Cash in Cash Out Form

What is the Cash In Cash Out Form

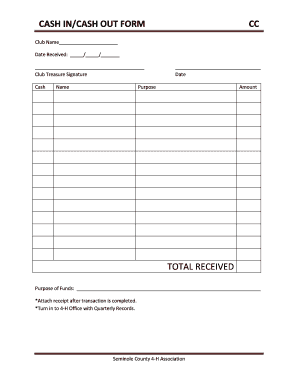

The cash in cash out form is a financial document used to record transactions involving cash inflows and outflows within a business or personal context. This form helps individuals and organizations track their cash movements, ensuring accurate financial management. It typically includes details such as the date of the transaction, the amount of cash received or disbursed, and the purpose of the transaction. By maintaining a clear record, users can better understand their cash flow and make informed financial decisions.

How to use the Cash In Cash Out Form

Using the cash in cash out form involves a few straightforward steps. First, gather all necessary information related to the cash transactions you wish to document. This includes the date, amount, and purpose of each transaction. Next, fill out the form by entering the cash inflows in one section and the cash outflows in another. Be sure to double-check your entries for accuracy. Once completed, the form can be saved for future reference or shared with relevant stakeholders to ensure transparency in financial dealings.

Steps to complete the Cash In Cash Out Form

Completing the cash in cash out form requires careful attention to detail. Follow these steps for effective completion:

- Start with the date of the transaction.

- Record cash inflows, specifying the amount and purpose.

- Document cash outflows in a separate section, including the amount and reason.

- Verify all entries for accuracy and completeness.

- Sign and date the form if required, ensuring it is authenticated.

Legal use of the Cash In Cash Out Form

The cash in cash out form can serve as a legally binding document if completed correctly. To ensure its validity, it is essential to comply with relevant laws and regulations governing financial documentation. This includes maintaining accurate records and ensuring that all parties involved in the transactions understand and agree to the terms outlined in the form. Utilizing a reliable digital tool, like signNow, can enhance the form's legitimacy by providing secure eSignature options and maintaining compliance with legal standards.

Key elements of the Cash In Cash Out Form

Several key elements are crucial for the effectiveness of the cash in cash out form. These include:

- Date: The specific date of each transaction.

- Transaction Type: Clearly delineate between cash inflows and outflows.

- Amount: The exact cash amount involved in each transaction.

- Purpose: A brief description of the reason for the transaction.

- Signatures: Required signatures from involved parties to validate the form.

Examples of using the Cash In Cash Out Form

There are various scenarios in which the cash in cash out form can be utilized. For instance, a small business may use this form to track daily sales and expenses, ensuring that they maintain a balanced cash flow. Similarly, an individual may use it to record personal finances, such as cash received from a side job or cash spent on household expenses. These examples highlight the versatility of the form in both personal and professional financial management.

Quick guide on how to complete cash in cash out form

Complete Cash In Cash Out Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without delays. Handle Cash In Cash Out Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Cash In Cash Out Form with ease

- Find Cash In Cash Out Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and eSign Cash In Cash Out Form and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cash in cash out form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cash out form and how does it work?

A cash out form is a document that allows individuals or businesses to request the withdrawal of funds from an account. By filling out this form, users can specify the amount they wish to cash out and any necessary account details. With airSlate SignNow, you can easily create, sign, and manage your cash out forms all in one platform.

-

How can airSlate SignNow simplify the cash out form process?

airSlate SignNow streamlines the cash out form process by providing customizable templates that can be filled out and signed electronically. This eliminates the need for physical paperwork and speeds up transaction times. With our secure platform, you can be sure that your cash out forms are processed efficiently and safely.

-

Is there a cost associated with using airSlate SignNow for cash out forms?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. Our plans are designed to be cost-effective while providing essential features for managing your cash out forms. You can choose the best plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for cash out forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications and software. This allows you to automate workflows and manage your cash out forms alongside your existing business tools, enhancing productivity and efficiency.

-

What security features does airSlate SignNow offer for cash out forms?

Security is a top priority at airSlate SignNow. Our platform includes advanced encryption and secure storage for all cash out forms. Additionally, we comply with industry standards to ensure your sensitive information remains protected throughout the signing process.

-

Can cash out forms be signed on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully mobile-friendly, allowing users to fill out and sign cash out forms from any device. Whether you're on a smartphone or tablet, our platform ensures you have quick and easy access to your forms anytime, anywhere.

-

What are the benefits of using airSlate SignNow for cash out forms?

Using airSlate SignNow for cash out forms provides numerous benefits, including faster processing times and reduced paperwork. Our eSignature capabilities streamline the signing process, helping you eliminate delays and improve overall financial operations. Plus, our user-friendly interface makes it easy for anyone to use.

Get more for Cash In Cash Out Form

Find out other Cash In Cash Out Form

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free