About Form 8827, Credit for Prior Year Minimum Tax

Understanding Form 8827: Credit for Prior Year Minimum Tax

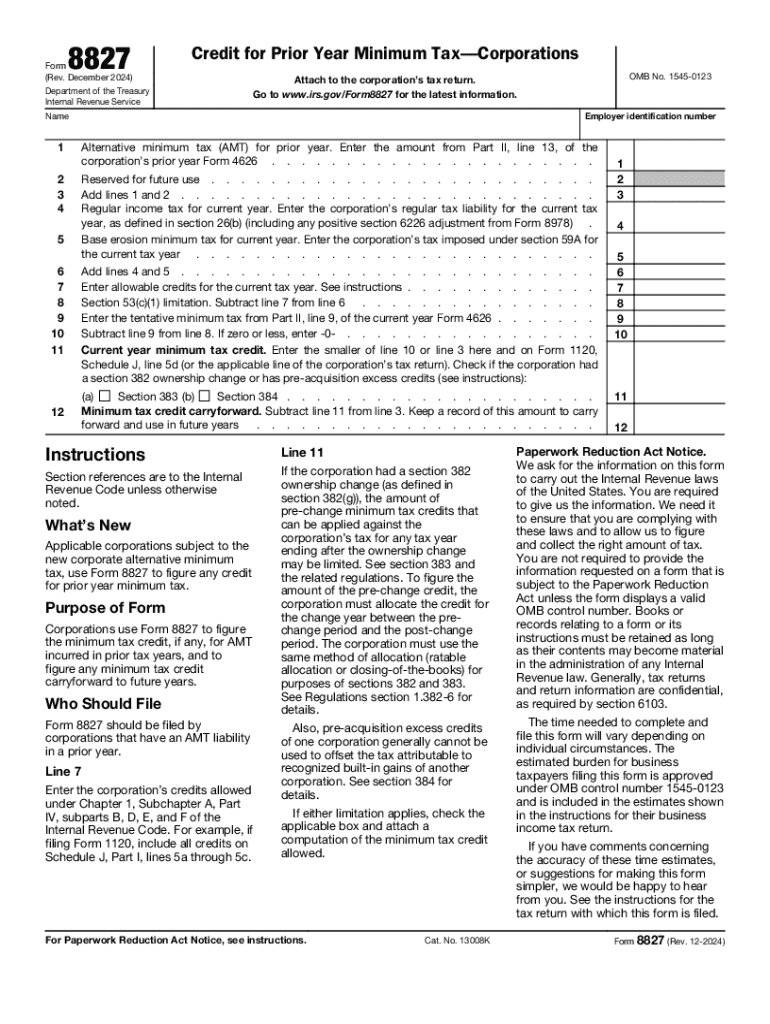

Form 8827 is used by corporations to claim a credit for prior year minimum tax. This credit is particularly beneficial for businesses that have paid alternative minimum tax (AMT) in previous tax years. The form allows eligible corporations to offset their regular tax liability with the credit, effectively reducing the amount of tax owed in the current year. The credit can be carried forward to future years if it is not fully utilized in the year it is claimed.

Steps to Complete Form 8827

Completing Form 8827 involves several key steps:

- Gather necessary financial documents, including prior year tax returns and records of any AMT paid.

- Fill out the identification section, providing your corporation's name, address, and Employer Identification Number (EIN).

- Calculate the credit amount based on the alternative minimum tax paid in prior years.

- Complete the required sections of the form, ensuring all calculations are accurate.

- Review the form for completeness and accuracy before submission.

Eligibility Criteria for Form 8827

To qualify for the credit claimed on Form 8827, a corporation must meet specific eligibility criteria. The corporation must have paid alternative minimum tax in a prior year and must be subject to regular income tax in the current year. Additionally, the credit is only available to corporations and not to individuals or other entity types. It is important to verify that the AMT paid was not refunded or otherwise negated in subsequent years.

Filing Deadlines for Form 8827

Form 8827 must be filed with the corporation's tax return for the year in which the credit is being claimed. Generally, the deadline for filing corporate tax returns is the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by April 15. If the corporation has received an extension, the deadline for filing Form 8827 will align with the extended due date of the tax return.

IRS Guidelines for Form 8827

The IRS provides specific guidelines for completing and submitting Form 8827. These guidelines include instructions on calculating the credit, eligibility requirements, and the necessary documentation to support the claim. It is essential to follow these guidelines closely to ensure compliance and avoid potential penalties. The IRS also emphasizes the importance of accurate record-keeping to substantiate the credit claimed on the form.

Common Scenarios for Using Form 8827

Form 8827 is particularly relevant for various corporate scenarios. For example, a corporation that experienced fluctuating income and paid AMT in a previous year may benefit from this credit when its income returns to a more stable level. Additionally, newly formed corporations that inherited AMT liabilities from prior years may also utilize this form to claim credits. Understanding these scenarios can help corporations maximize their tax benefits and ensure they are taking full advantage of available credits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 8827 credit for prior year minimum tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8827 and how can airSlate SignNow help?

Form 8827 is used to claim a credit for the federal tax on certain fuels. With airSlate SignNow, you can easily fill out and eSign form 8827, streamlining the process and ensuring accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for form 8827?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage form 8827 efficiently without breaking the bank.

-

What features does airSlate SignNow offer for managing form 8827?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for form 8827. These tools enhance your workflow and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for form 8827?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 8827 alongside your existing tools. This integration enhances productivity and simplifies your document management process.

-

How does airSlate SignNow ensure the security of my form 8827?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your form 8827 and other sensitive documents, ensuring that your information remains confidential.

-

Can I access my form 8827 from any device using airSlate SignNow?

Yes, airSlate SignNow is designed to be accessible from any device with internet connectivity. This means you can fill out and eSign your form 8827 on-the-go, making it convenient for busy professionals.

-

What are the benefits of using airSlate SignNow for form 8827?

Using airSlate SignNow for form 8827 offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the eSigning process, allowing you to focus on your core business activities.

Get more for About Form 8827, Credit For Prior Year Minimum Tax

- New mexico highlands university s its nmhu form

- Internship learning contract iwuedu form

- Academic support career services academic kaplan form

- Tel 866 522 7747 form

- Troy publication 384 326 form

- Activity club long waiverdocx form

- Time amp effort report instructions towson university towson form

- Uco ohlap request form

Find out other About Form 8827, Credit For Prior Year Minimum Tax

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed