Employer's Annual Federal Tax Return File IRS Form 944

What is the Employer's Annual Federal Tax Return File IRS Form 944

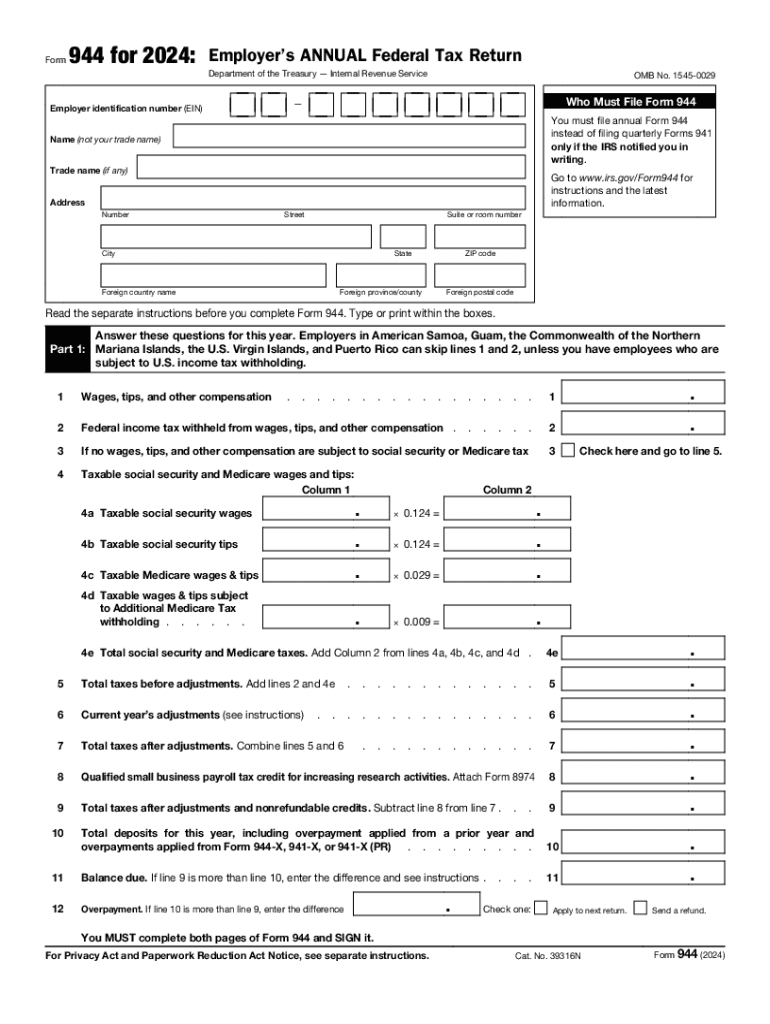

The Employer's Annual Federal Tax Return, commonly known as IRS Form 944, is a tax form used by small employers to report annual payroll taxes. This form is specifically designed for businesses that have a low volume of payroll tax liability, allowing them to file annually instead of quarterly. The 944 form simplifies the reporting process for eligible employers, ensuring compliance with federal tax regulations.

How to use the Employer's Annual Federal Tax Return File IRS Form 944

To use IRS Form 944, employers must first determine their eligibility based on their payroll tax liability. If eligible, they will need to gather necessary information, such as total wages paid, taxes withheld, and any adjustments. The form requires detailed reporting of these figures to accurately calculate the employer's tax obligations. Once completed, employers can submit the form to the IRS, either electronically or by mail.

Steps to complete the Employer's Annual Federal Tax Return File IRS Form 944

Completing IRS Form 944 involves several key steps:

- Gather necessary payroll records, including total wages and taxes withheld.

- Fill out the form accurately, ensuring all figures are correct.

- Double-check for any errors or omissions.

- Submit the completed form to the IRS by the designated deadline.

Employers should keep a copy of the submitted form for their records.

Filing Deadlines / Important Dates

The filing deadline for IRS Form 944 is typically January 31 of the year following the tax year being reported. Employers must ensure that the form is submitted on time to avoid penalties. Additionally, if any taxes are owed, payment should be made by the same deadline to prevent interest and penalties from accruing.

Penalties for Non-Compliance

Failure to file IRS Form 944 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Employers should be aware of these consequences and take steps to ensure timely and accurate filing to avoid financial repercussions.

Eligibility Criteria

Eligibility to file IRS Form 944 generally applies to small employers whose annual payroll tax liability is less than one thousand dollars. Employers must assess their tax liability from the previous year to determine if they qualify. If an employer's liability exceeds this threshold, they may need to file Form 941 instead, which is the quarterly tax return.

Handy tips for filling out Employer's Annual Federal Tax Return File IRS Form 944 online

Quick steps to complete and e-sign Employer's Annual Federal Tax Return File IRS Form 944 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum efficiency. Use signNow to e-sign and send Employer's Annual Federal Tax Return File IRS Form 944 for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employers annual federal tax return file irs form 944

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 944 and why is it important?

Form 944 is an annual tax return form used by small employers to report their payroll taxes to the IRS. It is important because it simplifies the filing process for businesses with a lower payroll tax liability, allowing them to file once a year instead of quarterly.

-

How can airSlate SignNow help with Form 944?

airSlate SignNow provides a streamlined solution for businesses to electronically sign and send Form 944 and other important documents. With its user-friendly interface, you can easily manage your tax forms and ensure compliance without the hassle of paper-based processes.

-

What are the pricing options for using airSlate SignNow for Form 944?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses that need to manage Form 944. Each plan provides access to essential features that help you efficiently handle your document signing and management.

-

Are there any features specifically designed for Form 944 users?

Yes, airSlate SignNow includes features that cater specifically to users handling Form 944, such as customizable templates and automated reminders. These features help ensure that your tax documents are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software for Form 944 management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easier to manage Form 944 alongside your other business processes. This integration helps streamline your workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for Form 944?

Using airSlate SignNow for Form 944 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your sensitive tax documents. The platform ensures that your forms are signed and stored securely, giving you peace of mind.

-

Is airSlate SignNow compliant with IRS regulations for Form 944?

Yes, airSlate SignNow is compliant with IRS regulations, ensuring that your electronic signatures on Form 944 are legally binding. This compliance helps you meet federal requirements while simplifying the filing process.

Get more for Employer's Annual Federal Tax Return File IRS Form 944

Find out other Employer's Annual Federal Tax Return File IRS Form 944

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer