City of Brunswick Income Tax Return TAXABLE PERIOD Form

What is the City Of Brunswick Income Tax Return TAXABLE PERIOD

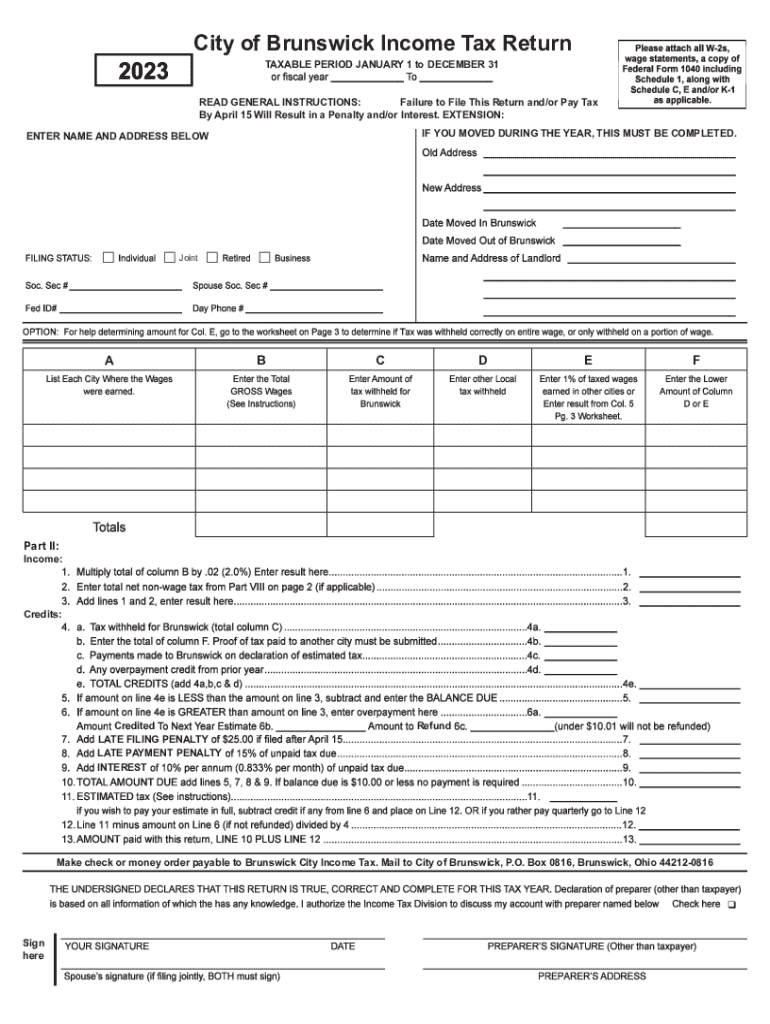

The City of Brunswick Income Tax Return taxable period refers to the specific timeframe for which income is reported for tax purposes. This period typically aligns with the calendar year, from January first to December thirty-first. Taxpayers are required to report all income earned during this period when filing their tax returns. Understanding the taxable period is essential for accurate reporting and compliance with local tax regulations.

Steps to complete the City Of Brunswick Income Tax Return TAXABLE PERIOD

Completing the City of Brunswick Income Tax Return involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Determine your taxable income by calculating total earnings and deducting eligible expenses.

- Fill out the appropriate income tax return form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Filing Deadlines / Important Dates

Taxpayers in Brunswick must be aware of critical deadlines for filing their income tax returns. Typically, the filing deadline is April fifteenth for the previous calendar year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates to avoid penalties.

Required Documents

To successfully complete the City of Brunswick Income Tax Return, several documents are necessary:

- W-2 forms from employers to report wages.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Receipts for deductible expenses, including business-related costs.

- Any relevant tax credits documentation.

Penalties for Non-Compliance

Failing to comply with the City of Brunswick income tax regulations can lead to various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for severe non-compliance. It is crucial for taxpayers to understand these risks and ensure timely and accurate filing to avoid such consequences.

Who Issues the Form

The City of Brunswick income tax return form is issued by the local tax authority. This authority is responsible for setting tax rates, collecting taxes, and providing guidance on compliance. Taxpayers should refer to the official resources provided by the city for the most accurate and updated information regarding the forms and filing procedures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of brunswick income tax return taxable period

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the City Of Brunswick Income Tax Return TAXABLE PERIOD?

The City Of Brunswick Income Tax Return TAXABLE PERIOD refers to the specific timeframe for which income is assessed for tax purposes. Typically, this period aligns with the calendar year, but it can vary based on individual circumstances. Understanding this period is crucial for accurate tax filing and compliance.

-

How can airSlate SignNow help with the City Of Brunswick Income Tax Return TAXABLE PERIOD?

airSlate SignNow streamlines the process of preparing and submitting your City Of Brunswick Income Tax Return TAXABLE PERIOD documents. With our easy-to-use platform, you can quickly eSign and send necessary forms, ensuring timely submission. This efficiency helps you stay compliant and avoid penalties.

-

What features does airSlate SignNow offer for managing the City Of Brunswick Income Tax Return TAXABLE PERIOD?

Our platform offers features such as customizable templates, secure eSigning, and document tracking specifically designed for the City Of Brunswick Income Tax Return TAXABLE PERIOD. These tools simplify the tax filing process, allowing you to focus on your business rather than paperwork. Additionally, our user-friendly interface makes it accessible for everyone.

-

Is there a cost associated with using airSlate SignNow for the City Of Brunswick Income Tax Return TAXABLE PERIOD?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible, allowing you to choose one that best fits your needs for managing the City Of Brunswick Income Tax Return TAXABLE PERIOD. Investing in our solution can save you time and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other software for the City Of Brunswick Income Tax Return TAXABLE PERIOD?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, enhancing your workflow for the City Of Brunswick Income Tax Return TAXABLE PERIOD. This connectivity allows for easy data transfer and ensures that all your documents are in sync, making tax preparation more efficient.

-

What are the benefits of using airSlate SignNow for the City Of Brunswick Income Tax Return TAXABLE PERIOD?

Using airSlate SignNow for the City Of Brunswick Income Tax Return TAXABLE PERIOD provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible, allowing you to manage your tax obligations with confidence. Additionally, the eSigning feature speeds up the approval process.

-

How secure is airSlate SignNow when handling the City Of Brunswick Income Tax Return TAXABLE PERIOD?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents related to the City Of Brunswick Income Tax Return TAXABLE PERIOD. You can trust that your sensitive information is safe while using our platform for eSigning and document management.

Get more for City Of Brunswick Income Tax Return TAXABLE PERIOD

Find out other City Of Brunswick Income Tax Return TAXABLE PERIOD

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract