Form 990 a Practical Review

Understanding IRS Schedule J

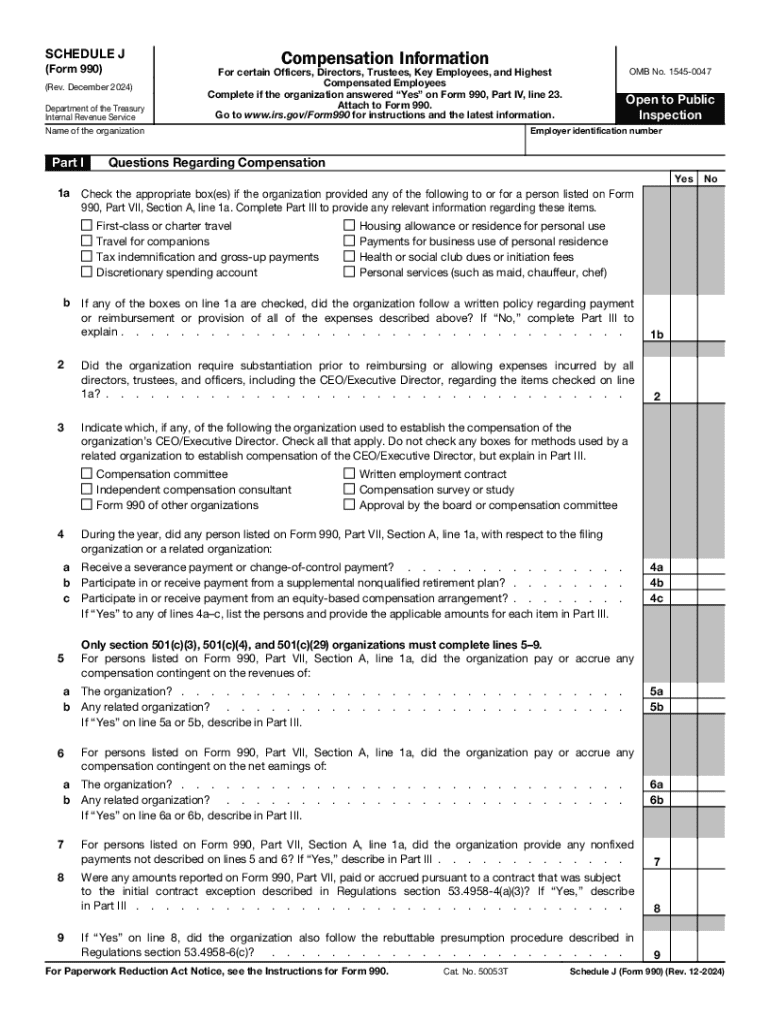

IRS Schedule J is a supplemental form that accompanies Form 990, which is the annual information return filed by tax-exempt organizations. This schedule is specifically designed to provide detailed information regarding the compensation of the highest-paid employees and contractors of the organization. It helps the IRS assess whether the compensation is reasonable and in line with the organization's mission and activities.

Organizations must report the total compensation for each individual, including salaries, bonuses, and other forms of remuneration. This information is crucial for transparency and accountability, ensuring that tax-exempt entities are using their resources effectively.

Steps to Complete IRS Schedule J

Completing IRS Schedule J requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the organization’s highest-paid employees and contractors.

- Determine the total compensation for each individual, including all forms of payment.

- Fill out the schedule, ensuring that all required fields are completed accurately.

- Review the completed schedule for any discrepancies or errors.

- Attach Schedule J to Form 990 before submission.

Following these steps ensures compliance with IRS regulations and helps maintain the integrity of the organization’s financial reporting.

Key Elements of IRS Schedule J

IRS Schedule J includes several key elements that organizations must address:

- Compensation Reporting: Organizations must report the total compensation for each individual, including salary, bonuses, and benefits.

- Reasonableness of Compensation: The schedule requires organizations to justify the compensation amounts to ensure they are reasonable based on industry standards.

- Disclosure of Related Party Transactions: Any transactions involving related parties must be disclosed to prevent conflicts of interest.

These elements are vital for maintaining transparency and ensuring that compensation practices align with the organization's mission.

IRS Guidelines for Filing Schedule J

The IRS provides specific guidelines for filing Schedule J, which organizations must follow to ensure compliance. Key points include:

- Ensure that all information reported is accurate and complete.

- File the schedule along with Form 990 by the designated deadline, typically the fifteenth day of the fifth month after the end of the organization’s fiscal year.

- Retain supporting documentation for all compensation reported, as the IRS may request this information during an audit.

Adhering to these guidelines helps organizations avoid penalties and maintain their tax-exempt status.

Filing Deadlines for IRS Schedule J

Organizations must be aware of the filing deadlines for IRS Schedule J to avoid late penalties. The general deadline for submitting Form 990, including Schedule J, is:

- The fifteenth day of the fifth month after the end of the organization’s fiscal year.

Organizations can apply for an extension if necessary, but it is essential to file the extension request before the original deadline to avoid penalties.

Penalties for Non-Compliance with IRS Schedule J

Failure to comply with the requirements of IRS Schedule J can result in significant penalties. These may include:

- Monetary fines for late filing or failure to file.

- Increased scrutiny from the IRS, leading to audits.

- Potential loss of tax-exempt status if non-compliance is deemed severe.

Organizations should take care to file accurately and on time to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 a practical review

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Schedule J and how does it relate to airSlate SignNow?

IRS Schedule J is a tax form used by farmers and fishermen to calculate their income tax. With airSlate SignNow, you can easily eSign and send your IRS Schedule J documents securely, ensuring compliance and efficiency in your tax filing process.

-

How can airSlate SignNow help me with my IRS Schedule J submissions?

airSlate SignNow streamlines the process of preparing and submitting your IRS Schedule J by allowing you to electronically sign and send documents. This not only saves time but also reduces the risk of errors, ensuring your submissions are accurate and timely.

-

Is there a cost associated with using airSlate SignNow for IRS Schedule J?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to features that facilitate the eSigning of documents like IRS Schedule J, making it a cost-effective solution for managing your tax documents.

-

What features does airSlate SignNow offer for managing IRS Schedule J?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance your ability to manage IRS Schedule J efficiently and ensure that all necessary signatures are obtained promptly.

-

Can I integrate airSlate SignNow with other software for IRS Schedule J processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including accounting and tax software. This integration allows you to manage your IRS Schedule J documents alongside your other financial tools, improving overall workflow and productivity.

-

What are the benefits of using airSlate SignNow for IRS Schedule J?

Using airSlate SignNow for your IRS Schedule J offers numerous benefits, including enhanced security, reduced paperwork, and faster processing times. By digitizing your document management, you can focus more on your business and less on administrative tasks.

-

Is airSlate SignNow user-friendly for filing IRS Schedule J?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to eSign and send IRS Schedule J documents. The intuitive interface ensures that even those with minimal tech experience can navigate the platform effortlessly.

Get more for Form 990 A Practical Review

- Department of revenue tax form cd 401s 2011

- Form 20 nebraska 2012

- Nebraska withholding return 941n 2012 form

- 2014 ne form 1040n

- 941n 2011 form

- 2013 nebraska 1040n form

- Nebraska individual income tax return form 1040n

- Form 6 nebraska salesuse tax and tire fee statement for motor vehicle and trailer sales 82012

Find out other Form 990 A Practical Review

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will