Publication 4235 Rev 10 Form

Understanding Publication 4235 Rev 10

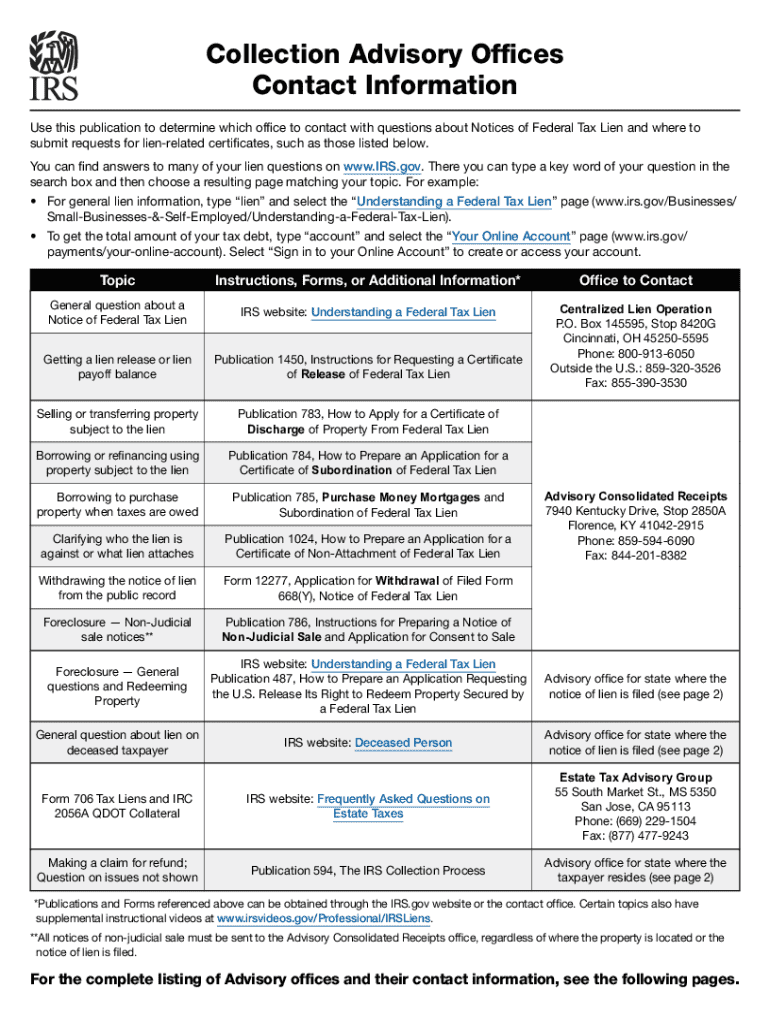

Publication 4235 Rev 10 is an important document issued by the IRS that provides guidance on various tax-related matters. This publication outlines the rules and regulations that taxpayers must adhere to when filing their taxes. It serves as a comprehensive resource for understanding tax obligations and compliance requirements. The publication is designed to assist both individuals and businesses in navigating the complexities of the tax system.

How to Utilize Publication 4235 Rev 10

To effectively use Publication 4235 Rev 10, taxpayers should first familiarize themselves with its contents. The publication is structured to provide clear explanations of tax laws, including eligibility criteria and filing procedures. It is advisable to read through the relevant sections that apply to your specific tax situation. Utilizing the publication can help ensure that you meet all necessary requirements and deadlines, ultimately aiding in the accurate completion of your tax filings.

Obtaining Publication 4235 Rev 10

Taxpayers can obtain Publication 4235 Rev 10 directly from the IRS website. The publication is available for download in PDF format, making it easily accessible for anyone who needs it. Additionally, physical copies may be requested through IRS offices or certain tax preparation services. Ensuring you have the most current version of the publication is crucial for compliance and accurate tax preparation.

Key Components of Publication 4235 Rev 10

Publication 4235 Rev 10 includes several key components that are essential for understanding tax obligations. These components often encompass:

- Detailed explanations of tax laws and regulations.

- Guidance on eligibility criteria for various tax benefits.

- Instructions for completing necessary forms accurately.

- Information on filing deadlines and important dates.

Each section is crafted to provide clarity, helping taxpayers navigate their responsibilities effectively.

Steps for Completing Publication 4235 Rev 10

Completing the requirements outlined in Publication 4235 Rev 10 involves several steps. First, gather all necessary documentation related to your income and deductions. Next, refer to the publication for specific instructions on how to fill out the relevant forms. Ensure that all information is accurate and complete to avoid delays or penalties. Finally, review your completed forms against the guidelines provided in the publication before submission.

IRS Guidelines for Compliance

The IRS provides specific guidelines that must be followed to maintain compliance with tax laws. These guidelines are detailed in Publication 4235 Rev 10 and cover various aspects of tax filing, including proper documentation, eligibility for deductions, and timelines for submission. Adhering to these guidelines is essential for avoiding penalties and ensuring that your tax filings are processed smoothly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 4235 rev 10

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 IRS advisory regarding electronic signatures?

The 2020 IRS advisory confirms that electronic signatures are legally valid for many tax documents. This means businesses can use solutions like airSlate SignNow to eSign necessary forms securely and efficiently. By leveraging this advisory, you can streamline your document processes while ensuring compliance with IRS regulations.

-

How does airSlate SignNow support the 2020 IRS advisory?

airSlate SignNow is designed to comply with the 2020 IRS advisory by providing a secure platform for electronic signatures. Our solution ensures that all signed documents meet legal standards, making it easier for businesses to manage their tax-related paperwork. This compliance helps you avoid potential issues with the IRS.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective, ensuring that you can access the features you need to comply with the 2020 IRS advisory without breaking the bank. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage. These tools help you manage your documents efficiently while adhering to the 2020 IRS advisory. With our user-friendly interface, you can easily send, sign, and store important documents.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow. By connecting with tools like CRM systems and cloud storage, you can streamline your document processes while ensuring compliance with the 2020 IRS advisory. This integration capability makes it easier to manage your business operations.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents provides numerous benefits, including increased efficiency and reduced turnaround time. The 2020 IRS advisory supports the use of electronic signatures, allowing you to expedite your filing process. Additionally, our platform enhances security and compliance, giving you peace of mind.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is an ideal solution for small businesses looking to manage their documents effectively. With features that comply with the 2020 IRS advisory, small businesses can benefit from a cost-effective way to eSign and send documents without the need for extensive resources.

Get more for Publication 4235 Rev 10

- Cigna pharmacy prior authorization form

- Readiness to change questionnaire pdf form

- Domestic violence payment centrelink form

- Mednet dental reimbursement form

- Lead property information sheet

- Temporary form for hsp screening for clinics bsehatbbperkesob sehat perkeso gov

- Tulostettava valtakirja pohja form

- Nevada llc operating agreement template form

Find out other Publication 4235 Rev 10

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later