Schedule SE Form 1040 Self Employment Tax

What is the Schedule SE Form 1040 Self Employment Tax

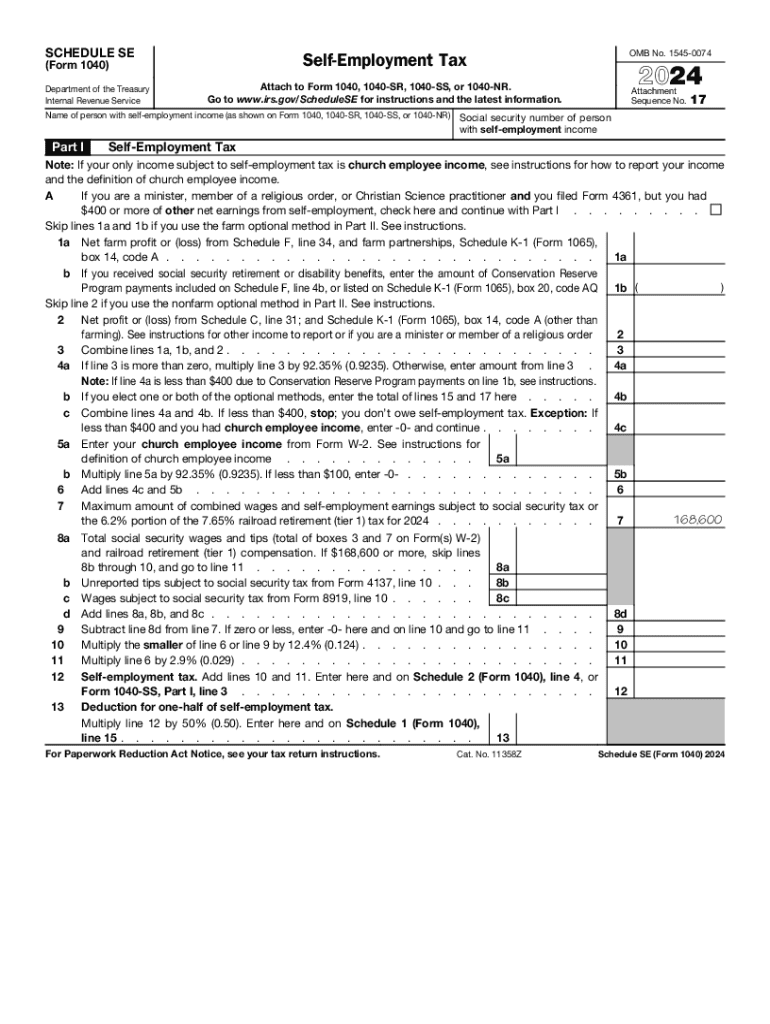

The Schedule SE Form 1040 is a crucial document for self-employed individuals in the United States. It is used to calculate the self-employment tax, which covers Social Security and Medicare taxes for those who work for themselves. This form is essential for reporting income earned from self-employment, ensuring that self-employed individuals contribute to these federal programs. The self-employment tax rate is typically 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare. Understanding this form is vital for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule SE Form 1040 Self Employment Tax

Using the Schedule SE Form 1040 involves several steps. First, gather all relevant income information from your self-employment activities. This includes income from freelance work, business profits, and any other sources of self-employment income. Next, complete the form by entering your net earnings from self-employment, which is typically calculated on Schedule C. You will then apply the appropriate tax rates to determine your self-employment tax liability. Finally, transfer the calculated amount to your Form 1040, ensuring that all figures are accurate to avoid penalties.

Steps to complete the Schedule SE Form 1040 Self Employment Tax

Completing the Schedule SE Form 1040 involves a systematic approach:

- Start by entering your name and Social Security number at the top of the form.

- Calculate your net earnings from self-employment using Schedule C or another applicable form.

- Determine your self-employment tax by applying the tax rates to your net earnings.

- Report any adjustments or credits that may apply to your situation.

- Finally, ensure that all calculations are correct before submitting the form with your Form 1040.

Key elements of the Schedule SE Form 1040 Self Employment Tax

Several key elements are essential when filling out the Schedule SE Form 1040. These include:

- Net Earnings: This is the total income from self-employment minus any allowable business expenses.

- Tax Rates: The self-employment tax rate is 15.3%, which is divided into Social Security and Medicare portions.

- Adjustments: Certain adjustments may apply, such as the deduction for one-half of the self-employment tax, which can reduce your taxable income.

- Filing Requirements: Self-employed individuals must file this form if their net earnings exceed $400.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE Form 1040 align with the general tax filing deadlines for individual taxpayers. Typically, the deadline to file your federal tax return, including the Schedule SE, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you need more time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Schedule SE Form 1040 or pay the required self-employment tax can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, if you do not pay the tax owed, you may incur interest and additional penalties. It is essential to comply with all filing requirements to avoid these financial consequences.

Handy tips for filling out Schedule SE Form 1040 Self Employment Tax online

Quick steps to complete and e-sign Schedule SE Form 1040 Self Employment Tax online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for maximum efficiency. Use signNow to electronically sign and send Schedule SE Form 1040 Self Employment Tax for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule se form 1040 self employment tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with self-signing documents?

airSlate SignNow is a powerful eSignature solution that allows users to self-sign documents quickly and securely. With its intuitive interface, individuals can easily upload, sign, and send documents without needing extensive training. This self-service approach streamlines the signing process, making it ideal for businesses of all sizes.

-

How much does airSlate SignNow cost for self-use?

airSlate SignNow offers flexible pricing plans tailored for self-users, starting with a free trial to explore its features. Paid plans provide additional functionalities, such as advanced templates and integrations, ensuring that self-signing remains cost-effective. Users can choose a plan that best fits their needs and budget.

-

What features does airSlate SignNow offer for self-signing?

airSlate SignNow includes a variety of features designed for self-signing, such as customizable templates, in-person signing, and mobile access. Users can also track document status and receive notifications, ensuring a seamless signing experience. These features empower individuals to manage their signing tasks efficiently.

-

Can I integrate airSlate SignNow with other tools for self-management?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows users to manage their documents and self-signing processes directly from their preferred platforms. The seamless integration enhances productivity and simplifies workflows.

-

What are the benefits of using airSlate SignNow for self-signing?

Using airSlate SignNow for self-signing provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform ensures that documents are signed quickly and stored securely in the cloud. This self-service solution helps businesses save time and resources while maintaining compliance.

-

Is airSlate SignNow secure for self-signing documents?

Absolutely! airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your self-signed documents. Compliance with regulations such as GDPR and eIDAS ensures that your data remains safe and confidential. Users can trust that their signing experience is secure.

-

How can I get started with self-signing on airSlate SignNow?

Getting started with self-signing on airSlate SignNow is easy. Simply sign up for a free trial on their website, where you can explore the platform's features. Once registered, you can upload documents, add your signature, and send them out for signing—all within minutes.

Get more for Schedule SE Form 1040 Self Employment Tax

- Msc cruises job application form

- Security bond for work permit in kenya form

- Business communication developing leaders for a networked world pdf form

- Momentum worksheet answer key 390335965 form

- Priority health healthy by choice form

- California child passenger safety law california department of cdss ca form

- West jefferson hospital foundation employee giving pledge form

- Veterinary release form for canine fitness training

Find out other Schedule SE Form 1040 Self Employment Tax

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online