E File IRS Form 940 for Federal Unemployment Tax Online

What is the E file IRS Form 940 For Federal Unemployment Tax Online

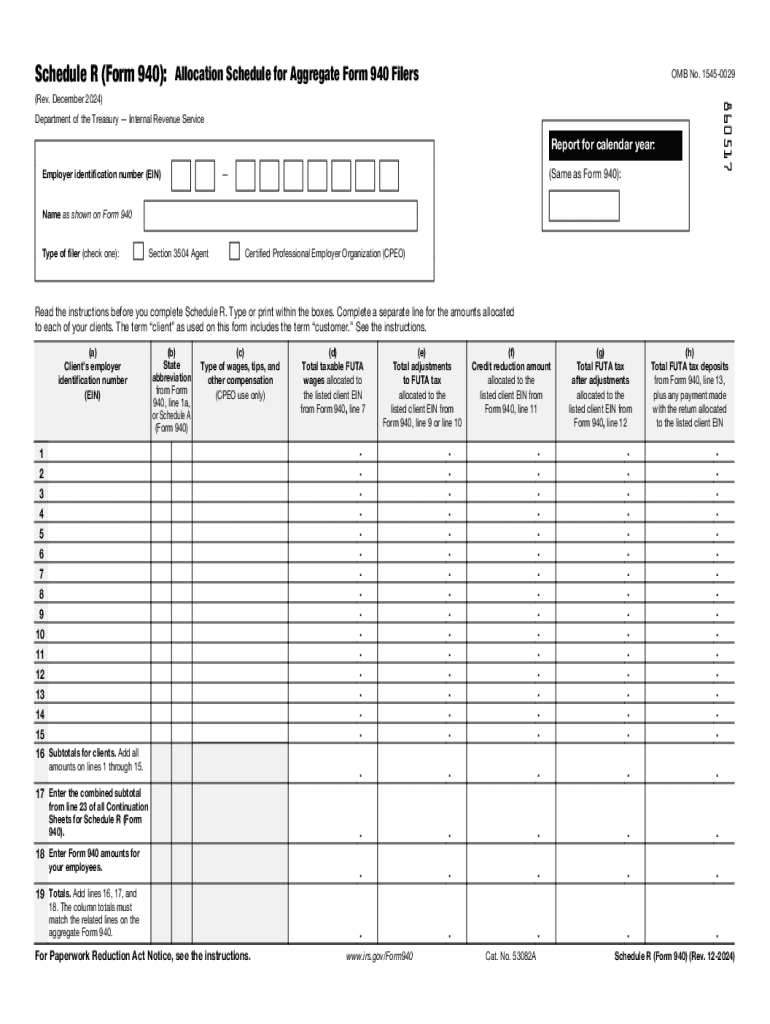

The E file IRS Form 940 is a critical document used by employers to report and pay federal unemployment taxes (FUTA). This form is essential for businesses that pay wages to employees, as it ensures compliance with federal tax regulations. Employers must file this form annually, detailing their taxable wages and the corresponding tax owed. The E file option allows for a streamlined and efficient submission process, reducing the potential for errors and expediting processing times.

Steps to complete the E file IRS Form 940 For Federal Unemployment Tax Online

Completing the E file IRS Form 940 online involves several straightforward steps:

- Gather necessary information, including your Employer Identification Number (EIN) and total taxable wages for the year.

- Access a reliable e-filing platform that supports IRS Form 940 submissions.

- Input your business details, including the number of employees and total wages paid.

- Review the calculated FUTA tax based on the information provided.

- Submit the form electronically to the IRS, ensuring you receive confirmation of submission.

IRS Guidelines

The IRS provides specific guidelines for filing Form 940 electronically. Employers must ensure that they are using approved e-filing software that meets IRS standards. Additionally, it is essential to keep records of all submitted forms and any correspondence with the IRS regarding your filings. Familiarity with these guidelines helps avoid penalties and ensures compliance with federal regulations.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for Form 940 to avoid penalties. The form is due annually by January 31 of the following year for the previous tax year. If you make timely payments of your FUTA tax, you may have until February 10 to file. Keeping track of these dates is crucial for maintaining compliance and avoiding late fees.

Required Documents

To successfully complete the E file IRS Form 940, employers should prepare several documents and pieces of information, including:

- Employer Identification Number (EIN)

- Total taxable wages paid to employees

- Records of any state unemployment tax payments made

- Previous year’s Form 940 for reference

Penalties for Non-Compliance

Failure to file Form 940 on time or inaccuracies in the submitted information can result in significant penalties. The IRS may impose fines for late filings, which can accumulate quickly. Additionally, incorrect information may lead to audits or further scrutiny, emphasizing the importance of accurate and timely submissions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e file irs form 940 for federal unemployment tax online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the best way to schedule r from airSlate SignNow?

To schedule r from airSlate SignNow, simply log into your account and navigate to the scheduling feature. You can set specific dates and times for document signing, ensuring that all parties are aligned. This feature streamlines the signing process and enhances efficiency.

-

How much does it cost to schedule r from airSlate SignNow?

The pricing for scheduling r from airSlate SignNow varies based on the plan you choose. We offer flexible pricing options that cater to different business needs, ensuring you get the best value for your investment. Visit our pricing page for detailed information on each plan.

-

What features are included when I schedule r from airSlate SignNow?

When you schedule r from airSlate SignNow, you gain access to a variety of features including document templates, real-time tracking, and automated reminders. These features help you manage your documents efficiently and ensure timely responses from signers. This makes the entire process seamless and user-friendly.

-

Can I integrate other tools when I schedule r from airSlate SignNow?

Yes, airSlate SignNow allows you to integrate with various tools and applications when you schedule r from our platform. This includes popular CRM systems, cloud storage services, and productivity tools. These integrations enhance your workflow and improve overall productivity.

-

What are the benefits of scheduling r from airSlate SignNow?

Scheduling r from airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround time, and improved document management. By automating the scheduling process, you can focus on other important tasks while ensuring that your documents are signed promptly. This leads to better business outcomes.

-

Is it easy to schedule r from airSlate SignNow for multiple signers?

Absolutely! Scheduling r from airSlate SignNow for multiple signers is straightforward. You can easily add multiple recipients to your document and set individual signing orders or deadlines. This feature simplifies the coordination of signatures and enhances collaboration.

-

What types of documents can I schedule r from airSlate SignNow?

You can schedule r from airSlate SignNow for a wide range of documents, including contracts, agreements, and forms. Our platform supports various file formats, making it easy to upload and send any document for eSignature. This versatility caters to diverse business needs.

Get more for E file IRS Form 940 For Federal Unemployment Tax Online

- Cbse invigilation duty remuneration form

- Demand for payment of wages form colorado

- R 19 voter registration form illinois

- Disability benefits law claim form db450 guardian life

- Tilley hat guarantee claim form 492284280

- Ct 2 form

- Instructions for florida family law rules of proce 789552670 form

- Internship academic credit form c t bauer college of bauer uh

Find out other E file IRS Form 940 For Federal Unemployment Tax Online

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy