Wisconsin, Sch CC Request for a Closing Certificate for Form

Understanding the Wisconsin Schedule CC Request for a Closing Certificate

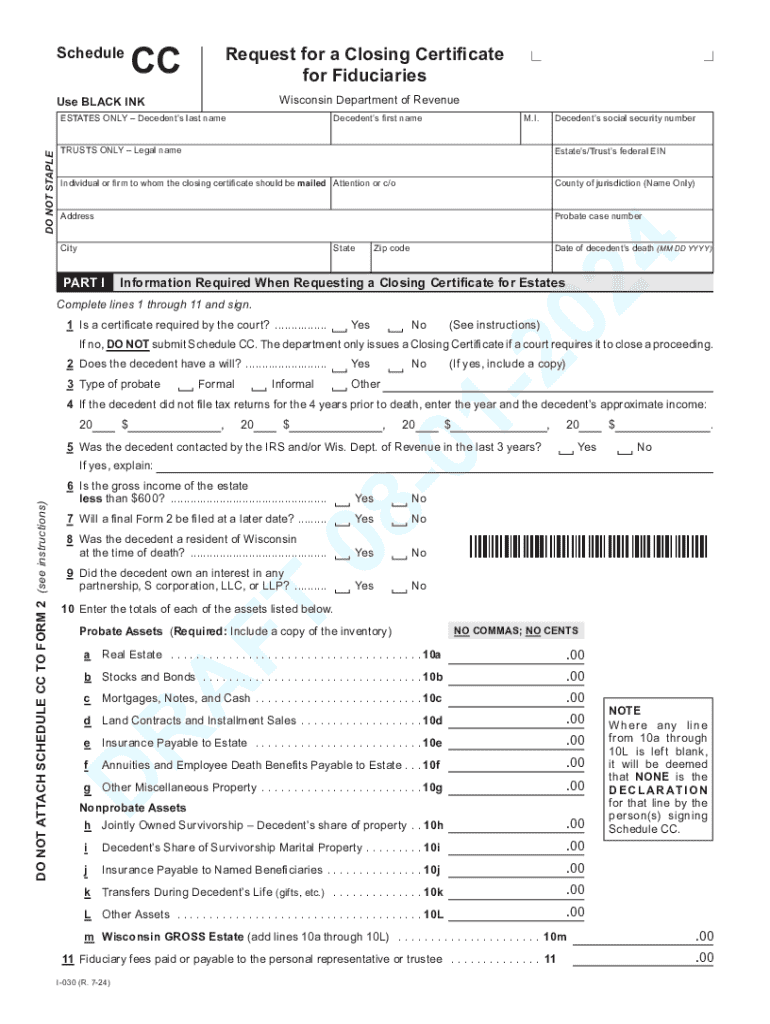

The Wisconsin Schedule CC Request for a Closing Certificate is a crucial document for fiduciaries managing estates or trusts. This form is used to request a closing certificate from the Wisconsin Department of Revenue, which confirms that all tax obligations related to the estate or trust have been fulfilled. The closing certificate serves as proof that the fiduciary has settled all necessary tax liabilities before distributing assets to beneficiaries.

Steps to Complete the Wisconsin Schedule CC Request for a Closing Certificate

Completing the Wisconsin Schedule CC Request for a Closing Certificate involves several key steps:

- Gather all relevant financial documents related to the estate or trust.

- Ensure that all tax returns, including income and estate tax returns, have been filed with the Wisconsin Department of Revenue.

- Complete the Schedule CC form accurately, providing necessary details such as the fiduciary's name, the estate or trust name, and tax identification numbers.

- Submit the completed form to the Wisconsin Department of Revenue, ensuring that all required supporting documents are included.

Required Documents for the Wisconsin Schedule CC Request

When submitting the Wisconsin Schedule CC Request for a Closing Certificate, it is essential to include specific documents to support your request. These may include:

- Copies of filed tax returns for the estate or trust.

- Documentation of any payments made towards tax liabilities.

- Any correspondence with the Wisconsin Department of Revenue regarding the estate or trust.

Providing these documents can expedite the processing of your request and ensure compliance with state regulations.

Eligibility Criteria for the Wisconsin Schedule CC Request

To be eligible for the Wisconsin Schedule CC Request for a Closing Certificate, the following criteria must be met:

- The request must be made by a duly appointed fiduciary of the estate or trust.

- All tax obligations, including income and estate taxes, must be settled before submitting the request.

- The estate or trust must have completed its financial activities, with no outstanding liabilities.

Form Submission Methods for the Wisconsin Schedule CC Request

The Wisconsin Schedule CC Request for a Closing Certificate can be submitted through various methods:

- Online: If available, you can submit the request through the Wisconsin Department of Revenue's online portal.

- Mail: Print and mail the completed form along with all required documents to the appropriate address provided by the Department of Revenue.

- In-Person: You may also choose to submit the form in person at a local Department of Revenue office.

Key Elements of the Wisconsin Schedule CC Request

When filling out the Wisconsin Schedule CC Request for a Closing Certificate, it is important to pay attention to the following key elements:

- Fiduciary Information: Provide accurate details about the fiduciary, including name and contact information.

- Estate or Trust Identification: Clearly identify the estate or trust for which the closing certificate is being requested.

- Tax Identification Number: Include the relevant tax identification number associated with the estate or trust.

Ensuring these elements are correctly filled out can help avoid delays in processing your request.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin sch cc request for a closing certificate for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Wisconsin Department of Revenue forms?

Wisconsin Department of Revenue forms are official documents required for various tax-related processes in Wisconsin. These forms include income tax returns, property tax forms, and other essential filings. Understanding these forms is crucial for compliance and accurate reporting.

-

How can airSlate SignNow help with Wisconsin Department of Revenue forms?

airSlate SignNow simplifies the process of completing and submitting Wisconsin Department of Revenue forms by allowing users to eSign and send documents securely. Our platform ensures that all forms are filled out correctly and submitted on time, reducing the risk of errors and penalties.

-

Are there any costs associated with using airSlate SignNow for Wisconsin Department of Revenue forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion and submission of Wisconsin Department of Revenue forms, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Wisconsin Department of Revenue forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for Wisconsin Department of Revenue forms. These tools enhance efficiency and ensure that all necessary steps are completed for compliance.

-

Can I integrate airSlate SignNow with other software for Wisconsin Department of Revenue forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing users to manage Wisconsin Department of Revenue forms alongside their existing tools. This integration enhances workflow efficiency and ensures that all documents are easily accessible.

-

What are the benefits of using airSlate SignNow for Wisconsin Department of Revenue forms?

Using airSlate SignNow for Wisconsin Department of Revenue forms offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your forms are completed accurately and submitted promptly, helping you avoid potential fines.

-

Is airSlate SignNow user-friendly for completing Wisconsin Department of Revenue forms?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete Wisconsin Department of Revenue forms. The intuitive interface guides users through the process, ensuring a smooth experience from start to finish.

Get more for Wisconsin, Sch CC Request For A Closing Certificate For

- Form it 212 att claim for historic barn rehabilitation credit and employment incentive credit tax year 2022

- R 1 business registration form virginia tax

- State income tax filing form

- How to fill out irs form 5695 to claim the solar tax credit

- Nj income taxreconciling tax withheld with form nj w3

- Form y 206 yonkers nonresident fiduciary earnings tax

- Rental surcharge tax information ctgov

- Form it 272 ampquotclaim for college tuition credit or itemized

Find out other Wisconsin, Sch CC Request For A Closing Certificate For

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer