Form 4684, Casualties and Thefts

Understanding IRS Form 4684: Casualties and Thefts

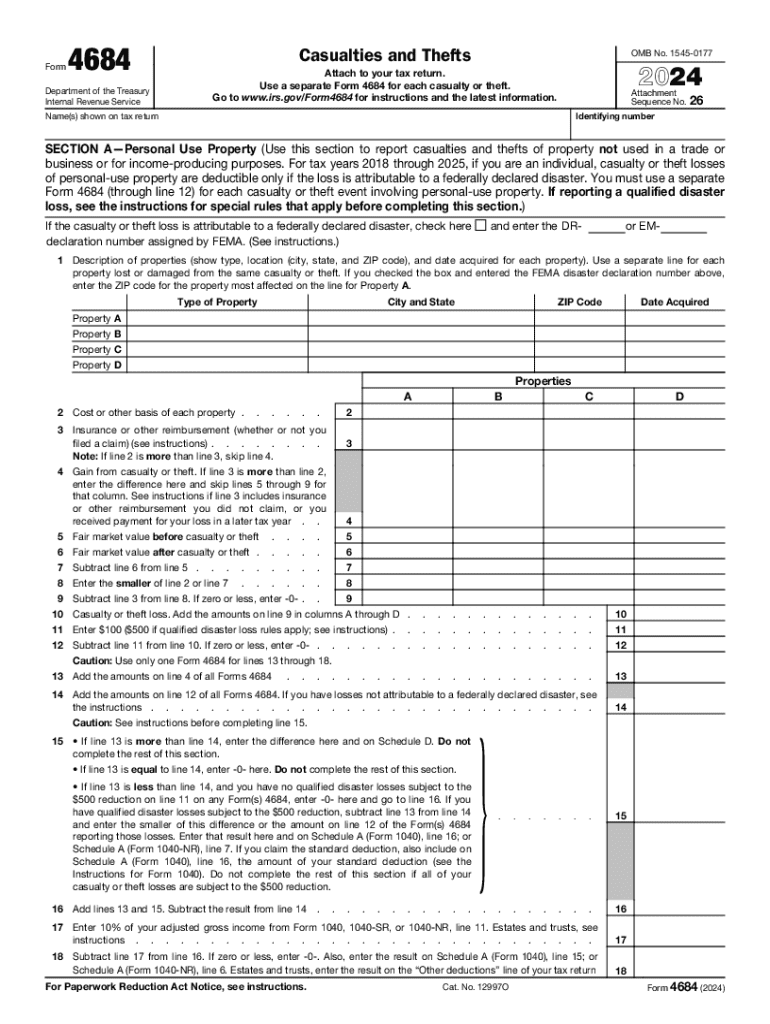

IRS Form 4684 is used to report casualties and thefts for tax purposes. This form allows taxpayers to claim losses resulting from natural disasters, accidents, or theft. It is essential for accurately documenting these losses to potentially receive tax deductions. The form is structured to help individuals and businesses calculate the amount of loss and determine how it affects their tax liability. Understanding how to properly fill out this form is crucial for maximizing potential tax benefits.

Steps to Complete IRS Form 4684

Completing Form 4684 involves several steps to ensure accuracy and compliance with IRS guidelines. Start by gathering all necessary documentation related to the loss, including receipts, police reports, and insurance claims. Next, follow these steps:

- Identify the type of loss: casualty or theft.

- Complete the relevant sections of the form, detailing the nature and amount of the loss.

- Calculate the deductible loss using the instructions provided on the form.

- Attach any supporting documents to substantiate your claim.

It is advisable to review the completed form for accuracy before submission to avoid delays or issues with the IRS.

Obtaining IRS Form 4684

IRS Form 4684 can be obtained directly from the IRS website, where it is available as a downloadable PDF. This allows taxpayers to print the form for manual completion. Additionally, the form may be available through tax preparation software, which can streamline the process of filling it out. Ensure you are using the correct version for the tax year you are filing, as forms may change annually.

IRS Guidelines for Form 4684

The IRS provides specific guidelines for completing Form 4684, which are crucial for ensuring compliance. These guidelines include:

- Detailed instructions on how to report different types of losses.

- Clarifications on what constitutes a deductible loss.

- Examples of acceptable documentation to support claims.

Reviewing these guidelines before filling out the form can help prevent common mistakes and ensure that all necessary information is included.

Examples of Using IRS Form 4684

Examples of situations where IRS Form 4684 is applicable include:

- Losses due to a house fire, where property damage needs to be reported.

- Theft of personal property, such as electronics or jewelry.

- Losses from natural disasters like hurricanes or floods.

These examples illustrate the diverse scenarios in which taxpayers may need to file this form, highlighting its importance in the tax reporting process.

Filing Deadlines for IRS Form 4684

Filing deadlines for IRS Form 4684 align with the annual tax return deadlines. Typically, the form must be submitted by April 15 of the following year for individual taxpayers. If additional time is needed, taxpayers can file for an extension, which allows for an extended deadline. However, it is important to keep in mind that any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents for IRS Form 4684

When filing IRS Form 4684, it is essential to include supporting documentation to substantiate your claims. Required documents may include:

- Receipts for repairs or replacements.

- Insurance claims and settlement statements.

- Police reports in cases of theft.

Having these documents ready can facilitate a smoother filing process and help ensure that your claims are processed without issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4684 casualties and thefts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 4684 and why is it important?

IRS Form 4684 is used to report casualties and thefts for tax purposes. Understanding how to fill out this form correctly is crucial for taxpayers who have experienced losses, as it can impact their tax deductions and overall financial situation.

-

How can airSlate SignNow help with IRS Form 4684?

airSlate SignNow provides an efficient platform for electronically signing and sending IRS Form 4684. With our user-friendly interface, you can easily manage your documents and ensure they are securely signed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for IRS Form 4684?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions ensure that you can manage IRS Form 4684 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for IRS Form 4684?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easier to prepare and submit IRS Form 4684 while maintaining compliance and security.

-

Can I integrate airSlate SignNow with other software for IRS Form 4684?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when handling IRS Form 4684. This integration helps you manage your documents more efficiently and enhances productivity.

-

What are the benefits of using airSlate SignNow for IRS Form 4684?

Using airSlate SignNow for IRS Form 4684 offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the signing process, ensuring that you can focus on what matters most—your business.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 4684?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that your IRS Form 4684 is handled securely and appropriately. Our commitment to compliance helps you avoid potential issues with your tax filings.

Get more for Form 4684, Casualties And Thefts

- 2020 pennsylvania e file signature authorization pa 8879 formspublications

- 2020 form 538 s claim for credit refund of sales tax

- Washington state department of revenue real estate excise form

- Sellers residency certificationexemption form gitrep 3 552389237

- Nj employees withholding allowance certificate nj employees withholding allowance certificate form

- Draft 2020 virginia resident form 760 individual income tax return 2020 virginia resident form 760

- Ty 2020 502x tax year 2020 502x individual taxpayer form

- Ty 2020 502b tax year 2020 502b individual taxpayer form

Find out other Form 4684, Casualties And Thefts

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself