Publication 4134 Rev 9 Low Income Taxpayer Clinic List Form

Understanding the Low Income Taxpayer Clinic List

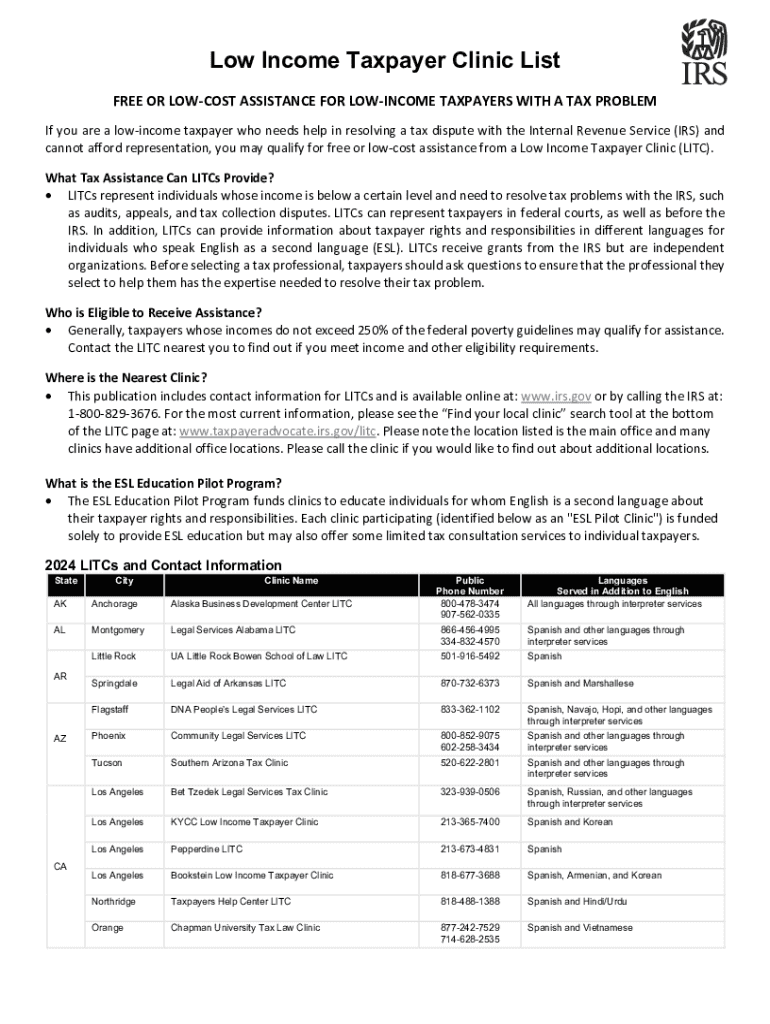

The Publication 4134 is a vital resource that provides a comprehensive list of low income taxpayer clinics across the United States. These clinics offer free or low-cost assistance to individuals who meet specific income criteria and need help with tax-related issues. The list includes the names, addresses, and contact information of participating clinics, making it easier for taxpayers to find support in their local area. This resource is particularly beneficial for those who may struggle to afford professional tax services.

How to Access the Low Income Taxpayer Clinic List

To obtain the Publication 4134 Low Income Taxpayer Clinic List, individuals can visit the IRS website or contact the IRS directly for a printed version. The document is updated regularly to reflect any changes in clinic availability or services offered. It is essential for taxpayers to ensure they are using the most current version of the publication to access accurate information. Additionally, many community organizations and legal aid offices may also have copies available for distribution.

Eligibility Criteria for Low Income Taxpayer Clinics

Eligibility for assistance from low income taxpayer clinics typically depends on the taxpayer's income level and specific tax issues. Generally, taxpayers must have an income at or below 250 percent of the federal poverty level to qualify for services. These clinics assist with various tax-related matters, including audits, appeals, and other disputes with the IRS. Understanding the eligibility criteria is crucial for taxpayers seeking help, as it ensures they receive appropriate support based on their financial situation.

Key Services Offered by Low Income Taxpayer Clinics

Low income taxpayer clinics provide a range of services designed to assist individuals with their tax needs. These services may include:

- Help with filing tax returns

- Assistance in resolving disputes with the IRS

- Representation during audits and appeals

- Education on taxpayer rights and responsibilities

- Support for non-English speaking taxpayers through language assistance

The clinics aim to empower taxpayers by providing them with the knowledge and resources necessary to navigate the tax system effectively.

IRS Guidelines for Low Income Taxpayer Clinics

The IRS has established specific guidelines for the operation of low income taxpayer clinics to ensure they provide quality services. These guidelines include requirements for clinic staffing, training, and the types of services offered. Clinics must also maintain a commitment to confidentiality and professionalism when handling taxpayer information. By adhering to these guidelines, clinics can effectively support low income taxpayers while fostering trust and reliability within the community.

Examples of Taxpayer Scenarios for Clinic Assistance

Low income taxpayer clinics cater to a variety of taxpayer scenarios. Some common situations where individuals may seek assistance include:

- Self-employed individuals facing challenges with tax deductions and reporting

- Retired individuals needing help with pension income and tax implications

- Students navigating tax issues related to scholarships and education expenses

These examples illustrate the diverse needs of taxpayers who can benefit from the services provided by low income taxpayer clinics, highlighting the importance of accessible support for all income levels.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 4134 rev 9 low income taxpayer clinic list 770660175

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a low income taxpayer clinic?

A low income taxpayer clinic is a nonprofit organization that provides free or low-cost assistance to individuals who cannot afford tax representation. These clinics help taxpayers understand their rights and navigate the complexities of tax law, ensuring they receive the support they need.

-

How can a low income taxpayer clinic help me with my tax issues?

A low income taxpayer clinic can assist you with various tax-related issues, including filing tax returns, resolving disputes with the IRS, and understanding tax credits and deductions. Their trained professionals are dedicated to helping low-income individuals achieve compliance and maximize their tax benefits.

-

Are services at a low income taxpayer clinic really free?

Many low income taxpayer clinics offer their services for free or at a signNowly reduced cost. However, it's essential to check with the specific clinic for any potential fees or eligibility requirements, as some may charge nominal fees based on your income level.

-

What features should I look for in a low income taxpayer clinic?

When choosing a low income taxpayer clinic, look for features such as experienced staff, a range of services offered, and a commitment to client confidentiality. Additionally, clinics that provide multilingual support can be beneficial for non-English speakers seeking assistance.

-

How do I find a low income taxpayer clinic near me?

You can find a low income taxpayer clinic near you by visiting the IRS website, which provides a searchable database of clinics across the country. Additionally, local community organizations and legal aid offices may have information on available clinics in your area.

-

What are the benefits of using a low income taxpayer clinic?

Using a low income taxpayer clinic can provide you with expert guidance on tax matters, ensuring you receive the maximum benefits available to you. These clinics also help alleviate the stress of dealing with tax issues, allowing you to focus on other important aspects of your life.

-

Can a low income taxpayer clinic assist with e-signing documents?

Yes, many low income taxpayer clinics are equipped to assist clients with e-signing documents, making the process more efficient and accessible. Utilizing tools like airSlate SignNow can streamline document management and ensure that all necessary paperwork is completed accurately.

Get more for Publication 4134 Rev 9 Low Income Taxpayer Clinic List

Find out other Publication 4134 Rev 9 Low Income Taxpayer Clinic List

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application