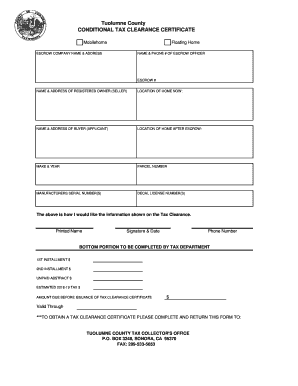

CONDITIONAL TAX CLEARANCE CERTIFICATE 2017

What is the Conditional Tax Clearance Certificate

The Conditional Tax Clearance Certificate is an official document issued by tax authorities that confirms a taxpayer's compliance with tax obligations under specific conditions. This certificate is often required when a business is involved in transactions such as mergers, acquisitions, or when applying for certain licenses. It serves as proof that the entity has settled its tax liabilities and is in good standing with the tax authorities, which can be crucial for maintaining trust and credibility in business dealings.

How to Obtain the Conditional Tax Clearance Certificate

To obtain a Conditional Tax Clearance Certificate, taxpayers must typically submit a request to the relevant state or federal tax authority. This process may involve filling out a specific form and providing necessary documentation, such as proof of tax payments and identification. The requirements can vary by state, so it is important to check local regulations for specific instructions. Generally, taxpayers should ensure that all tax returns are filed and any outstanding balances are paid before applying for the certificate.

Steps to Complete the Conditional Tax Clearance Certificate

Completing the Conditional Tax Clearance Certificate involves several key steps:

- Gather necessary documents, including tax returns, payment records, and identification.

- Fill out the required application form accurately, ensuring all information is current and complete.

- Submit the application along with any required fees to the appropriate tax authority.

- Await confirmation from the tax authority regarding the status of your application.

- Once approved, receive the Conditional Tax Clearance Certificate, which may be sent electronically or via mail.

Legal Use of the Conditional Tax Clearance Certificate

The Conditional Tax Clearance Certificate is legally recognized as proof of tax compliance. It is often required in various legal and business contexts, such as during the sale of a business, applying for loans, or securing permits and licenses. Failing to provide this certificate when required can lead to legal complications or delays in business operations. Therefore, understanding when and how to use this certificate is essential for maintaining compliance and facilitating business transactions.

Required Documents

When applying for a Conditional Tax Clearance Certificate, taxpayers typically need to provide several documents, including:

- Completed application form for the certificate.

- Proof of identity, such as a driver's license or passport.

- Copies of recent tax returns, demonstrating compliance.

- Documentation of any outstanding tax payments or agreements.

Having these documents ready can streamline the application process and help ensure a successful request.

Filing Deadlines / Important Dates

It is crucial to be aware of any filing deadlines associated with the Conditional Tax Clearance Certificate. These deadlines can vary by state and may be tied to specific business activities, such as mergers or license renewals. Taxpayers should consult their local tax authority for the most accurate deadlines to avoid penalties or delays. Keeping track of these dates can help ensure timely compliance and prevent any disruptions in business operations.

Create this form in 5 minutes or less

Find and fill out the correct conditional tax clearance certificate

Create this form in 5 minutes!

How to create an eSignature for the conditional tax clearance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CONDITIONAL TAX CLEARANCE CERTIFICATE?

A CONDITIONAL TAX CLEARANCE CERTIFICATE is an official document issued by tax authorities that confirms a taxpayer's compliance with tax obligations under specific conditions. It is often required for various business transactions, ensuring that all tax liabilities are settled before proceeding.

-

How can airSlate SignNow help with obtaining a CONDITIONAL TAX CLEARANCE CERTIFICATE?

airSlate SignNow streamlines the process of obtaining a CONDITIONAL TAX CLEARANCE CERTIFICATE by allowing businesses to easily send and eSign necessary documents. Our platform simplifies document management, ensuring that all required forms are completed accurately and submitted on time.

-

What are the benefits of using airSlate SignNow for a CONDITIONAL TAX CLEARANCE CERTIFICATE?

Using airSlate SignNow for a CONDITIONAL TAX CLEARANCE CERTIFICATE offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution allows for quick document turnaround, ensuring that you can obtain your certificate without unnecessary delays.

-

Is there a cost associated with obtaining a CONDITIONAL TAX CLEARANCE CERTIFICATE through airSlate SignNow?

While airSlate SignNow provides a cost-effective solution for document management, the fees associated with obtaining a CONDITIONAL TAX CLEARANCE CERTIFICATE may vary based on your local tax authority. However, our platform helps minimize costs by reducing the time and resources needed for document processing.

-

What features does airSlate SignNow offer for managing CONDITIONAL TAX CLEARANCE CERTIFICATE requests?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning to manage CONDITIONAL TAX CLEARANCE CERTIFICATE requests efficiently. These tools help ensure that all necessary documents are prepared and signed correctly, facilitating a smoother application process.

-

Can airSlate SignNow integrate with other software for managing CONDITIONAL TAX CLEARANCE CERTIFICATE processes?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage CONDITIONAL TAX CLEARANCE CERTIFICATE processes. This integration allows for better data management and communication between different platforms, streamlining your workflow.

-

How long does it typically take to receive a CONDITIONAL TAX CLEARANCE CERTIFICATE?

The time it takes to receive a CONDITIONAL TAX CLEARANCE CERTIFICATE can vary depending on the tax authority and the completeness of your application. By using airSlate SignNow, you can expedite the process by ensuring all documents are correctly signed and submitted promptly.

Get more for CONDITIONAL TAX CLEARANCE CERTIFICATE

Find out other CONDITIONAL TAX CLEARANCE CERTIFICATE

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service