IRS Information and Forms 2025 Tax Forms, Instructions

Understanding the 2024 Standard Deduction

The 2024 standard deduction is a fixed dollar amount that taxpayers can subtract from their income before income tax is applied. This deduction reduces the amount of income that is subject to federal income tax, making it an essential part of tax planning. For the tax year 2024, the standard deduction amounts have been adjusted for inflation, which may affect how much taxpayers can deduct. It is important for individuals to understand these amounts as they prepare their tax returns.

Eligibility Criteria for the 2024 Standard Deduction

To qualify for the 2024 standard deduction, taxpayers must meet specific criteria. Generally, all taxpayers can claim the standard deduction unless they choose to itemize their deductions. Special rules apply for married couples filing separately, dependents, and those who are 65 years or older or blind. It is essential to review these eligibility requirements to determine the most beneficial deduction method for your situation.

Filing Deadlines and Important Dates

Taxpayers should be aware of key deadlines related to the 2024 standard deduction. The federal income tax return for the 2024 tax year is typically due on April 15, 2025. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Understanding these dates helps ensure that taxpayers file their returns on time and avoid penalties.

Steps to Claim the 2024 Standard Deduction

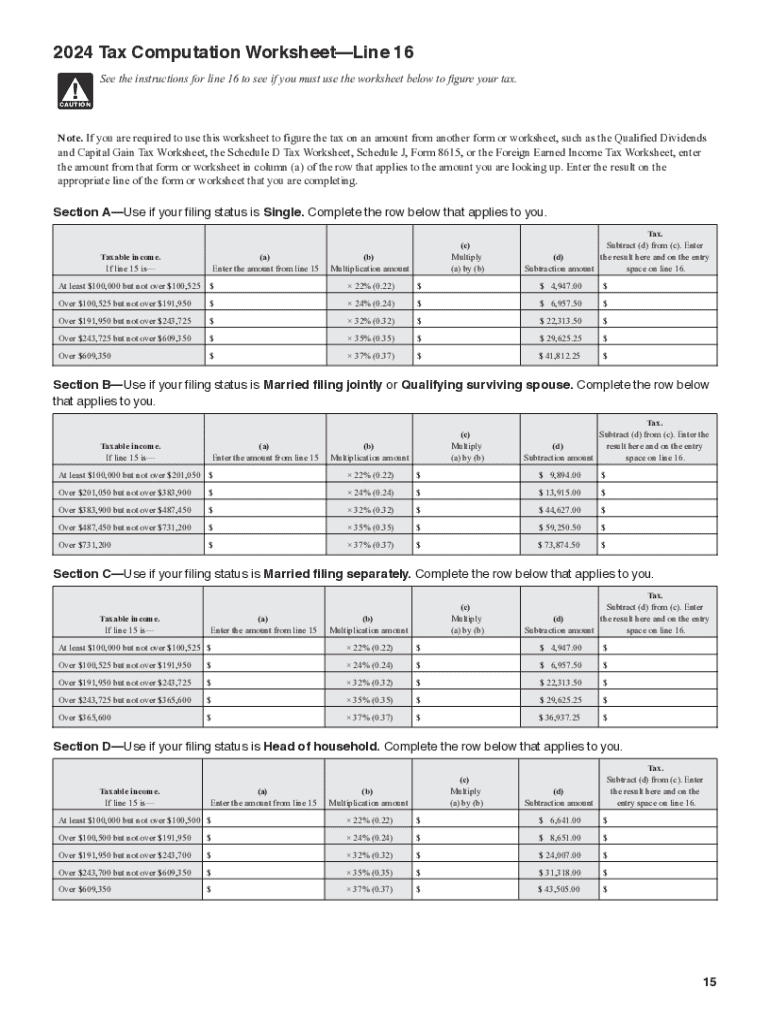

Claiming the 2024 standard deduction involves a straightforward process. Taxpayers need to complete their federal income tax return, typically using Form 1040. On this form, there is a designated line where the standard deduction amount can be entered. It is crucial to ensure that all information is accurate and that the correct deduction amount is applied based on filing status and eligibility.

Implications of Choosing the Standard Deduction

Opting for the standard deduction can significantly impact a taxpayer's overall tax liability. By reducing taxable income, the standard deduction can lower the amount of tax owed. However, taxpayers should consider their individual financial situations, as itemizing deductions may yield greater tax benefits in certain scenarios. Evaluating both options can help determine the most advantageous approach for tax filing.

Common Scenarios for the 2024 Standard Deduction

Different taxpayer scenarios can influence the decision to take the standard deduction. For instance, single filers or married couples without significant itemized deductions may find that the standard deduction provides a more straightforward and beneficial tax outcome. Conversely, those with substantial deductible expenses, such as mortgage interest or medical expenses, may benefit more from itemizing. Understanding these scenarios can assist taxpayers in making informed decisions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs information and forms 2025 tax forms instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 standard deduction and how does it affect my taxes?

The 2024 standard deduction is a specific amount that taxpayers can deduct from their taxable income, reducing their overall tax liability. For the tax year 2024, the standard deduction amounts have been adjusted for inflation. Understanding the 2024 standard deduction is crucial for effective tax planning and can help you maximize your savings.

-

How can airSlate SignNow help me with tax documents related to the 2024 standard deduction?

airSlate SignNow provides a seamless platform for sending and eSigning tax documents, including those related to the 2024 standard deduction. Our solution ensures that your documents are securely signed and stored, making it easy to manage your tax paperwork efficiently. This can save you time and reduce the stress of tax season.

-

What features does airSlate SignNow offer that are beneficial for tax preparation in 2024?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are all beneficial for tax preparation in 2024. These tools help streamline the process of gathering necessary signatures and ensure that all documents are compliant with tax regulations. Utilizing these features can simplify your experience when dealing with the 2024 standard deduction.

-

Is airSlate SignNow cost-effective for small businesses preparing for the 2024 standard deduction?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, especially when preparing for the 2024 standard deduction. Our pricing plans are flexible and cater to various business sizes, ensuring that you can access essential eSigning features without breaking the bank. This affordability allows small businesses to focus on maximizing their deductions.

-

Can I integrate airSlate SignNow with my accounting software for the 2024 standard deduction?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your tax documents related to the 2024 standard deduction. This integration allows for a seamless flow of information, ensuring that your financial records are up-to-date and accurate. Simplifying your workflow can lead to better tax outcomes.

-

What benefits does eSigning provide for documents related to the 2024 standard deduction?

eSigning provides numerous benefits for documents related to the 2024 standard deduction, including speed, security, and convenience. With airSlate SignNow, you can quickly obtain signatures from clients or partners without the hassle of printing and mailing documents. This efficiency can signNowly enhance your tax preparation process.

-

How does airSlate SignNow ensure the security of my documents related to the 2024 standard deduction?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure storage solutions. When dealing with sensitive information related to the 2024 standard deduction, you can trust that your data is protected against unauthorized access. Our commitment to security helps you focus on your business without worrying about document safety.

Get more for IRS Information And Forms 2025 Tax Forms, Instructions

Find out other IRS Information And Forms 2025 Tax Forms, Instructions

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms