Arizona Transfer on Death Deed or TOD Beneficiary Deed for Husband and Wife to Four Individuals Form

What is the Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals

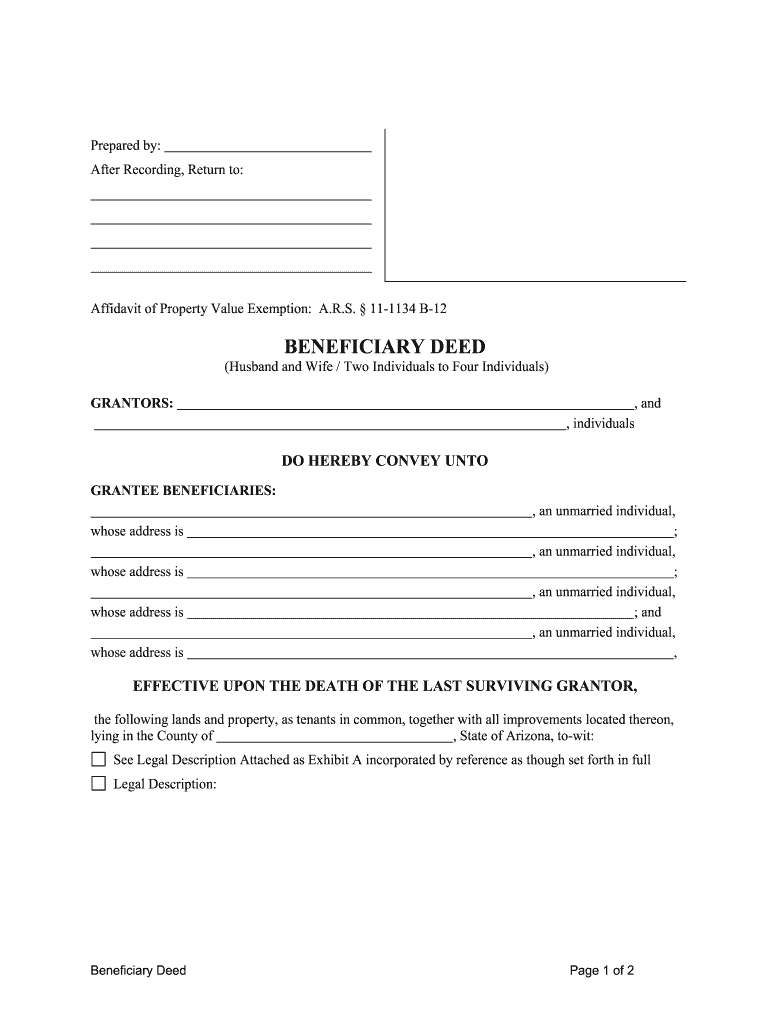

The Arizona Transfer On Death Deed, commonly referred to as a TOD Beneficiary Deed, is a legal instrument that allows a husband and wife to designate four individuals as beneficiaries for the transfer of property upon their passing. This deed enables the couple to retain full control of their property during their lifetime while ensuring a smooth transition of ownership to the named beneficiaries without the need for probate. The TOD Beneficiary Deed is particularly advantageous as it simplifies the estate planning process and can help avoid lengthy legal procedures after death.

How to use the Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals

To effectively use the Arizona Transfer On Death Deed, the husband and wife must complete the deed form, clearly identifying the property and the four beneficiaries. It is essential to ensure that the deed is signed by both spouses in the presence of a notary public. Once executed, the deed must be recorded with the county recorder's office where the property is located. This recording makes the deed effective and legally binding. The couple should keep a copy of the recorded deed for their records and inform the beneficiaries of their designation.

Steps to complete the Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals

Completing the Arizona Transfer On Death Deed involves several key steps:

- Obtain the appropriate form for the TOD Beneficiary Deed, which can typically be found through legal resources or state websites.

- Fill out the form with the required information, including the names of the husband and wife, the property description, and the names of the four beneficiaries.

- Both spouses must sign the form in front of a notary public to validate the document.

- Record the signed deed with the county recorder's office to ensure its legal standing.

- Keep a copy of the recorded deed and inform the beneficiaries of their status.

Key elements of the Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals

Several key elements define the Arizona Transfer On Death Deed:

- Property Description: The deed must include a clear and accurate description of the property being transferred.

- Beneficiary Designation: The deed allows for up to four individuals to be named as beneficiaries, ensuring a clear transfer of ownership.

- Signature Requirements: Both spouses must sign the deed, and it must be notarized to be legally valid.

- Recording Requirement: The deed must be recorded with the county recorder's office to take effect.

Legal use of the Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals

The legal use of the Arizona Transfer On Death Deed is primarily to facilitate the transfer of property upon the death of the owners without going through probate. This deed is recognized under Arizona law and provides a straightforward method for couples to ensure their property is passed on to their chosen beneficiaries. It is crucial for the deed to comply with state laws regarding property transfer to avoid any legal complications. Proper execution and recording of the deed are essential to uphold its validity.

State-specific rules for the Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals

Arizona has specific rules governing the use of Transfer On Death Deeds. These rules include:

- The deed must be executed by both spouses and notarized.

- It must be recorded in the county where the property is located to be effective.

- Beneficiaries can be individuals or entities, but the total number of beneficiaries cannot exceed four.

- The deed can be revoked or modified at any time before the death of the property owners.

Quick guide on how to complete arizona transfer on death deed or tod beneficiary deed for husband and wife to four individuals

Complete Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Manage Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The most efficient way to modify and eSign Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals without hassle

- Locate Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Draft your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivery for your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, monotonous form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choice. Edit and eSign Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals and guarantee seamless communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Arizona Transfer On Death Deed or TOD Beneficiary Deed?

An Arizona Transfer On Death Deed or TOD Beneficiary Deed allows property owners to transfer their real estate to beneficiaries without going through probate. For husbands and wives looking to pass property to four individuals, this deed simplifies the process and provides peace of mind for estate planning.

-

How does an Arizona Transfer On Death Deed work for husbands and wives?

In Arizona, a Transfer On Death Deed allows husbands and wives to designate four individuals as beneficiaries who will automatically receive the property upon their death. This legally binding document ensures that the transfer happens smoothly and without the hassle of probate court.

-

What are the benefits of using a TOD Beneficiary Deed in Arizona?

The primary benefit of an Arizona Transfer On Death Deed is that it avoids probate, making the transfer of property to four individuals simpler and faster. Additionally, it provides the property owners with flexibility, as they can revoke or amend the deed at any time before their passing.

-

Are there any associated costs with creating an Arizona Transfer On Death Deed?

Creating an Arizona Transfer On Death Deed typically involves minimal costs, primarily related to legal fees if you choose to consult an attorney. Using platforms like airSlate SignNow, you can create and eSign documents at a fraction of traditional costs, ensuring that you can efficiently manage your estate for husbands and wives.

-

Is the Arizona TOD Beneficiary Deed legally binding?

Yes, the Arizona Transfer On Death Deed is a legally binding document once it is properly executed and recorded at the county recorder's office. Both husbands and wives can ensure that their property will transition smoothly to four individuals of their choice.

-

Can I change the beneficiaries on my Arizona TOD Beneficiary Deed?

Absolutely. One of the advantages of an Arizona Transfer On Death Deed is that the property owner retains the right to revoke or modify the deed at any point before their death. This flexibility allows husbands and wives to adapt their estate plans to changing circumstances.

-

How can airSlate SignNow assist in drafting an Arizona TOD Beneficiary Deed?

airSlate SignNow offers an intuitive platform that empowers you to draft and eSign your Arizona Transfer On Death Deed efficiently. Our easy-to-use tools help husbands and wives manage their documents seamlessly, ensuring the correct information is included for the four individuals designated as beneficiaries.

Get more for Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals

- Chapter 13 local formseastern district of missouriunited

- Mo bkr 800e fpdf form

- Disclosure under section 41 b of right to information act

- How to create a matrix western district of missouri form

- Respondents answer to petition for dissolution of marriage form cafc010 r

- 2018 form mo cafc050 fill online printable fillable blank

- Certificate of dissolution of marriage form

- Confidential case filing information sheet domestic

Find out other Arizona Transfer On Death Deed Or TOD Beneficiary Deed For Husband And Wife To Four Individuals

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template