, you can choose from various plans that fit your needs, ensuring you only pay for the features you require while maximizing your investment.

-

What features does airSlate SignNow offer for users interested in how to wi return?

airSlate SignNow offers a range of features including customizable templates, real-time tracking, and secure cloud storage. These tools are essential for anyone looking to learn how to wi return efficiently, as they enhance productivity and ensure document security.

-

Can I integrate airSlate SignNow with other applications while learning how to wi return?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and more. This integration capability is crucial for those exploring how to wi return, as it allows for a more cohesive workflow across different platforms.

-

What are the benefits of using airSlate SignNow for understanding how to wi return?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced document security. For anyone looking to master how to wi return, these advantages can signNowly improve your overall document management process.

-

Is there a free trial available for airSlate SignNow for those wanting to learn how to wi return?

Yes, we offer a free trial that allows you to explore all the features of airSlate SignNow. This is an excellent opportunity for users interested in how to wi return to test the platform and see how it can meet their document signing needs.

-

How secure is airSlate SignNow for users learning how to wi return?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance with industry standards, ensuring that your documents are safe while you learn how to wi return and manage your eSignatures effectively.

Get more for January S 012 ST 12 Wisconsin Sales And Use Tax Return State, County, City, And Stadium Sales And Use Tax

Find out other January S 012 ST 12 Wisconsin Sales And Use Tax Return State, County, City, And Stadium Sales And Use Tax

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online