IRS Schedule M 1 and M 2 1120 F Form

Understanding the IRS Schedule M-1 and M-2 for Form 1120-F

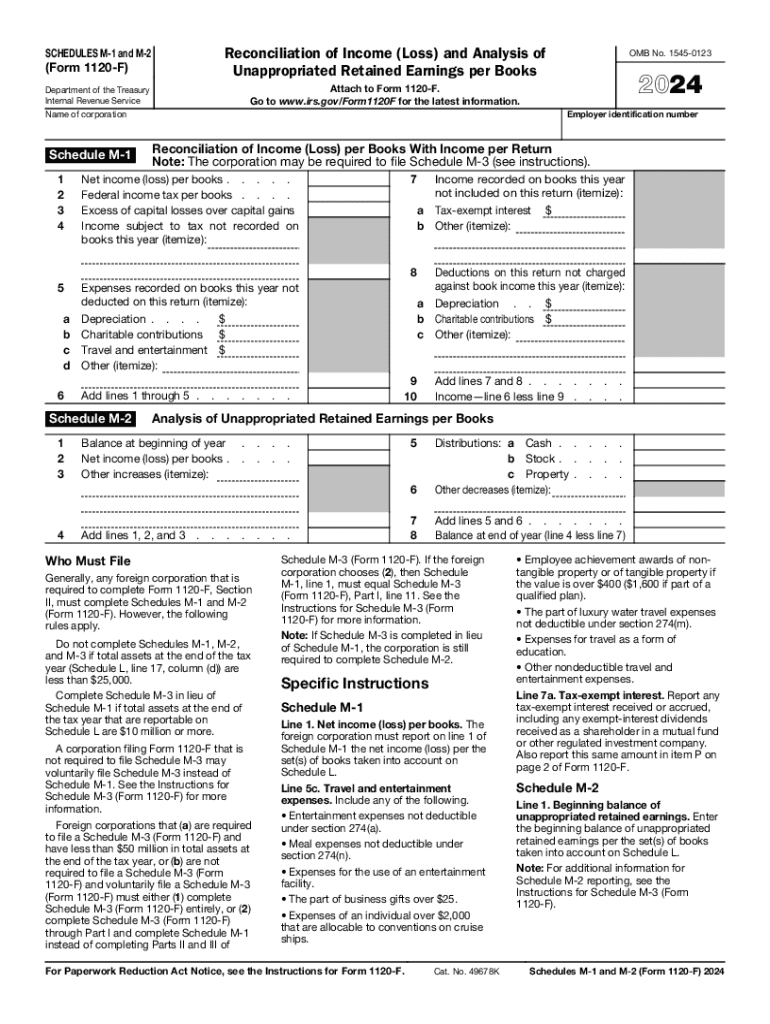

The IRS Schedule M-1 and M-2 are essential components of Form 1120-F, which is used by foreign corporations to report income effectively. Schedule M-1 reconciles the differences between financial accounting income and taxable income, while Schedule M-2 provides a summary of the corporation's retained earnings. Understanding these schedules is crucial for accurate tax reporting and compliance.

Steps to Complete the IRS Schedule M-1 and M-2 for Form 1120-F

Completing the IRS Schedule M-1 and M-2 involves several steps:

- Gather financial statements and tax documents to ensure accurate reporting.

- Fill out Schedule M-1 by listing adjustments that reconcile book income to taxable income.

- Complete Schedule M-2 by summarizing retained earnings and any distributions made during the tax year.

- Review both schedules for accuracy before submitting them with Form 1120-F.

How to Obtain the IRS Schedule M-1 and M-2 for Form 1120-F

The IRS Schedule M-1 and M-2 can be obtained directly from the IRS website or through tax preparation software that includes Form 1120-F. It is important to ensure you have the most current version of these schedules to comply with the latest tax regulations.

Legal Use of the IRS Schedule M-1 and M-2 for Form 1120-F

Using the IRS Schedule M-1 and M-2 legally requires accurate reporting of all income and adjustments. These schedules must be submitted with Form 1120-F to ensure compliance with U.S. tax laws. Failure to accurately complete these forms can lead to penalties and interest on unpaid taxes.

Filing Deadlines for the IRS Schedule M-1 and M-2

The filing deadline for Form 1120-F, including Schedule M-1 and M-2, typically falls on the fifteenth day of the sixth month after the end of the corporation’s tax year. For corporations operating on a calendar year, this means the deadline is June 15. It is essential to file on time to avoid penalties.

Examples of Using the IRS Schedule M-1 and M-2

Examples of using the IRS Schedule M-1 and M-2 include:

- A foreign corporation with U.S. source income must reconcile its book income with taxable income using Schedule M-1.

- A company that has retained earnings from previous years will summarize these on Schedule M-2, showing any distributions made to shareholders.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs schedule m 1 and m 2 1120 f form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the m2 bmw?

The m2 bmw is known for its powerful engine, agile handling, and sporty design. It offers advanced technology features, including a high-resolution display and premium sound system. Additionally, the m2 bmw comes with various driving modes to enhance performance and comfort.

-

How much does the m2 bmw cost?

The starting price of the m2 bmw typically ranges from $60,000 to $70,000, depending on the selected options and packages. It's important to check with local dealerships for the most accurate pricing. Financing options may also be available to help manage the cost.

-

What are the benefits of owning an m2 bmw?

Owning an m2 bmw provides an exhilarating driving experience with its impressive acceleration and handling. Additionally, it offers a blend of luxury and performance, making it suitable for both daily driving and weekend adventures. The m2 bmw also has a strong resale value, which is a signNow benefit for owners.

-

Can the m2 bmw be customized?

Yes, the m2 bmw offers a variety of customization options, including different paint colors, interior materials, and performance upgrades. Customers can choose packages that enhance technology, comfort, and style. This allows owners to tailor their m2 bmw to their personal preferences.

-

What technology features are included in the m2 bmw?

The m2 bmw is equipped with cutting-edge technology features such as a navigation system, smartphone integration, and advanced driver assistance systems. These features enhance safety and convenience while driving. The infotainment system is user-friendly, making it easy to access various functions.

-

How does the m2 bmw compare to other models in its class?

The m2 bmw stands out in its class due to its exceptional performance and handling characteristics. Compared to competitors, it offers a more engaging driving experience and a well-crafted interior. Additionally, the m2 bmw's distinctive styling sets it apart from other vehicles in the same segment.

-

What are the maintenance costs for the m2 bmw?

Maintenance costs for the m2 bmw can vary, but regular servicing is essential to keep it in top condition. Owners should budget for routine maintenance, including oil changes and tire rotations. Overall, the m2 bmw is designed for reliability, which can help minimize unexpected repair costs.

Get more for IRS Schedule M 1 And M 2 1120 F Form

Find out other IRS Schedule M 1 And M 2 1120 F Form

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast