Schedule D Form 1040 Capital Gains and Losses

What is the Schedule D Form 1040 Capital Gains And Losses

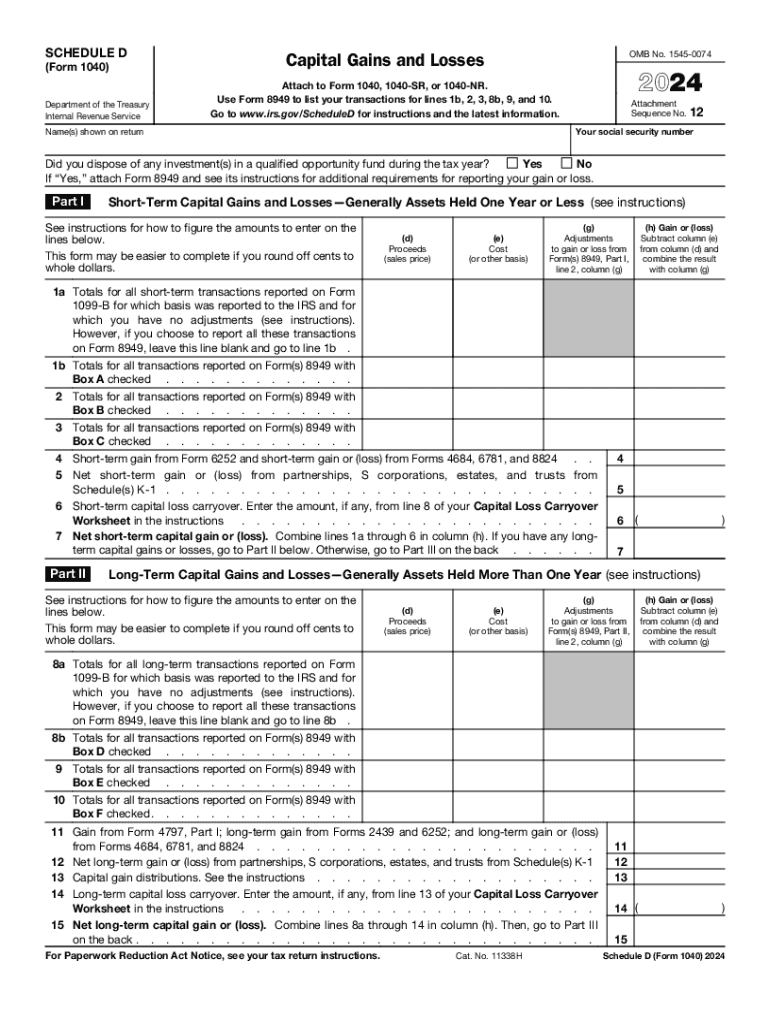

The Schedule D Form 1040 is a tax document used by U.S. taxpayers to report capital gains and losses from the sale of assets, such as stocks, bonds, and real estate. This form is essential for calculating the taxable income derived from these transactions. Taxpayers must complete this form to determine their overall capital gains or losses, which can significantly affect their tax liability. Understanding how to accurately report these figures is crucial for compliance with IRS regulations.

Steps to complete the Schedule D Form 1040 Capital Gains And Losses

Completing the Schedule D Form 1040 involves several key steps:

- Gather necessary documents: Collect all relevant records of asset sales, including purchase and sale dates, amounts, and any associated costs.

- Determine capital gains or losses: Calculate the difference between the sale price and the purchase price of each asset. Include any adjustments for improvements or selling expenses.

- Fill out the form: Enter the calculated gains and losses in the appropriate sections of the Schedule D. Be sure to follow the instructions closely to ensure accuracy.

- Transfer totals to your tax return: After completing Schedule D, transfer the total capital gains or losses to the main Form 1040.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form 1040. Taxpayers should refer to the official IRS instructions for detailed information on reporting requirements, including how to handle short-term versus long-term capital gains. Additionally, the IRS outlines the importance of accurately reporting all transactions to avoid potential penalties. Keeping thorough records and understanding the tax implications of capital gains and losses can help ensure compliance with these guidelines.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the Schedule D Form 1040. Typically, the deadline for filing individual income tax returns, including Schedule D, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any potential extensions that may apply if they need additional time to file their returns.

Required Documents

To complete the Schedule D Form 1040 accurately, taxpayers need several key documents:

- Transaction records: Documentation of all asset purchases and sales, including dates and amounts.

- Brokerage statements: Year-end statements from brokers that detail capital gains and losses.

- Form 8949: If applicable, this form is used to report sales and exchanges of capital assets and is often required before completing Schedule D.

Examples of using the Schedule D Form 1040 Capital Gains And Losses

Examples can clarify how to utilize the Schedule D Form 1040 effectively. For instance, if a taxpayer sells shares of stock bought for $2,000 and sold for $3,000, they would report a capital gain of $1,000. Conversely, if an asset is sold for less than its purchase price, such as buying a property for $250,000 and selling it for $200,000, the taxpayer would report a capital loss of $50,000. These examples illustrate the importance of accurately calculating gains and losses to reflect true financial situations on tax returns.

Handy tips for filling out Schedule D Form 1040 Capital Gains And Losses online

Quick steps to complete and e-sign Schedule D Form 1040 Capital Gains And Losses online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum efficiency. Use signNow to e-sign and send Schedule D Form 1040 Capital Gains And Losses for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 1040 capital gains and losses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the schedule d instructions for using airSlate SignNow?

The schedule d instructions for airSlate SignNow involve a straightforward process of uploading your documents, adding signers, and sending them for eSignature. Our platform guides you through each step, ensuring that you can complete your tasks efficiently. With user-friendly features, you can easily manage your documents and track their status.

-

How much does airSlate SignNow cost for accessing schedule d instructions?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including access to schedule d instructions. You can choose from monthly or annual subscriptions, with options that provide additional features for larger teams. Visit our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow provide for schedule d instructions?

airSlate SignNow includes a range of features designed to simplify the process of following schedule d instructions. These features include customizable templates, automated workflows, and real-time tracking of document status. Our platform ensures that you can manage your eSigning process seamlessly.

-

How can airSlate SignNow benefit my business with schedule d instructions?

By using airSlate SignNow, your business can streamline the eSigning process, making it easier to follow schedule d instructions. This efficiency leads to faster turnaround times and improved productivity. Additionally, our solution is cost-effective, helping you save on operational costs.

-

Can I integrate airSlate SignNow with other tools while following schedule d instructions?

Yes, airSlate SignNow offers integrations with various tools and platforms, allowing you to follow schedule d instructions seamlessly. Whether you use CRM systems, cloud storage, or project management tools, our integrations enhance your workflow. This flexibility ensures that you can work within your existing ecosystem.

-

Is there customer support available for schedule d instructions?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions regarding schedule d instructions. Our support team is available via chat, email, or phone to ensure you have the help you need. We are committed to making your experience as smooth as possible.

-

Are there any tutorials available for understanding schedule d instructions?

Yes, airSlate SignNow offers a variety of tutorials and resources to help you understand schedule d instructions. These materials include video guides, FAQs, and step-by-step documentation. Our goal is to empower you with the knowledge needed to utilize our platform effectively.

Get more for Schedule D Form 1040 Capital Gains And Losses

Find out other Schedule D Form 1040 Capital Gains And Losses

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request