Instructions for Form 2555 Instructions for Form 2555, Foreign Earned Income

Understanding the Instructions for Form 2555

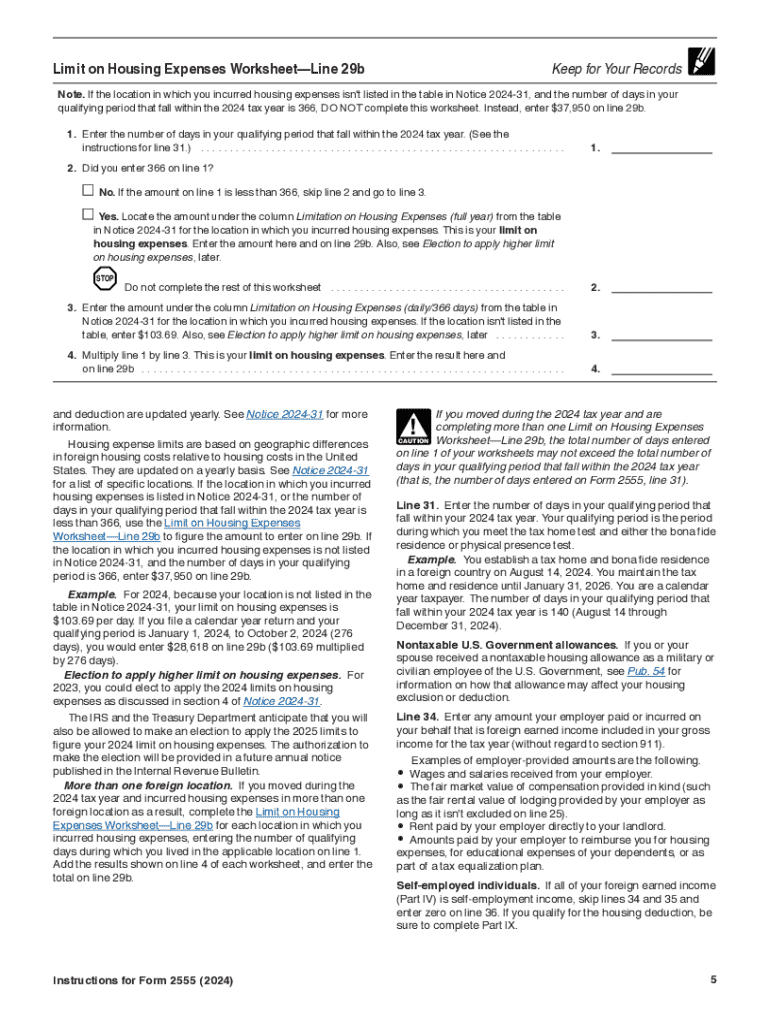

The Instructions for Form 2555 provide essential guidance for U.S. citizens and resident aliens who earn income abroad. This form is primarily used to claim the Foreign Earned Income Exclusion, which allows eligible taxpayers to exclude a certain amount of their foreign earnings from U.S. taxation. It is crucial to understand the eligibility criteria and the specific requirements outlined in the instructions to ensure compliance with IRS regulations.

Steps to Complete the Instructions for Form 2555

Completing the Instructions for Form 2555 involves several key steps:

- Gather necessary documentation, including proof of foreign earned income and residency.

- Determine your eligibility based on the physical presence test or the bona fide residence test.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Review the completed form for any errors or omissions before submission.

Following these steps can help streamline the process and reduce the likelihood of complications with the IRS.

Key Elements of the Instructions for Form 2555

Several key elements are crucial when working with the Instructions for Form 2555:

- Eligibility Requirements: Understanding who qualifies for the Foreign Earned Income Exclusion is vital.

- Income Reporting: Accurate reporting of foreign earned income and any applicable deductions is necessary.

- Residency Tests: Familiarity with the physical presence test and bona fide residence test helps determine eligibility.

- Filing Requirements: Knowing the deadlines and submission methods is essential to avoid penalties.

Obtaining the Instructions for Form 2555

The Instructions for Form 2555 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is advisable to ensure you have the most current version of the instructions, as they may be updated annually to reflect changes in tax law or filing procedures.

IRS Guidelines for Form 2555

The IRS provides specific guidelines for completing Form 2555, which include detailed explanations of each section of the form. These guidelines are designed to assist taxpayers in accurately reporting their foreign income and understanding the implications of the Foreign Earned Income Exclusion. Taxpayers should refer to these guidelines to ensure compliance and to maximize their benefits under the tax code.

Filing Deadlines for Form 2555

Filing deadlines for Form 2555 align with the standard tax filing deadlines, typically April 15 for most taxpayers. However, if you are living abroad, you may qualify for an automatic extension, allowing you to file up to June 15. It is important to be aware of these deadlines to avoid late fees or penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 2555 instructions for form 2555 foreign earned income 767976010

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions for filling out the 2555 form?

The instructions for the 2555 form provide detailed guidance on how to report foreign earned income and claim the foreign housing exclusion. It's essential to follow these instructions carefully to ensure compliance with IRS regulations. You can find the official instructions on the IRS website or through tax preparation software.

-

How can airSlate SignNow help with the 2555 form?

airSlate SignNow simplifies the process of signing and sending the 2555 form electronically. With our platform, you can easily upload your completed form, add signatures, and send it securely to recipients. This streamlines the submission process and ensures your documents are handled efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2555 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage documents like the 2555 form without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSignature, document templates, and real-time tracking, which are beneficial for managing forms like the 2555. These features enhance productivity and ensure that your documents are processed quickly and securely. Additionally, our user-friendly interface makes it easy to navigate through the document management process.

-

Can I integrate airSlate SignNow with other software for the 2555 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the 2555 form. Whether you use CRM systems, cloud storage, or accounting software, our platform can connect seamlessly to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the 2555 form provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are signed and sent quickly, minimizing delays in your tax filing process. Additionally, the electronic format helps keep your information secure and organized.

-

How secure is airSlate SignNow when handling sensitive documents like the 2555 form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive documents, including the 2555 form. Our platform complies with industry standards to ensure that your information remains confidential and secure throughout the signing process.

Get more for Instructions For Form 2555 Instructions For Form 2555, Foreign Earned Income

Find out other Instructions For Form 2555 Instructions For Form 2555, Foreign Earned Income

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure