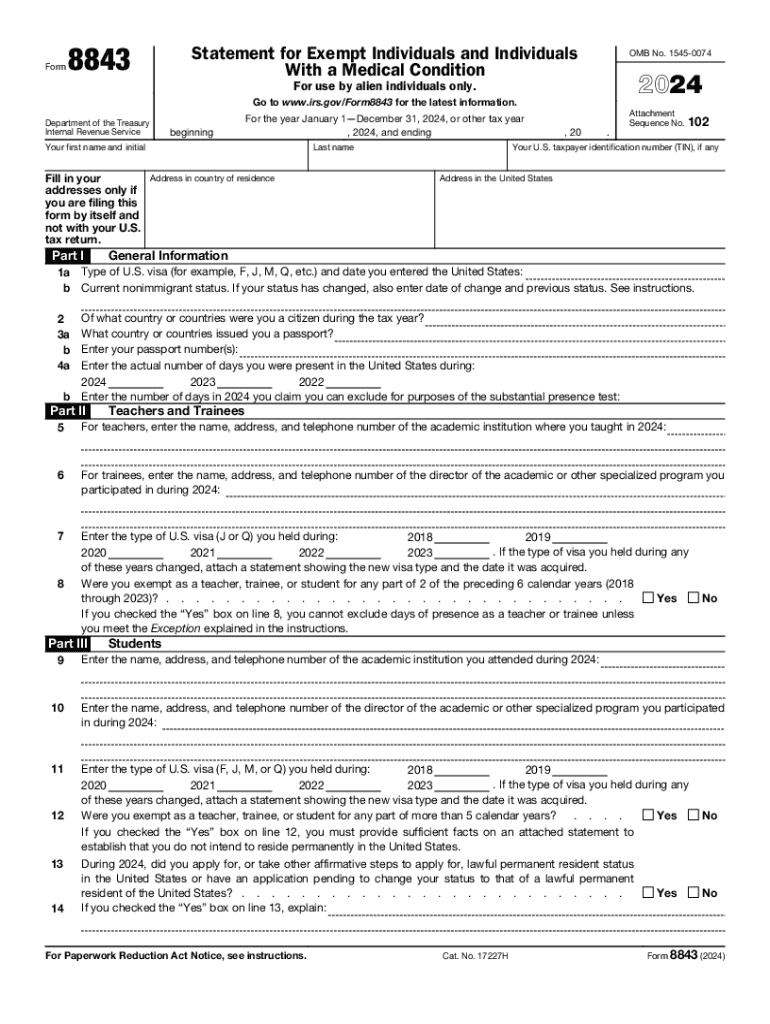

Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition

What is the Form 8843 Statement for Exempt Individuals and Individuals With a Medical Condition

The Form 8843, officially known as the Statement for Exempt Individuals and Individuals With a Medical Condition, is a document required by the Internal Revenue Service (IRS) for certain non-resident aliens in the United States. This form is primarily used by international students, teachers, trainees, and individuals with medical conditions who are exempt from being classified as resident aliens for tax purposes. By filing this form, individuals can provide necessary information about their status and claim any applicable exemptions under U.S. tax law.

How to Use the Form 8843

Using the Form 8843 involves providing detailed information about your residency status and the reasons for your exemption. This form must be filled out accurately and submitted as part of your tax return if you are required to file one. If you are an international student or trainee, you will need to include your visa type, the number of days you were present in the U.S., and any relevant medical conditions that apply to your exemption. It is important to ensure that all information is complete to avoid delays or issues with your tax status.

Steps to Complete the Form 8843

Completing the Form 8843 requires several steps:

- Gather necessary documents, including your visa information and any relevant medical documentation.

- Fill out your personal information, including your name, address, and taxpayer identification number.

- Provide details regarding your visa type and the number of days you were present in the U.S. during the tax year.

- Indicate any medical conditions that may qualify you for an exemption.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

The filing deadline for Form 8843 typically aligns with the tax return deadline for the year in question. For most individuals, this is April 15. However, if you are a non-resident alien and do not have to file a tax return, you still need to submit Form 8843 by the deadline to maintain your exempt status. It is crucial to stay informed about any changes to deadlines, especially if you are filing for the current tax year, such as 2024.

Eligibility Criteria

Eligibility for filing Form 8843 primarily includes non-resident aliens who fall under specific categories. This includes international students on F or J visas, teachers, trainees, and individuals with medical conditions that prevent them from meeting the substantial presence test. To qualify, individuals must demonstrate that they have been in the U.S. for a limited time and are not considered residents for tax purposes. Understanding these criteria is essential for ensuring compliance with IRS regulations.

Where to Send Form 8843

Form 8843 should be mailed to the address specified in the instructions provided with the form. Generally, if you are not filing a tax return, you would send the form to the address for non-resident aliens. If you are filing a return, include the form with your tax return submission. It is advisable to check the latest IRS guidelines for any updates regarding where to send the form, as this can vary based on your specific situation.

Handy tips for filling out Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition online

Quick steps to complete and e-sign Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for maximum simpleness. Use signNow to electronically sign and send out Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8843 statement for exempt individuals and individuals with a medical condition

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8843 and who needs to file it?

Form 8843 is a tax form required by certain non-resident aliens in the United States to explain their status and claim exemptions. Individuals who are in the U.S. on a visa and meet specific criteria must file this form to avoid being taxed as residents. Understanding how to complete form 8843 is crucial for compliance with U.S. tax laws.

-

How can airSlate SignNow help with signing form 8843?

airSlate SignNow provides a seamless platform for electronically signing form 8843, making the process quick and efficient. Users can upload their documents, add signatures, and send them securely without the need for printing. This not only saves time but also ensures that your form 8843 is filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for form 8843?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The cost is competitive and reflects the value of a user-friendly platform that simplifies the signing process for documents like form 8843. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for managing form 8843?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, which are beneficial for managing form 8843. Users can create templates for repetitive tasks, track the status of their documents, and access them from anywhere. These features enhance efficiency and organization when handling important forms.

-

Can I integrate airSlate SignNow with other applications for form 8843?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when dealing with form 8843. Whether you use CRM systems, cloud storage, or other productivity tools, these integrations help you manage your documents more effectively and save time.

-

What are the benefits of using airSlate SignNow for form 8843?

Using airSlate SignNow for form 8843 provides numerous benefits, including enhanced security, ease of use, and faster processing times. The platform ensures that your documents are encrypted and securely stored, giving you peace of mind. Additionally, the intuitive interface allows users to complete and send their forms quickly.

-

How does airSlate SignNow ensure the security of my form 8843?

airSlate SignNow prioritizes security by employing advanced encryption protocols to protect your form 8843 and other documents. The platform complies with industry standards for data protection, ensuring that your sensitive information remains confidential. You can trust airSlate SignNow to keep your documents safe throughout the signing process.

Get more for Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition

- How to write a letter of recommendation for physical work form

- Tceq csi form

- Https disclosure capitarvs co uk nereo form

- Rental application nc form

- Request for use of school facilities the school district of form

- Hfs 458sp form

- Instuctions on how to fill out straight bill of lading short form

- Adult name change packet form

Find out other Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement