About Form 943 A, Agricultural Employer's Record

What is Form 943 A, Agricultural Employer's Record

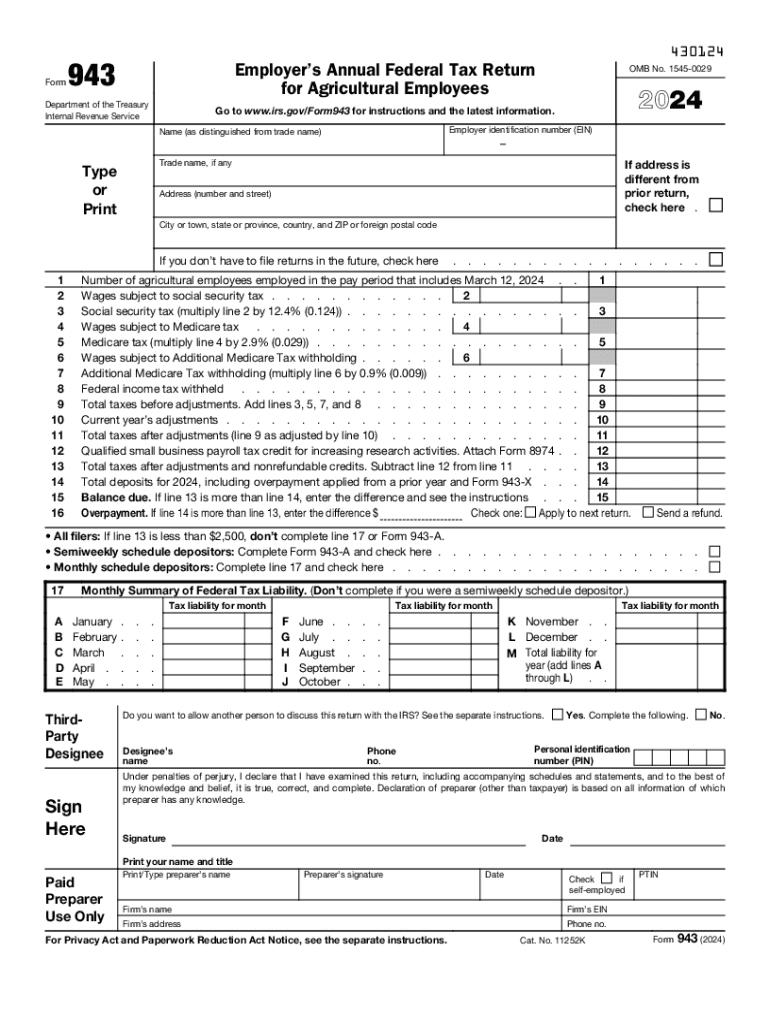

Form 943 A, Agricultural Employer's Record, is a crucial document for agricultural employers in the United States. This form is used to report employment taxes related to agricultural workers. It serves as a record of wages paid and taxes withheld, ensuring compliance with federal tax regulations. Agricultural employers must maintain accurate records to facilitate proper tax reporting and to avoid potential penalties.

Steps to Complete Form 943 A

Completing Form 943 A requires careful attention to detail. Here are the essential steps:

- Gather employee information, including names, Social Security numbers, and wages paid.

- Calculate the total wages and the corresponding federal tax withholding.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

It is important for agricultural employers to be aware of the filing deadlines for Form 943 A. Typically, the form must be filed annually, with the due date falling on January 31 of the following year. Employers should also keep in mind any extensions that may apply and ensure that they submit the form on time to avoid late fees and interest charges.

Legal Use of Form 943 A

Form 943 A is legally required for agricultural employers to report employment taxes. Failure to file this form can lead to significant penalties, including fines and interest on unpaid taxes. It is essential for employers to understand their legal obligations and to maintain compliance with IRS regulations to avoid potential legal issues.

IRS Guidelines for Form 943 A

The IRS provides specific guidelines for completing and submitting Form 943 A. Employers should refer to the IRS instructions for detailed information on eligibility, filing procedures, and record-keeping requirements. Adhering to these guidelines helps ensure accurate reporting and compliance with federal tax laws.

Required Documents for Form 943 A

When preparing to complete Form 943 A, employers should gather all necessary documents. This includes payroll records, employee tax information, and any prior year forms that may be relevant. Having these documents on hand will streamline the process and help ensure that all information reported is accurate and complete.

Handy tips for filling out About Form 943 A, Agricultural Employer's Record online

Quick steps to complete and e-sign About Form 943 A, Agricultural Employer's Record online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and send About Form 943 A, Agricultural Employer's Record for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 943 a agricultural employers record

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable 943 form?

A fillable 943 form is a tax document used by agricultural employers to report wages paid to farmworkers. With airSlate SignNow, you can easily create and manage fillable 943 forms, ensuring compliance and accuracy in your reporting.

-

How can airSlate SignNow help with fillable 943 forms?

airSlate SignNow provides a user-friendly platform to create, send, and eSign fillable 943 forms. Our solution streamlines the process, making it easier for businesses to manage their tax documentation efficiently.

-

Is there a cost associated with using airSlate SignNow for fillable 943 forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution ensures that you can manage your fillable 943 forms without breaking the bank, providing great value for your investment.

-

What features does airSlate SignNow offer for fillable 943 forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for fillable 943 forms. These features enhance your workflow and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for fillable 943 forms?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage your fillable 943 forms alongside your existing tools. This integration capability enhances productivity and simplifies your document management process.

-

What are the benefits of using airSlate SignNow for fillable 943 forms?

Using airSlate SignNow for fillable 943 forms provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your tax documentation is processed quickly and accurately, saving you time and resources.

-

How secure is airSlate SignNow when handling fillable 943 forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your fillable 943 forms and sensitive information, ensuring that your documents are safe from unauthorized access.

Get more for About Form 943 A, Agricultural Employer's Record

- Alabama department of revenue drive out certificate for non residents form

- Slu medical records fax number form

- School bus driver application form

- Oath of secrecy form pdf

- Burn permits near me form

- Form 499

- Diabetes questionnaire sample 389342102 form

- Corporate farm applicationlimited liability company corporate farm application for limited liability companies form

Find out other About Form 943 A, Agricultural Employer's Record

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors